Why I Have a Weekly family Business Meeting

In the bustle of modern life, finding a delicate balance between work and family can be akin to walking a tightrope. As an orthodontist and practice owner alongside my husband, a general dentist, with a lively two-year-old in tow, life is a constant juggling act. Amidst the myriad responsibilities, we've found a beacon of organization and harmony in an unexpected place: the weekly family business meeting.

Our family, much like a business, requires strategic planning and, most importantly, regular check-ins. The weekly family business meeting has become our compass, guiding us through the maze of tasks, appointments, and familial responsibilities. It's a designated time to synchronize our calendars, discuss the upcoming week's events, and ensure we're all on the same page.

In the bustle of modern life, finding a delicate balance between work and family can be akin to walking a tightrope. As an orthodontist and practice owner alongside my husband, a general dentist, with a lively two-year-old in tow, life is a constant juggling act. Amidst the myriad responsibilities, we've found a beacon of organization and harmony in an unexpected place: the weekly family business meeting.

The Family as a Business: Strategy and Regular Check-ins

Our family, much like a business, requires strategic planning and, most importantly, regular check-ins. The weekly family business meeting has become our compass, guiding us through the maze of tasks, appointments, and familial responsibilities. It's a designated time to synchronize our calendars, discuss the upcoming week's events, and ensure we're all on the same page.

Balancing Act: Work-Life Harmony

Maintaining a harmonious equilibrium between our professional and personal lives is no small feat. The family business meeting allows us to recalibrate, ensuring neither work nor family takes an undue toll. It's a deliberate effort to strike a balance, acknowledging that the success of our family is intrinsically linked to the success of our professional endeavors.

Delegating: The Art of Sharing Responsibilities

One of the key lessons learned through these meetings is the art of delegation. Recognizing that we can't do it all, we've embraced the support of hired help, whether it’s a family member, a nanny, a housekeeper to keep our home in order, and occasional babysitters for those rare moments of solitude. Delegating tasks allows us to focus on what truly matters: the well-being of our family and the success of our practices.

Roles and Responsibilities: Creating Order in Chaos

Assigning roles within the household, devoid of rigid gender stereotypes, has been pivotal. Everyone, regardless of age, has a part to play. Whether it's ensuring the toys are picked up, organizing family outings, or managing the household finances, having defined roles instills a sense of order and responsibility.

Proper Planning: A Pillar of Success

In the world of dentistry, proper planning is the linchpin of success. The same principle applies at home. Our family business meetings delve into long-term planning—financial goals, vacations, and even the occasional date night. This foresight allows us to anticipate challenges and celebrate victories together.

Conclusion: Nurturing the Dual Identity

As the dual identity of a dental power couple and a loving family intertwines, our weekly family business meetings serve as the crucible where the alchemy of strategy, communication, and love transpires. It's our commitment to ensuring that the tapestry of our lives, woven with professional and familial threads, remains resilient, vibrant, and harmonious. In the symphony of our existence, the family business meeting is the conductor that orchestrates a melodious rhythm, blending the diverse notes of our lives into a harmonious tune.

23 Goals for 2023 End of year Check-In

As this year comes to a close, I find myself revisiting the 23 goals I set for myself in my "23 Goals for 2023" blog post at the beginning of this year. Along the way, I provided a mid-year check-in to update you on my progress, and here we are now, at the end-of-year check-in, evaluating how far I've come and what I've achieved.

2023 turned out to be more challenging than I anticipated. While I didn't quite accomplish all 23 goals I set, I managed to achieve the more meaningful ones. As the year unfolded, I had to prioritize certain things over others. It's been a year of growth, of learning to appreciate the small things, and understanding the true essence of wealth – family, health, and simple moments of joy.

"Happy are those who dream dreams and are ready to pay the price to make them come true." — Leon Joseph Cardinal Suenens

As this year comes to a close, I find myself revisiting the 23 goals I set for myself in my "23 Goals for 2023" blog post at the beginning of this year. Along the way, I provided a mid-year check-in to update you on my progress, and here we are now, at the end-of-year check-in, evaluating how far I've come and what I've achieved.

2023 turned out to be more challenging than I anticipated. While I didn't quite accomplish all 23 goals I set, I managed to achieve the more meaningful ones. As the year unfolded, I had to prioritize certain things over others. It's been a year of growth, of learning to appreciate the small things, and understanding the true essence of wealth – family, health, and simple moments of joy.

Read at least 23 books in 2023: While I fell short of this goal by only three books, considering where I was six months ago, I'm content with my progress. I read 20 books this year. You can see all the books I read this year here - consider joining my book club so we can read together each month.

Commit to working out 2-3 times per week: Scheduling workouts became a challenge, but it's an area I plan to improve upon.

Run a 10K: Unfortunately, this didn't happen, but it's on the list for 2024.

Maintain a 7-figure practice/business: My practice sustained its status, despite not experiencing the growth I anticipated. Nevertheless, I found different kinds of growth, not just financial.

Re-commit to date night with my husband once per week: Though not every week, my husband and I found other ways to stay connected, making our bond stronger.

Schedule a CEO day once per month: While I faced difficulty sticking to this, I acknowledge the importance of these days.

Go to church at least one Sunday per month: My spiritual growth was a highlight of the year, attending regularly (not just on Sundays) and deepening my faith.

Complete the Wharton Masters Business of Orthodontics-AAO Program: Completed, although its direct impact is yet to be seen.

Be more active on the Board of the DC Dental Society: Actively engaged throughout the year and plan to continue for 2024.

Drink more water (4-6 cups/day): Continual progress in this area. I have found keeping a bottle of water near at all times increases the chance of drinking more regularly. Example: a glass/bottle on the bedside table.

Increase my blogging & candle company income: Notably, my blogging income saw tremendous growth.

Do one family/kid-friendly activity per week(end): Managed to fulfill this, enriching family life which was of great importance to me this year.

Spend 1000 hours outdoors: A rough estimate, but we did spend ample time in nature.

Try a new restaurant every month: The adventure of exploring new cuisines continued, although this did not happen every month.

Find ways to give back to my community: Planning for increased involvement in 2024 both locally and overseas.

Do continuing education (CEs) once per month: Completed at least 30 hours of CE this year.

One spa day per month (self-care): Regular self-care days, although slightly less frequent than planned.

Book at least four trips and two "real" vacations: Unfortunately, some trips didn't materialize.

Gain a new skill: Personal growth achieved through acquiring new skills mostly in my professional life.

Get more sleep: Conscious efforts made towards better rest. I plan to track this next year,

Pay off debt: Substantial progress in financial discipline made.

Learn one new recipe every month: This fell by the wayside, reconsidering for the next year.

Shop with more small businesses: Continued support for local and small businesses.

Reflecting on this year, while it was not without challenges, I'm grateful for the lessons learned and the progress made. My appreciation for life's simple joys has grown immensely. As I enter a new year, I carry forward these lessons and focus on what truly matters.

Thank you for being a part of my journey. Let's continue to inspire each other as we navigate the path of personal growth and self-improvement. What are your goals for the upcoming year? Let's embark on this journey together, encouraging and supporting one another along the way. Cheers to new beginnings and the promise of a fresh start!

11 Extra Income Streams For Young Professionals: Fresh Perspectives on Financial Freedom

As the financial landscape continues to evolve, the pursuit of extra income streams, or as it's popularly known, the "side hustle," has become more crucial than ever for young professionals navigating the challenges of student loan debt and escalating living costs. This is especially vital for gaining financial freedom, as additional income provides the means to invest, reduce debt, increase savings, and ultimately achieve financial independence.

While the term itself has gained notoriety over recent years, the concept of supplementing a 9 to 5 job with additional income has been a longstanding practice. As a young professional, I myself leverage my “free time,” nights and weekends to carve out supplementary incomes through real estate investing, blogging, my candle company, digital products and monetizing my influence on social media.

As the financial landscape continues to evolve, the pursuit of extra income streams, or as it's popularly known, the "side hustle," has become more crucial than ever for young professionals navigating the challenges of student loan debt and escalating living costs. This is especially vital for gaining financial freedom, as additional income provides the means to invest, reduce debt, increase savings, and ultimately achieve financial independence.

While the term itself has gained notoriety over recent years, the concept of supplementing a 9 to 5 job with additional income has been a longstanding practice. As a young professional, I myself leverage my “free time,” nights and weekends to carve out supplementary incomes through real estate investing, blogging, my candle company, digital products and monetizing my influence on social media.

In today's dynamic economy, not all side hustles are created equal, and the array of options can be overwhelming. This post aims to provide a fresh take on this concept, presenting 11 diverse and contemporary “side hustles” or extra income streams that go beyond traditional norms.

1. Blogging

Blogging has transcended from a hobby to a proven online business model, offering a flexible avenue for young professionals to build passive income, expand networks, and explore numerous opportunities. While the journey may demand commitment and consistency, the potential for substantial rewards awaits those willing to offer value and cultivate an engaged audience. I have documented my blogging journey since it’s inception. What began as a way to document my experiences and offer information, inspiration and advice to my readers has become a lucrative income stream for me. A few months ago I was interviewed by LinkedIn to talk about the process, you can find that interview here.

2. Advertising & Affiliate Marketing: Monetizing Your Influence

Affiliate marketing remains a lucrative industry where income is generated through commission-based promotion of products. Young professionals can leverage their social media presence to become brand ambassadors, opening doors for sponsored posts, takeovers, or product sales.

3. Become a Brand Ambassador: Turning Passion into Profit

Social media platforms, particularly Instagram, offer a unique space for young professionals to become influencers and brand ambassadors. Aligning with products or brands that resonate personally ensures authentic endorsements, fostering trust and potential monetization.

4. Freelance Writing/Services: Flexing Creative Muscles for Income

For those with creative skills, freelancing presents ample opportunities, ranging from web development to graphic design, writing, or editing. Utilize platforms like Upwork, Freelancer, or Fiverr to advertise your services and cater to a broad market.

5. Start a Podcast: The Rising Trend in Passive Income

Podcasting has emerged as a powerful medium for passive income. Young professionals can explore avenues like sponsorships, advertising, affiliate marketing, coaching, and public speaking events to monetize their podcasts.

6. Write an Ebook: Transforming Expertise into Revenue

Writing an ebook offers an accessible route for young professionals to share expertise and passions. With minimal upfront costs, ebooks can be sold online, providing an additional stream of income.

7. Locum Tenens: Flexible Options for Medical/Dental Professionals

Medical professionals, like dentists, can embrace locum tenens positions, offering services on off days or weekends in other practices. This flexible approach allows professionals to control the extent of their involvement and supplement their income.

8. Invest In Real Estate: Navigating Lucrative Yet Risky Waters

Real estate investment provides an opportunity to diversify income streams. Whether through property flipping, rentals, or fractional ownership via crowdfunding, young professionals can explore real estate ventures with careful research and professional consultation.

9. Rent Space In Your Home or on Airbnb: Maximizing Your Living Space

Leveraging spare bedrooms or vacant homes on platforms like Airbnb can turn unused spaces into lucrative income streams. Young professionals can maximize their living arrangements, transforming underutilized areas into profitable assets.

10. Create a Product and Sell Online: Monetizing Creativity

Creativity can be monetized by creating and selling products online. Whether through personal websites, e-commerce platforms like Shopify, or marketplaces like Etsy, young professionals can turn hobbies into profitable side hustles.

11. Create a Mobile App: Tapping into the Digital Economy

For those with coding skills or innovative ideas, developing a mobile app can open new income streams. With the potential for widespread usage, successful apps can generate substantial passive income.

Your side hustle is not just a means of making extra money; it has the potential to replace your 9 to 5 income. It can also help you develop new skills, build your personal brand or portfolio, and most importantly, contribute significantly to your journey towards financial freedom. More income translates to more opportunities for investment, accelerated debt repayment, robust savings, and the ultimate goal of financial independence. Take the risk by starting the business or pursuing that new hobby you’ve been curious about. A side hustle is your best opportunity to live life on your own terms. And with more money in your pocket, there’s nothing stopping you from making your dreams come true, all while securing a pathway to financial freedom and independence.

Discovering True Wealth: The New Rich

In a world often measured by financial wealth, the concept of true richness extends beyond bank accounts and possessions. It’s about acknowledging the overlooked treasures that enrich our lives, nurturing our spirits and granting us a sense of fulfillment. Welcome to "The New Rich," where abundance transcends monetary figures and instead resides in the simple yet profound aspects of existence.

What if our genuine wealth is rooted in the things we often take for granted? Imagine waking up to a sunrise, feeling the gentle morning breeze, or savoring the aroma of freshly brewed coffee. These simple pleasures, often overlooked in the rush of daily life, compose the fabric of true richness. It's about relishing the unhurried moments that embrace our souls, granting us a profound sense of fulfillment.

In a world often measured by financial wealth, the concept of true richness extends beyond bank accounts and possessions. It’s about acknowledging the overlooked treasures that enrich our lives, nurturing our spirits and granting us a sense of fulfillment. Welcome to "The New Rich," where abundance transcends monetary figures and instead resides in the simple yet profound aspects of existence.

What if our genuine wealth is rooted in the things we often take for granted? Imagine waking up to a sunrise, feeling the gentle morning breeze, or savoring the aroma of freshly brewed coffee. These simple pleasures, often overlooked in the rush of daily life, compose the fabric of true richness. It's about relishing the unhurried moments that embrace our souls, granting us a profound sense of fulfillment.

"The New Rich" isn't solely about financial affluence but encompasses the freedom to craft a life aligned with our values. It’s about having enough to meet our needs without drowning in overindulgences. This paradigm shift reflects a life where time is our true luxury – a life where slow mornings and the liberty to pursue our passions take precedence over the relentless pursuit of material wealth.

Moreover, this newfound wealth isn’t just about financial resources; it’s about time freedom. It's about listening to our bodies and honoring our need for rest or leisure without feeling enslaved by the traditional rat race. The true richness lies in having the autonomy to choose, to create, and to live life on our own terms.

True wealth isn’t always tangible; it resides in the intangible moments that fill our hearts. It’s the joy of spending quality time with loved ones, the satisfaction derived from pursuing our passions, and the inner peace that comes with living authentically. It’s about creating a life that resonates with purpose, finding contentment in the present, and relishing the freedom to be exactly who we are.

Let’s redefine wealth, embracing "The New Rich" that honors the richness within – the treasure trove of moments, experiences, and connections that fill our lives with meaning and abundance. Because in the end, true richness isn’t measured by what we have, but by the richness we bring into each moment, nurturing our souls and embracing the beauty of life itself.

Elevating Orthodontic Care: OrthoNu Tweakz for Braces and Aligners

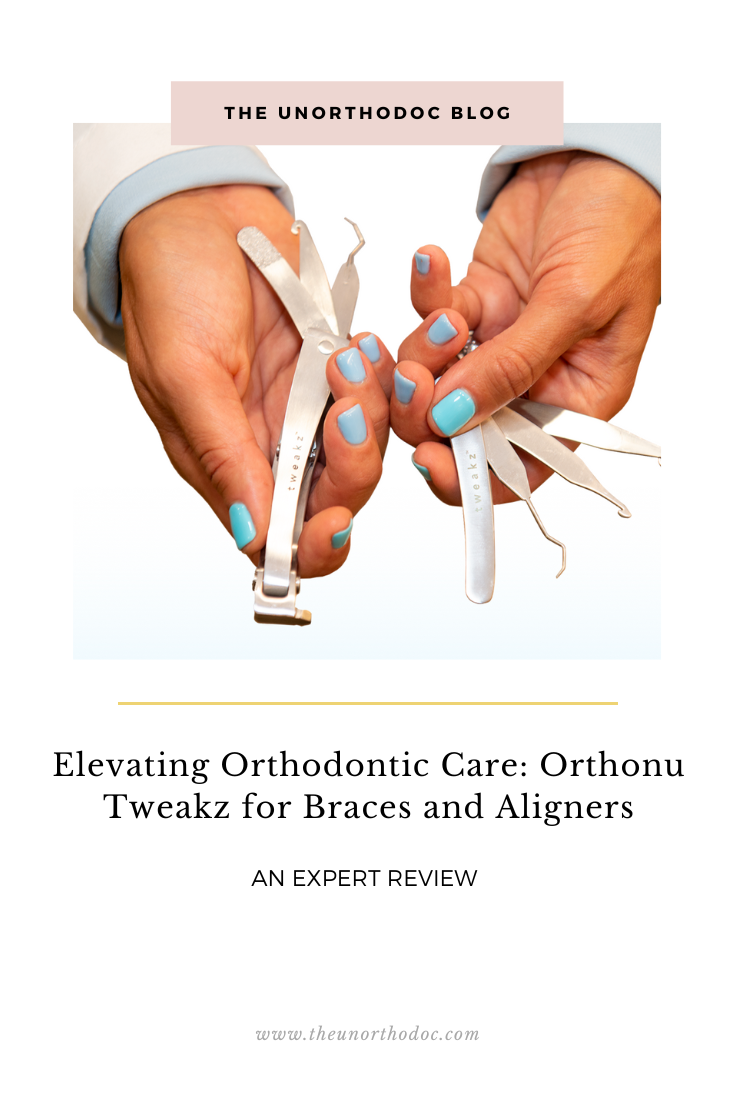

OrthoNu Tweakz for Braces and Aligners have emerged as a transformative innovation within the realm of orthodontic care. As an orthodontist deeply invested in optimizing patient experiences, I've been intrigued by the potential these Tweakz offer for both patients undergoing treatment and orthodontic professionals seeking novel solutions.

OrthoNu stands out as a pioneer, focusing on driving innovation in oral care to enhance the orthodontic journey. With a mission to redefine the standard of care in response to the significant growth in patients seeking orthodontic treatment, OrthoNu Tweakz aim to streamline processes while offering practical solutions

Disclosure: This is a sponsored post by OrthoNu. All opinions are my own.

OrthoNu Tweakz for Braces and Aligners have emerged as a transformative innovation within the realm of orthodontic care. As an orthodontist deeply invested in optimizing patient experiences, I've been intrigued by the potential these Tweakz offer for both patients undergoing treatment and orthodontic professionals seeking novel solutions.

OrthoNu stands out as a pioneer, focusing on driving innovation in oral care to enhance the orthodontic journey. With a mission to redefine the standard of care in response to the significant growth in patients seeking orthodontic treatment, OrthoNu Tweakz aim to streamline processes while offering practical solutions. These self-care products cater to emergency care, oral hygiene, oral aesthetics, and overall oral health, seeking to alleviate the impact of emergency visits and enhance the orthodontic experience for patients.

For Patients: Enhancing Your Orthodontic Journey

Navigating the journey with braces or aligners can present unexpected challenges and occasional discomfort. However, OrthoNu's Tweakz offer a unique approach to enhance your orthodontic experience. These innovative tools serve as practical aids, empowering you to handle common orthodontic issues conveniently from the comfort of your home.

Picture having the ability to address a poking or protruding wire, adjust an uncomfortable bracket, or manage aligner discomfort without rushing to your orthodontist's office. OrthoNu's Tweakz enable you to handle these minor adjustments independently, reducing the need for immediate visits. This translates to fewer interruptions in your daily routine, less time away from work, and minimal disruptions to your child's school schedule.

By alleviating discomfort caused by braces or aligners and swiftly resolving minor issues, OrthoNu's Tweakz provide you with the means to effectively manage your orthodontic treatment. They serve as your reliable solutions for minimizing inconvenience and ensuring a smoother journey throughout your orthodontic care.

For Orthodontic Colleagues: Streamlining Patient Care

Introducing OrthoNu's Tweakz into your practice is not only about enhancing patient care but also about optimizing practice efficiency. These innovative tools, created by an orthodontist for orthodontists, offer patients the capability to manage minor orthodontic issues independently, leading to a reduction in chair-side emergencies and subsequently decreasing unscheduled visits and adjustments. Beyond the direct impact on patient care, this reduction in emergencies also translates to a noteworthy decrease in practice overhead.

Encouraging patients to utilize OrthoNu's Tweakz for minor adjustments significantly curtails emergency visits and minimizes chair time. This streamlined patient care not only benefits your practice's efficiency but also allows for more focused attention on critical orthodontic procedures, elevating the overall quality of care provided to patients.

As an orthodontist myself, I've had the opportunity to try OrthoNu's Tweakz for both aligners and braces on a few new patients. The feedback thus far has been positive, with patients reporting that they have not needed to come in for emergency visits because they’ve been able to alleviate their discomfort themselves. This success has spurred me to continue incorporating these tools with more patients, with the ultimate goal of including them in all my new patient kits. This means that every patient, regardless of braces or aligners, will have access to these empowering tools as part of their orthodontic journey.

By integrating OrthoNu's Tweakz for Braces and Aligners into your orthodontic care regimen, you're not only empowering patients but also optimizing practice operations. This transformative approach fosters patient independence while concurrently reducing practice overhead and revolutionizing the orthodontic experience for both patients and practitioners. Embrace this shift toward patient empowerment and witness the positive impact on your practice's efficiency and patient satisfaction.

Tweakz for Braces

A 4-in-1 tool kit helps with the following:

1. Rubber Band Applicator removes and replaces rubber bands with ease.

2. Dislodged Bracket & Elastic Remover removes broken or dislodged brackets and food from hard-to-reach areas and in between teeth.

3. Diamond Dental File helps smooth out rough spots on brackets, hooks and bands that can cause ulcerations

4. Flush Distal End Cutter eliminates the emergency of sharp wires; the wire cutter holds the cut piece for safety

Tool comes in a nifty travel case with mirror.

Go here for an instructional video on how to use Tweakz for braces.

Tweakz for Aligners

A 4-in-1 tool kit helps with the following:

1. Aligner Remover used to remove retentive aligners.

2. Elastics Applicator removes and replaces rubber bands with ease.

3. Dental Pick removes food from hard-to-reach areas and in between teeth.

4. Diamond Dental File helps smooth out rough spots on composite attachments or aligners that can cause ulcerations

Tool comes in a nifty travel case with mirror.

Go here for an instructional video on how to use Tweakz for aligners.

In the realm of orthodontics, innovation is a catalyst for change, and OrthoNu's Tweakz for Braces and Aligners stand as a testament to this transformation. Empowering patients to handle minor orthodontic adjustments independently, these tools not only enhance patient comfort but also streamline practice operations for orthodontic professionals.

As an orthodontist embracing this evolution, my journey with OrthoNu's Tweakz has revealed their significant potential to redefine the orthodontic experience. Witnessing patients' positive responses and the reduction in emergency visits has solidified my commitment to integrating these tools into my practice. The impact of these nifty tools, created by Dr. Sima Yakoby Epstein, an orthodontist passionate about advancing patient care, has been profound.

The goal of incorporating OrthoNu's Tweakz into orthodontic care goes beyond mere convenience; it signifies a paradigm shift toward patient empowerment. It's about equipping patients with the means to actively participate in their orthodontic journey while allowing practitioners to prioritize critical procedures and elevate the overall quality of care.

To learn more about Orthonu's Tweakz and explore their practical application for braces and aligners, visit their website. Embrace a transformative approach to orthodontic care that places convenience and efficiency at the forefront for both patients and orthodontic professionals. Let's embark on this journey together toward a more empowered and streamlined orthodontic experience. If you’re ready to join me in revolutionizing our practices, make purchases here.

Ultimate 2023 Holiday Gift Guide: Perfect Presents for Everyone on Your List!

'Tis the season to spread joy, and what better way to do so than with the perfect gifts that light up the faces of your loved ones? It's that time of year again, and I'm thrilled to unveil my highly anticipated 2023 Holiday Gift Guide! Year after year, this curated selection of gifts has been a favorite among my readers, and I can't wait to share this year's fabulous finds with you all.

As the holidays draw near, finding the ideal presents can often be a daunting task. But fear not! My ultimate gift guide is here to make your holiday shopping a breeze. Handpicked with care and thoughtfulness, this collection features an array of gifts that cater to every taste, personality, and budget.

'Tis the season to spread joy, and what better way to do so than with the perfect gifts that light up the faces of your loved ones? It's that time of year again, and I'm thrilled to unveil my highly anticipated 2023 Holiday Gift Guide! Year after year, this curated selection of gifts has been a favorite among my readers, and I can't wait to share this year's fabulous finds with you all.

As the holidays draw near, finding the ideal presents can often be a daunting task. But fear not! My ultimate gift guide is here to make your holiday shopping a breeze. Handpicked with care and thoughtfulness, this collection features an array of gifts that cater to every taste, personality, and budget.

I've scoured the latest trends and timeless classics to bring you a diverse assortment of gift ideas that are bound to delight. From tech gadgets to cozy comforts, wellness essentials to chic fashion picks, there's something for everyone on your list. And the cherry on top? Some of these fabulous finds are currently on sale!

This year, I've taken special care to include items that not only make for wonderful gifts but also come with incredible deals and discounts. The holiday spirit is in the air, and what better way to embrace it than by taking advantage of these fantastic sales and offers?

So, whether you're shopping for that tech-savvy friend, the wellness enthusiast, the fashionista, or even the hard-to-shop-for relative, my gift guide has you covered. Say goodbye to holiday shopping stress and hello to finding the perfect presents with ease.

Get ready to spread cheer and warmth with presents that will bring smiles and joy to all your cherished ones. Happy gifting! 🎁✨

Songmont Medium Luna Bag - The most versatile bag for everyday wear! The shape embodies a moon and it can be worn in multiple ways, as a clutch, a shoulder bag, and as a crossbody bag. You can easily transition from day to night with this bag. Not to mention, it’s made of vegan leather and super affordable.

AirEssential Wide Leg Pant - One word: COMFORT. Made with spacer fabric that’s lightweight, luxuriously soft and ultra drapey. Designed with refined comfort to feel silky against your skin, these ultimate throw-on-and-go styles will take you anywhere and everywhere. Pair it with the crew to complete the look. Wear it around the house, to run errands, to the airport, anywhere. Plus, they’re currently 20% off, hurry!

Suri electric toothbrush - The last toothbrush you’ll ever need. I absolutely love this brand and what they stand for. The brush uses recyclable plant-based heads and bristles, the slim aluminum body is designed to be taken apart and repaired, all while delivering a dentist-approved clean. It's quiet, powerful, and the battery lasts over 40 days. They offer a 100-day money back guarantee because they know you'll love it. Currently 25% off for black Friday.

Bistro Tile Margot Monogram Mug - I absolutely love these mugs! They are Parisan inspired so say au revoir to everyone-has-it dinnerware & décor – and bonjour (or bon appetit!) to bold, mosaic-inspired motifs, and a hint of glimmer. Pair it with these dinner plates to compete the look.

Molekule Air Purifier - Give the gift of clean air! It rids the air of 6 different types of pollutants: viruses, dust mites, VOCs, smoke, pet dander, etc. They are having the biggest sale ever, at 25% off.

Foreo Bear2 - The microcurrent device that evens out fine lines and wrinkles! Steady current stimulates muscles to strengthen them, while tightening skin above. No need for botox - I am in love with mine.Made of bacteria-resistant silicone, 100% waterproof, easy to clean. These devices are on sale now and you can get an additional 5% off with code: PATRICE5.

YSL Libre Absolu Platine - My go-to is always perfume and you will love this scent! It’s rich, sultry and feminine but I could also see it being unisex. Perfect for this time of year.

LV Cactus Garden - Great for hubby, dad or a guy friend. It smells amazing! Fresh and masculine, but could also be unisex. The bottle can also be personalized. We got this as a wedding gift and so it has our wedding date engraved on it making it extra special.

Square Valet Tray - The Square Valet Tray is a gorgeous addition to any entry table, desk, or vanity. Simply drop your keys or watch in it at the end of the day and trust they will be there when you head out in the morning. Perfect to add to your travel set, this valet tray organizer unsnaps and lays flat so you can easily pack it without bulking up your luggage.

Sonos Speakers - You cannot go wrong with a portable speaker, especially for men. My husband loves his bose speaker and takes it with him on vacation, to outdoor family picnics or to just chill in the backyard. This one is from Sonos, great sound quality, is lightweight and a great price.

Colored Coupé Glasses - These are elegant and fun and a great gift for the hostess with the mostest. They make beautiful additions to your wine/champagne flute collection.

SM Water Tumbler - Move over Stanley, these tumblers are all the craze this year and comes in a variety of colors. It’s a great inexpensive and practical gift.

Ninja Air fryer - I am super tardy to the air fryer party and only got one about two months ago and let me tell you, I have totally been missing out. I have been cooking everything in it! The perfect gift for the busy professional or mom, or anyone who cooks.

Nespresso Vertup Plus Coffee Maker - For the coffee lover! Coffee makers make a great gift and this is on major sale at the moment.

2024 Goal Planner - The gift that keeps on giving all 2024 long! Can be gifted to anyone on your list that is goal oriented and loves writing all their dreams and aspirations down.

Thoughts & Feelings Journal - Whether for notes, reminders, gratitude, etc notebooks and journals come in handy. I love these, they are practical, pretty and super affordable.

Candles - Such a no-brainer and always a simple yet thoughtful gift. Everyone loves candles, why not treat your loved one with the gift of fragrance to set the mood this holiday season.

RL Men’s Pajamas - My husband swears y these pajamas. They are breathable, soft, light and can be doubled as loungewear.

Lina Wine Bottle Holder - Display and serve multiple bottles of reds and whites within this hand-carved holder.

Get easy access to a lot of these products on amazon here!

There you have it, 19 amazing gift ideas this season. I hope you see something you love for yourself or will gift to someone. Happy holidays! and happy shopping friends.

Debt Consolidation Strategies: Streamlining Your Financial Obligations

Debt: a tricky topic, but a must if you want financial stability. Managing various loans, credit card bills, and financial obligations often leads to stress and confusion.

Enter debt consolidation strategies, your ally in simplifying financial obligations. In this article, we’ll delve deeper into what debt consolidation is and share insights, tips, and strategies to empower you to regain control of your financial well-being.

A guest post by Myrtle Bautista

Debt: a tricky topic, but a must if you want financial stability. Managing various loans, credit card bills, and financial obligations often leads to stress and confusion.

Enter debt consolidation strategies, your ally in simplifying financial obligations. In this article, we’ll delve deeper into what debt consolidation is and share insights, tips, and strategies to empower you to regain control of your financial well-being.

What is Debt Consolidation?

Debt consolidation is a savvy financial strategy that revolves around the integration of multiple debts into a single, more manageable debt. This can be achieved in a variety of ways, like obtaining a consolidation loan, executing a balance transfer, or implementing a comprehensive debt management plan. The overarching objective is to simplify your financial life and alleviate the weight of high-interest debt.

Types of Debt to Consolidate

Credit Card Debt

Personal Loans

Medical Bills

Student Loans

Other Unsecured Debts

Benefits of Debt Consolidation

Debt consolidation offers a host of advantages that can significantly improve your financial situation:

Simplified Repayment: The beauty of a single monthly payment is that it streamlines debt management. No more keeping tabs on numerous due dates, which drastically reduces the chances of accidentally missing a payment.

Lower Interest Rates: Among the most appealing benefits is the potential for lower interest rates. Debt consolidation may secure a reduced overall interest rate, saving you a substantial amount of money in the long run.

Reduced Monthly Payments: Debt consolidation often leads to lower monthly payments, freeing up more of your income for savings, investments, or essentials.

Improved Credit Score: Paying your consolidated loan on time can boost your credit score, leading to better financial opportunities and lower interest rates on future loans.

Structured Repayment Plan: Having a debt consolidation plan in place offers a structured and clear path toward achieving debt-free status. This, in turn, can alleviate the stress and anxiety commonly linked with managing multiple debts.

Debt Consolidation Strategies

Consolidation Loans

A consolidation loan is a straightforward approach. It entails acquiring a new loan to pay off your existing debts, effectively merging various high-interest debts into one. The key benefit is often securing a lower interest rate, which can lead to savings and more manageable monthly payments.

Balance Transfers

If you're grappling with high-interest credit card debt, consider balance transfers. This method allows you to move your debt from a high-interest card to a new one with a lower or even 0% introductory interest rate. It's a smart way to cut down on interest expenses, but do remember that introductory rates can expire, so understanding the terms is crucial.

Debt Management Plans

Debt management plans involve working closely with a credit counseling agency. Together, you create a structured plan to repay your debts over time. These plans often come with reduced interest rates, making it easier to manage your debt. It's a method that adds organization and expertise to your journey toward financial stability.

Choosing the Right Strategy

Assess Your Debt

Before deciding on a consolidation strategy, it's crucial to assess your total debt and the interest rates associated with each debt. This assessment provides the insight needed to determine which method is most suitable for your unique financial situation.

Credit Score Consideration

Your credit score matters when evaluating consolidation options. Certain strategies may impact your credit score temporarily, so it's important to be aware of these potential effects. However, with proper management, consolidation can ultimately have a positive impact on your credit.

Debt Consolidation Tips

Stick to Your Plan

Once you’ve chosen a consolidation strategy, commit to it, pay on time, and avoid more debt. Remember: consistency is success.

Avoid Scams

When consolidating debt, it's essential to remain vigilant and avoid insurance scams, identity theft, and phishing. Be cautious of offers that promise debt relief in exchange for upfront fees or personal information.

Here are just a few tips on how you can steer clear of scams:

Research Thoroughly: Investigate the company or organization offering debt consolidation services.

Read the Fine Print: Scrutinize any agreements and contracts before signing.

Consult a Professional: Consider seeking advice from a financial advisor or attorney.

Budget Wisely

Creating a realistic budget is extremely crucial. It should be designed to help you meet your financial obligations without relying on credit. A well-structured budget is your tool for financial control.

Seek Professional Guidance

Given the intricacies of debt consolidation, it's a prudent choice to seek guidance from a financial advisor or credit counselor. Small business owners can also benefit from the insights of an accountant. Their expertise ensures that you're making the best decisions aligned with your unique financial circumstances. The value of their guidance on your path to financial freedom is immeasurable.

Conclusion

Debt consolidation is a powerful tool that streamlines your financial obligations, slashes interest rates, and even has the potential to improve your credit score. With the right strategy and the wisdom you've gained from the tips above, you're primed to take the crucial first step toward a future free from debt!

For more finance advice, check out the UnOrthoDoc Blog!

About The Author:

Myrtle is a journalism major, a social media marketer and is now exploring freelance writing. She's fond of anything related to health and wellness, and when she's not writing, you'll find her doing long-distance cycling, ultramarathons, hiking, or in a local cafe enjoying a good cold brew

An Honorable Distinction: Selected for Incisal Edge's Top 40 Under 40 Dental Specialists

I am thrilled and deeply honored to share some exciting news – I have been selected as one of Incisal Edge's Top 40 Under 40 Dental Specialists in the United States. This recognition is a significant milestone in my career, and I am humbled to be counted among the most talented and forward-thinking young dental specialists across the nation.

I am thrilled and deeply honored to share some exciting news – I have been selected as one of Incisal Edge's Top 40 Under 40 Dental Specialists in the United States. This recognition is a significant milestone in my career, and I am humbled to be counted among the most talented and forward-thinking young dental specialists across the nation.

For the 13th consecutive year, Incisal Edge, Benco Dental's award-winning magazine, is shining a spotlight on the 40 best general dentists and 40 best specialists in the United States. This esteemed recognition acknowledges the most innovative, clinically adept, and ambitious dental professionals who are pushing the boundaries of dental care.

Being part of this elite group of dental specialists is not only a personal achievement but also a testament to the dedication and hard work of my entire team. It's a recognition of the countless hours spent in pursuit of clinical excellence, the commitment to staying at the forefront of dental technology, and the passion for making a positive impact on the lives of our patients.

As I reflect on this honor, I am reminded of the responsibility that comes with it – the responsibility to continue providing the highest quality care, to remain at the cutting edge of dental innovations, and to inspire the next generation of dental specialists.

I want to express my heartfelt gratitude to all my patients, colleagues, mentors, and the entire dental community for their unwavering support and encouragement throughout this journey. I am excited about the future and the opportunity to contribute to the advancement of dental healthcare.

Here's to a future filled with more remarkable achievements and a commitment to excellence in dentistry.

Things to Consider When Starting a Private Practice

For healthcare professionals, the idea of opening a private practice in the medical field is both thrilling and potentially life-changing. Whether you are a doctor, therapist, dentist, or another type of healthcare professional, operating your practice holds out the prospect of both personal and professional pleasure. However, this project demands careful preparation and reflective consideration. Therefore, here are a few things you need to know before launching a solo practice, so take these things into consideration right now.

A guest post by Emma Joyce

For healthcare professionals, the idea of opening a private practice in the medical field is both thrilling and potentially life-changing. Whether you are a doctor, therapist, dentist, or another type of healthcare professional, operating your practice holds out the prospect of both personal and professional pleasure. However, this project demands careful preparation and reflective consideration. Therefore, here are a few things you need to know before launching a solo practice, so take these things into consideration right now.

Comprehensive Business Plan

Making a thorough and well-organized business plan is one of the key building blocks of starting a solo practice successfully. This strategy should cover the core values, aims, and goals of your practice. The target patient population and the area of expertise you want to concentrate on should also be specified. Examine where your practice is located since location matters, especially if you want to create a strong brand. Size issues are crucial in terms of both physical space and patient capacity. Include painstakingly produced financial estimates, an itemized spending plan, and a clear schedule for accomplishing your objectives.

Legal and Regulatory Requirements

When starting a private practice in the healthcare industry, you must manage the complex web of legal and regulatory regulations with skill. Depending on where you live and the specialty you decide to pursue, these requirements could change dramatically. Getting the required licenses, permissions, and certificates is a crucial factor. The choice of your practice's legal form—a sole proprietorship, partnership, limited liability company (LLC), or corporation—must also be carefully considered. Health Insurance Portability and Accountability Act (HIPAA) compliance is a requirement that cannot be negated. It is crucial to protect patient privacy and uphold the highest ethical standards because any legal problems could seriously impede the expansion of your practice.

Practice Management and Technology

A successful private practice is built on effective practice management. The maintenance of patient records, billing, and appointment scheduling are just a few of the administrative processes that can be streamlined by purchasing reliable practice management software. Maintaining a leading edge in your field's technical developments is equally important. This is why using a practical dental review management solution might turn out to be very important in the setting of dental practices. This entails keeping an eye on and managing internet reviews and feedback from patients, which have a direct bearing on your practice's reputation and patient satisfaction levels. Adopting technology improves operational effectiveness while also enhancing patient care and the success of the practice as a whole.

Financing and Budgeting

The success and durability of your private practice are based on sound financial planning, which is its lifeblood. You must first determine the up-front expenses related to starting your practice. These could include the cost of renting or buying office space, purchasing equipment, getting insurance, and hiring necessary personnel. It is likely that obtaining funding via grants, loans, personal investments, or a combination of these will be required. Both beginning and ongoing operational costs should be included in a well-structured budget. These continuous costs could include utility bills, employee wages, marketing campaigns, and prescription drugs. They could also include rent or mortgage payments. If you want to keep your practice financially stable and ready for expansion, you must maintain a consistent and healthy cash flow.

Staffing and Training

The success of your private practice is greatly influenced by the quality of your team. It is crucial to work with people who share your values and passion for patient care, and who are highly skilled and qualified. Make sure prospective team members are thoroughly vetted to make sure they adhere to the culture and values of your practice. Equally important is making ongoing investments in your staff's professional development. By doing this, you can be confident that your team is always up to date on the most recent developments in your industry and that they are also well-equipped to deliver the best possible patient care. For employee retention and ultimately patient satisfaction, a positive workplace culture where team members feel appreciated and involved is crucial.

Marketing and Patient Acquisition

For private practitioners, finding new patients and keeping them on board are continual problems. It is crucial to develop a thoughtful marketing plan. To reach and engage your target audience in an efficient manner, your plan should include both online and offline media. An effective internet marketing effort must include building a credible website, having a significant social media presence, and spending money on search engine optimization (SEO). Nevertheless, it's critical to acknowledge the lasting power of patient referrals and word-of-mouth advertising, which frequently attract excellent, devoted patients. Grow these organic development channels while enhancing them with clever marketing initiatives.

Starting a solo practice in the healthcare sector is a big project that requires careful planning, smart thinking, and unrelenting dedication. You may start your private practice journey with confidence by thoughtfully addressing these important factors, setting up your business for long-term success in the fast-paced and cutthroat healthcare industry.

About the Author:

Emma Joyce is a writer who likes to share her experience with fellow enthusiasts. When she's not writing, she is reading about new trends in the business world and learning how to implement them into her work and writing. She is a regular contributor to https://bizzmarkblog.com/

Living a Fulfilling Life: Balancing a Successful Career and Personal Happiness

As a busy professional, it can become all too easy to lose sight of the importance of maintaining a balance between career success and personal happiness. We can become so consumed with work and the pressures that come with it, that we forget about the things that truly matter. However, the good news is that it is possible to lead a fulfilling life while juggling a successful career and maintaining a happy personal life. Let this guide shared by The UnOrthoDoc help you strike that balance between work and happiness.

This is a guest post by Marjorie Jones

As a busy professional, it can become all too easy to lose sight of the importance of maintaining a balance between career success and personal happiness. We can become so consumed with work and the pressures that come with it, that we forget about the things that truly matter. However, the good news is that it is possible to lead a fulfilling life while juggling a successful career and maintaining a happy personal life. Let this guide shared by The UnOrthoDoc help you strike that balance between work and happiness.

Prioritizing Self-Care for Opt Well-being

One of the most important things you can do for yourself is prioritize your self-care. Taking care of your physical and mental wellness is crucial, especially when you’re trying to balance a successful career with personal happiness. Make sure you’re getting enough sleep, eating a healthy, balanced diet, and exercising regularly. Additionally, it's important to take care of your mental health. Incorporating activities like meditation, deep breathing, or yoga into your day can help you manage stress more effectively.

Setting Boundaries for a Healthy Work-Life Balance

It can be challenging to separate work and your personal life when they feel like they're constantly blurring together. However, setting boundaries is crucial to maintaining a healthy work-life balance. When you’re at work, try to focus on work-related tasks, and when you’re at home, make a conscious effort to switch off. Avoid checking work emails or taking phone calls during your personal time. By setting these boundaries, you'll create a clear distinction between your work and personal life, which can help reduce stress and improve productivity.

Set Realistic Work Goals

Setting attainable goals helps you avoid burnout from feeling overwhelmed or feeling like you’re not moving forward. Breaking down larger projects and initiatives into smaller goals allows you to make progress in a more manageable way that gradually leads toward your larger end goal. Being realistic about what you can accomplish while still maintaining balance for yourself can help you avoid burnout and lead to a more sustainable path to success.

Mindfulness Practices for Stress Reduction

Mindfulness practices, like meditation, can help reduce stress while increasing focus. Mindfulness is all about being aware of the present moment and accepting it without judgment. Taking a few minutes every day to practice mindfulness, whether it's through breathing exercises or simply focusing your mind, can help you feel more centered and less stressed. Incorporating mindful practices can also help you approach work and personal situations with more clarity and intention, improving your overall productivity.

Use Time Management Strategies

Time management is essential for juggling a successful career and personal life. Prioritization and scheduling are two effective strategies that can help maximize productivity while minimizing stress. Prioritize your workload by assessing what tasks need to be done first or which require the most time to complete. Use tools like calendars or reminders to help you stay organized and on track. Avoid over-booking yourself and create a realistic schedule that allows you to have time for outside interests and hobbies.

Pursuing Personal Growth: Going Back to School

If you’re feeling stuck in a career rut, going back to school can help facilitate your career progression. One great option is to get a business bachelor degree. An online program offers the flexibility of studying at your own pace while still being able to maintain your professional and personal obligations. Obtaining additional education or certifications related to your field can open up new opportunities for career advancement and personal fulfillment.

Leading a fulfilling life while navigating a successful career and personal happiness can be a challenging endeavor for busy professionals. But with realistic goal-setting, effective time management, etc., it becomes entirely plausible. Consider incorporating these strategies and taking additional educational courses to help facilitate your career growth and improve your overall well-being. Remember, it’s never too late to prioritize your happiness and find success in both your career and your personal life.

About the Author:

Marjorie Jones created Working Class Wow because she knows you don’t need a big budget to make your business look like a million bucks! From a well-designed logo and a carefully-crafted website to grammatically-correct copy and professionally-printed marketing materials, it is entirely possible (and surprisingly affordable) to bring a little “Working Class WOW” to your small business to build your brand, improve relationships with customers, and benefit the bottom line. WorkingClassWow.com can show you how.

The Evolution of Work in the Post-Pandemic Era

The COVID-19 pandemic has fundamentally altered the landscape of work in ways we could not have imagined just a few years ago. As the world grappled with the challenges and uncertainties brought about by the virus, individuals and businesses adapted and evolved in response to the crisis. This period of adaptation has reshaped the world of work, redefining our understanding of where, how, and why we work.

The COVID-19 pandemic has fundamentally altered the landscape of work in ways we could not have imagined just a few years ago. As the world grappled with the challenges and uncertainties brought about by the virus, individuals and businesses adapted and evolved in response to the crisis. This period of adaptation has reshaped the world of work, redefining our understanding of where, how, and why we work. In this think piece, we will explore the transformation of work since the pandemic, the role of the economy in shaping work choices, the growing appeal of remote work and side businesses, and what the future of work may hold.

The State of the Economy and Its Impact on Work

The pandemic ushered in a period of economic uncertainty, resulting in job losses, furloughs, and business closures on a global scale. These challenges forced individuals to rethink their career paths and consider alternative ways to earn a living. The state of the economy played a pivotal role in driving changes in the labor market, as people sought greater financial stability and flexibility.

1. Remote Work as a New Norm

One of the most prominent shifts in the world of work during the pandemic was the widespread adoption of remote work. As businesses adapted to lockdowns and social distancing measures, they rapidly transitioned to remote work models to keep their operations running. Employees discovered the benefits of working from home, such as reduced commuting time and increased flexibility, prompting a reevaluation of their work preferences.

Even as the pandemic subsided, many companies continued to offer remote work options, reflecting the desire of both employees and employers to maintain this newfound flexibility. As a result, remote work is now seen as a viable and attractive choice, enabling individuals to balance work with personal life and contributing to reduced carbon emissions through fewer commutes.

2. Side Businesses and the Gig Economy

The pandemic also accelerated the rise of side businesses and the gig economy. With economic instability and job uncertainty, people turned to entrepreneurship and gig work as means of generating income and securing their financial future. Platforms like Uber, Airbnb, and freelancing websites saw a surge in activity as individuals sought opportunities for supplementary income.

Side businesses, ranging from online stores to freelance consulting, became avenues for pursuing passions, gaining financial independence, and diversifying income streams. The gig economy, with its flexible work arrangements, provided a lifeline for many, allowing them to adapt to changing economic circumstances.

The Future of Work

Looking ahead, the future of work appears to be a dynamic blend of traditional employment, remote work, side businesses, and gig work. This shift presents both opportunities and challenges.

1. Embracing Flexibility

The future of work will prioritize flexibility, with remote work options remaining a cornerstone of many job markets. Employees will seek employers who offer work arrangements that align with their lifestyle choices, including remote and hybrid models.

2. Emphasizing Skills and Adaptability

As the job market continues to evolve, individuals must prioritize upskilling and adaptability. The ability to learn new skills quickly and pivot into different roles or industries will be crucial for career longevity.

3. Entrepreneurship and Gig Work

The rise of side businesses and the gig economy is likely to continue as individuals recognize the value of diversifying their income streams and pursuing their passions. Preparing for the future of work may involve exploring entrepreneurial ventures and building a personal brand.

The COVID-19 pandemic reshaped the world of work in profound ways, with the economy serving as a catalyst for change. Remote work, side businesses, and the gig economy have become attractive options for individuals seeking flexibility, financial stability, and personal fulfillment. The future of work will be defined by flexibility, adaptability, and entrepreneurship. To prepare for this future, individuals must prioritize skills development, embrace change, and explore diverse avenues for income generation. As we navigate this evolving landscape, the world of work will continue to offer new and exciting opportunities for personal and professional growth.

Breaking Up with the Side Hustle: My Love-Hate Relationship in the New Era of Entrepreneurship

In this era brimming with opportunities and flexible work structures, "side hustle" has become a familiar phrase in our lexicon. I, too, have liberally used it throughout this blog, often boasting a few "side hustles" of my own. For many, it embodies ambition, the prospect of extra income, and the pursuit of dreams. But now, at the crossroads of entrepreneurship, I stand pondering why I'm considering parting ways with the term "side hustle."

In this era brimming with opportunities and flexible work structures, "side hustle" has become a familiar phrase in our lexicon. I, too, have liberally used it throughout this blog, often boasting a few "side hustles" of my own. For many, it embodies ambition, the prospect of extra income, and the pursuit of dreams. But now, at the crossroads of entrepreneurship, I stand pondering why I'm considering parting ways with the term "side hustle." It's not the entire phrase, but the latter half, "hustle," that raises questions—it conveys strain, busyness, and difficulty.

These side ventures have indeed played a pivotal role in molding my entrepreneurial journey. Beyond my role in running an Orthodontics practice, they've brought immense joy as I've nurtured them into steady earners, generating $10-$12K per month. It's a genuinely delightful experience! Yet, as I plunge deeper into the realm of business, the phrase itself emerges as a love-hate relationship that merits examination.

The Love:

1. Extra Income: Let's face it, who doesn't appreciate a financial cushion? My side hustle has been a reliable source of extra income, which has often eased the financial stress in my life.

2. Flexibility: The freedom to work on my terms, at my pace, has been a game-changer. It aligns perfectly with the era of remote work and flexible schedules.

3. Passion Projects: It allows me to pursue my passions and hobbies as income-generating endeavors. What's better than getting paid for doing what you love?

The Hate:

1. Limiting Label: The term "side hustle" can be constricting, often implying a secondary role or a mere supplement to a 'main' job. Yet, what if your side venture embodies your true passion? Sometimes, these pursuits begin as secondary endeavors but possess the potential to blossom into full-fledged ventures. Perhaps it's time to adopt a different phrase that better captures this transformative journey.

2. Stress and Burnout: The term "hustle" itself often carries associations with stress and burnout. The idea of balancing a full-time job, family responsibilities, and a side venture can be overwhelming and risk causing burnout. Therefore, it's crucial to establish a sustainable rhythm that prioritizes both mental and physical well-being. After all, a side pursuit should be an additional source of income, not a source of undue strain.

3. Entrepreneurial Evolution: In this era, we're witnessing the evolution of entrepreneurship. Businesses born as side hustles have grown into thriving ventures. The phrase 'side hustle' can't encapsulate the magnitude of such aspirations.

So, why the breakup with the term? It's about acknowledging the transformation in my mindset. I no longer see my ventures as something secondary. They are bona fide businesses, an entrepreneurial pursuit that deserves to stand on its own.

In the era of entrepreneurship and flexible work, it's time to embrace a new lexicon, one that reflects the diverse journeys we embark upon. Terms like "profit pursuit," "earnings endeavor," and "spare time startup” and “income initiative" better encapsulate the potential and ambition behind what we do.

The side hustle era has laid the groundwork, but now we're taking the reins and redefining our entrepreneurial narratives. It's time to break up with the limitations of the past and step into a future where our businesses, no matter their origins, shine brilliantly.

As I embark on this journey of linguistic liberation, I invite you to explore your own relationship with the term "side hustle." Are you ready to redefine your narrative and embrace the entrepreneurial era with a fresh perspective? It's time to discover a new language of ambition, one that truly reflects the transformative power of our pursuits.

Mastering the Art of Effective Networking for Professional Success

In today's interconnected world, networking isn't just a buzzword; it's a skill that has become the cornerstone of my journey as a millennial orthodontist and blogger with a thriving orthodontics practice and a robust online community. From crowded conference halls to the virtual landscapes of social media, networking has been the secret ingredient that has elevated my professional success to new heights.

In today's interconnected world, networking isn't just a buzzword; it's a skill that has become the cornerstone of my journey as a millennial orthodontist and blogger with a thriving orthodontics practice and a robust online community. From crowded conference halls to the virtual landscapes of social media, networking has been the secret ingredient that has elevated my professional success to new heights.

Just like perfectly aligning teeth requires precision and attention to detail, so does crafting a network that serves as a foundation for growth. As I've navigated the ever-evolving landscape of dentistry and online presence, I've discovered that the art of effective networking goes beyond superficial exchanges—it's about forging connections that are as sturdy as braces, connections that support your journey and allow you to support others in return.

Picture this: I remember attending my very first industry conference, palms slightly sweaty as I clutched my badge, and trying to muster the courage to introduce myself to established figures in my field. It was a bit nerve-wracking, but that moment marked the beginning of relationships that have transformed both my career and my perspective on networking.

That brings me to the heart of the matter:

1. Clarify Your Networking Goals:

Before diving into networking events or activities, it's essential to define your networking goals. Ask yourself: What do you hope to achieve through networking? Are you seeking career opportunities, mentorship, or industry insights? Having a clear vision of what you want to accomplish will guide your networking efforts and help you identify relevant opportunities.

2. Cultivate a Genuine Mindset:

Authenticity is key. Approach networking with an authentic and genuine mindset. Focus on building meaningful connections rather than viewing others solely as potential stepping stones. Show a genuine interest in people, listen actively, and seek to understand their perspectives. By building real connections based on trust and mutual respect, you can forge relationships that last.

3. Choose the Right Networking Channels:

Identify the networking channels that align with your professional goals and target audience. Attend industry conferences, seminars, or meetups relevant to your field. Engage in online networking through platforms like LinkedIn, where you can connect with professionals in your industry and join relevant groups. Selecting the right channels increases the chances of meeting like-minded individuals and finding valuable connections.

4. Craft an Elevator Pitch:

Prepare a concise and compelling elevator pitch that succinctly describes who you are, what you do, and what sets you apart. This 30-second introduction should leave a lasting impression and spark curiosity in the listener. Tailor your pitch based on the context and the individuals you are networking with, highlighting relevant aspects of your expertise or shared interests.

5. Nurture Relationships:

Networking is not just about exchanging business cards or connecting on social media—it's about building and nurturing relationships. Follow up with the individuals you meet, whether it's sending a personalized email, scheduling a coffee chat, or connecting on professional platforms. Cultivate relationships by providing value, sharing insights, and offering assistance whenever possible.

6. Give Before You Ask:

Approach networking with a mindset of giving first. Offer assistance, share your knowledge, and provide value to your network without expecting immediate returns. By being generous with your time, expertise, and resources, you build trust and goodwill within your network. This paves the way for future collaborations and opportunities that may arise organically.

7. Stay Connected and Engaged:

Maintain regular contact with your network by staying engaged and updated. Follow up with connections, congratulate them on their achievements, and engage with their content on social media. Attend industry events and participate in online discussions to stay visible within your professional community. Consistency and active engagement help you stay top of mind and foster stronger relationships.

Effective networking is a powerful tool for success, enabling you to expand your knowledge, find new opportunities, and build a support system of like-minded individuals. It's not just about expanding your professional reach; it's about weaving a tapestry of relationships that enrich your journey as well as the journeys of those you touch. So, whether you're mingling at a conference or typing away on LinkedIn, remember that mastering the art of networking isn't just about achieving professional success; it's about crafting a masterpiece of human connection.

Tax-Savvy Strategies: Maximizing Deductions for Dental Professionals and Side Hustlers

Whether you're managing your own dental practice or pursuing your passion through a side hustle, understanding the tax write-offs available can significantly impact your financial outlook. Let's delve into some valuable deductions tailored to both dental professionals and individuals with side businesses, empowering you to make impactful financial decisions.

Whether you're managing your own dental practice or pursuing your passion through a side hustle, understanding the tax write-offs available can significantly impact your financial outlook. Let's delve into some valuable deductions tailored to both dental professionals and individuals with side businesses, empowering you to make impactful financial decisions.

Essential Tools and Supplies

For dental professionals, having the right equipment and supplies is paramount for delivering top-notch patient care. The good news is that you can deduct the expenses associated with these essential items. From dental instruments and chairs to sterilization equipment and X-ray machines, keeping a record of your equipment purchases throughout the year is essential. Additionally, remember to account for costs related to supplies like gloves, masks, disposable items, and dental materials.

Investing in Expertise and Growth

In the dynamic landscape of dentistry, staying up-to-date with the latest developments is crucial. The costs you incur for attending dental workshops, seminars, courses, and conferences can be eligible for tax deductions. This encompasses registration fees, travel expenses, accommodation, and study materials. By dedicating resources to your professional development, you enhance your skills and simultaneously reduce your tax obligations.

Home Workspace Benefits

Whether you're a dental professional or a side business enthusiast, working from home might be part of your routine. If you've designated a specific area exclusively for your dental practice or side endeavors, you might qualify for a home office deduction. This deduction enables you to deduct a portion of your home-related expenses, including rent or mortgage, utilities, and related costs. It's important to ensure your home office adheres to IRS guidelines and is solely used for business purposes.

Boosting Visibility Through Marketing

Promoting your dental practice or side business is essential for attracting clients and customers. Fortunately, expenses related to marketing and advertising are generally tax-deductible. This encompasses costs associated with creating and maintaining a professional website, printing business materials, online advertising, social media campaigns, and even sponsoring local events. Maintaining a detailed record of these expenses will substantiate your deductions during tax season.

Networking and Resources

As a dental professional with a side business or blog, staying connected with your industry and accessing valuable resources is invaluable. Membership fees for professional associations, dental societies, and online communities are deductible. Additionally, subscriptions to dental publications, research databases, blogging platforms, and industry-related magazines can also be considered valid deductions. Stay informed, engaged, and enjoy the tax advantages these memberships provide.

While these deductions offer significant advantages, it's advisable to consult with a qualified tax professional or CPA who specializes in dental professionals and small business owners. They can offer personalized guidance based on your unique situation, assisting you in navigating the intricate realm of tax deductions.

Leveraging these tax write-offs allows you to optimize your tax circumstances, alleviate your overall tax responsibilities, and retain more of your hard-earned income. Embrace the advantages that come with being a dental professional and pursuing a side venture, all while making prudent financial decisions.

Here's to your ongoing success in your dental practice and your journey as a side business enthusiast. Keep shining, both in your clinical work and on your digital platform!

Boost Your Business with Square: Empowering Entrepreneurs with Seamless Payment Solutions

In the fast-paced world of business, staying ahead of the competition and providing convenient payment options for customers is crucial. Square, a revolutionary payment processing platform, has emerged as a game-changer for entrepreneurs and businesses of all sizes. In this blog post, we will explore the numerous benefits of Square and how it can transform your business with its seamless payment solutions.

In the fast-paced world of business, staying ahead of the competition and providing convenient payment options for customers is crucial. Square, a revolutionary payment processing platform, has emerged as a game-changer for entrepreneurs and businesses of all sizes. In this blog post, we will explore the numerous benefits of Square and how it can transform your business with its seamless payment solutions.

As an entrepreneur deeply rooted in various ventures, I'm thrilled to share my personal success story with Square – a versatile payment processing solution that has seamlessly integrated into my diverse business landscape. From my Orthodontics practice where I leverage the Square reader to kickstart new patients' orthodontic journeys at local events such as bridal shows, community gatherings, and farmers markets, to my flourishing candle company that thrives at flea markets, and even in the realm of my aesthetic business where precision and reliability are paramount, Square has been the driving force behind my seamless transactions. The straightforward and efficient nature of Square's payment solutions has allowed me to dedicate more time to providing exceptional service and fostering business growth. Throughout this post we will; explore the exceptional benefits of Square and how it can effortlessly elevate your entrepreneurial pursuits. Plus, an exciting incentive awaits: make the most of your decision to embrace Square before August 24th, using the exclusive discount code SUMMERSAVE to enhance the value of your journey towards success!

What is Square?

Square is a financial services and mobile payment company founded in 2009 by Jack Dorsey and Jim McKelvey. It began as a small, portable card reader that attached to smartphones and allowed merchants to accept credit card payments on-the-go. Since then, Square has grown exponentially and expanded its suite of services to include an extensive range of payment and business management solutions.

Benefits of Square for Your Business

1. Seamless Payment Processing:

Square offers a user-friendly and seamless payment processing system that enables businesses to accept various payment methods effortlessly. Whether it's credit cards, debit cards, mobile payments, or even contactless transactions like Apple Pay and Google Pay, Square has got you covered. With quick and reliable transactions, customers experience a smoother checkout process, leading to increased customer satisfaction and repeat business.

2. Diverse Product Offerings:

Square offers an array of products tailored to cater to different business needs. Apart from the traditional card reader, they provide solutions like Square Terminal, Square Register, Square Stand, and Square for Restaurants. Each of these options is designed to streamline transactions and manage sales efficiently, making it a versatile choice for businesses across industries.

3. Inventory Management:

Keeping track of inventory and sales is a breeze with Square's integrated inventory management system. Users can effortlessly track stock levels, set up low-stock alerts, and manage purchase orders directly from the Square dashboard. This feature helps businesses make informed decisions, prevent stockouts, and reduce the risk of overstocking.

4. Online Payment Solutions:

In addition to in-person transactions, Square offers powerful online payment solutions for e-commerce businesses. Whether you're running a website or selling through social media, Square's e-commerce tools ensure a smooth and secure checkout process for your online customers.

5. Business Analytics and Reporting:

Square provides valuable insights into your business through detailed analytics and reporting features. You can access real-time sales data, track performance, and understand customer behavior, all of which are essential for making informed business decisions and formulating effective marketing strategies.

Square Fees and Costs

One of the most appealing aspects of Square for small businesses is its transparent and straightforward fee structure. Here's an overview of the main fees associated with using Square:

1. Card-present Transactions: For swiped, dipped, or tapped payments, Square charges a flat fee of around 2.6% + $0.10 per transaction.

2. Card-not-present Transactions: For keyed-in or online payments, the fee is slightly higher at around 3.5% + $0.15 per transaction.

3. Additional Services: Square may charge fees for certain additional services, such as chargebacks, instant transfers, and virtual terminal usage.

It's worth noting that while Square's fees may seem marginally higher than some traditional merchant service providers, the absence of monthly fees, contracts, or hidden costs makes it an attractive option, particularly for smaller businesses and startups.

Types of Square Terminals