6 Expenses To Consider When Opening a Business

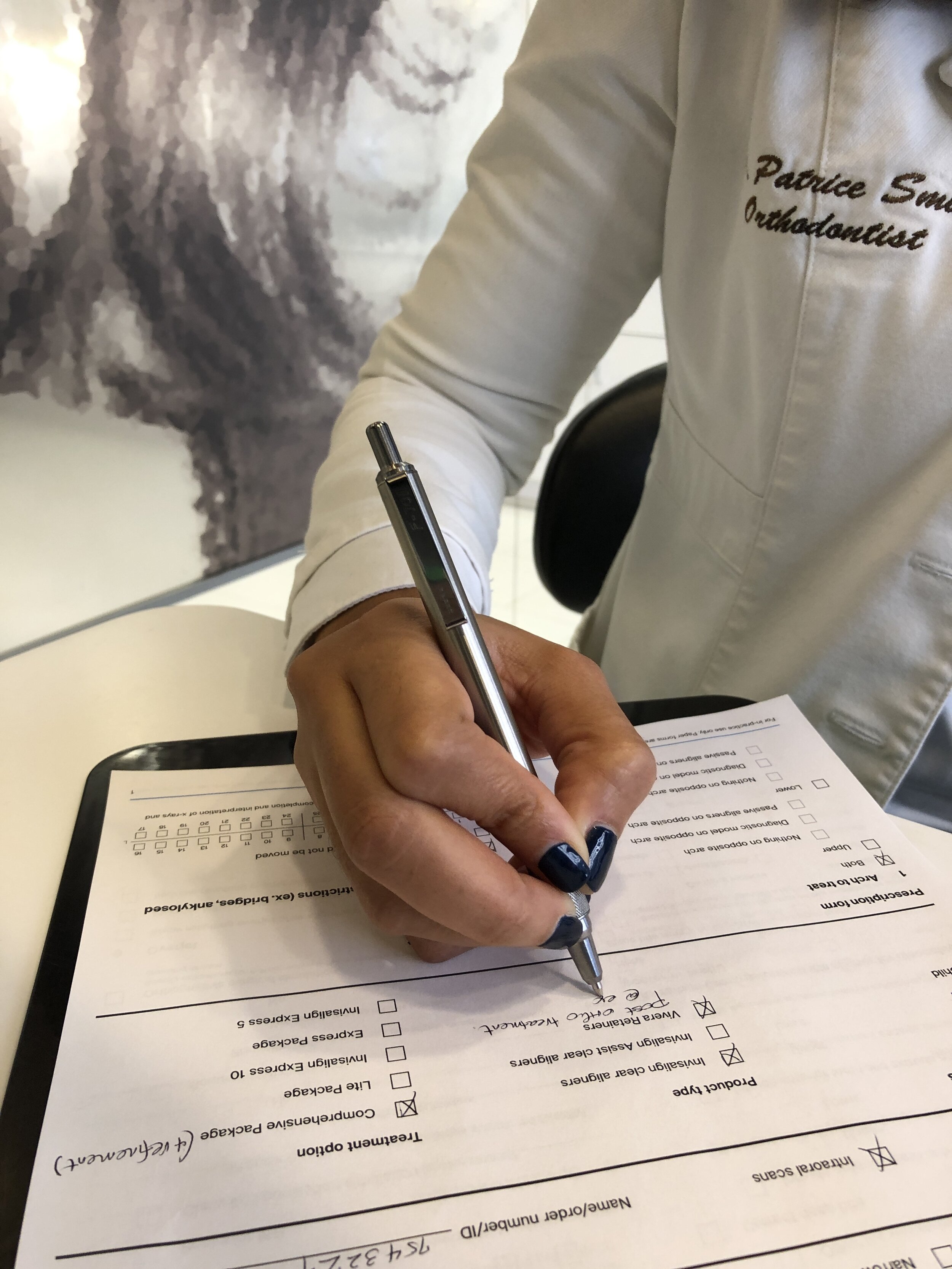

Are you thinking of starting up a new business? Fantastic! Whether it’s a dental practice, finally turning your hobby into a side business or another type of business, there are some expenses that we don’t necessarily give thought to.

Are you thinking of starting up a new business? Fantastic!

Whether it’s a dental practice, finally turning your hobby into a side business or another type of business, there are some expenses that we don’t necessarily think about. In all our excitement to launch, start marketing, hire staff, secure financing, and set up our websites, it’s easy to miss or misjudge a few important startup costs. Yet, neglecting these often-overlooked expenses could result in a cash crunch before our business even gets off the ground.

Here are six sneaky small business startup costs:

1. Business Insurance

While you hope nothing goes wrong when you’re launching a new business venture, the reality is sometimes it does. Not having business insurance in place could leave you struggling to pay for expenses you didn’t budget for while trying to finance a new business.

Every small business is different, so do your research and choose the insurance coverages best suited for your situation. Here are a few:

Business property insurance- this helps to protect your workplace location and property like tools and equipment, while

General liability insurance - this helps protect your new business from claims for bodily injury, property damage, and other personal claims.

Business income insurance - this helps protect income lost when you can’t operate due to covered losses such as theft or fire.

Life insurance and disability insurance - this is a no-brainer, it protects your family against income loss.

2. Fees and Licenses

Among other often-overlooked startup costs are the fees associated with establishing a business. You may have to pay to search and register your business name and even have it trademarked. Depending on your business location and the nature of the business, you may need federal, state, and/or municipal licenses and permits. If you’re a dental professional you will need to pay for the renewal of your license to practice dentistry, your licenses to prescribe controlled substances and professional dues almost on a yearly basis. The costs and requirements will vary.

3. Professional Expertise

Don’t underestimate legal fees and accounting fees when estimating the costs to start a new business. Paying for good advice regarding your business structure, legal agreements, and financial issues early on in your business can help you minimize or avoid costly future legal or tax entanglements. Get a few quotes so you’ll have a realistic idea of the costs you’ll incur.

4. Taxes

There’s no getting away from paying taxes. Find out what municipal, state, and federal taxes your startup must pay and when. State and municipal taxes vary, so visit the U.S. Small Business Administration website or ask your trusted CPA or tax lawyer about the details pertinent to your location. At the very minimum, expect to pay state income tax and state employment taxes if you have staff, plus your federal business taxes, depending on your corporate/business structure.

5. Payroll/Bookkeeping/accounting Fees

Whether you have an automated online system, a bookkeeper who visits your office, a virtual assistant, or a trusted CPA don’t forget to account for this important monthly cost. While a bookkeeper may charge a small fee per hour, a monthly flat-fee arrangement may be better, or you may opt for a subscription to an automated online payroll and bookkeeping program, such as Quickbooks or Gusto.

6. Utility Bills

While you probably studied the commercial rents or property values in your area pretty carefully when budgeting for your startup costs, an area often overlooked are monthly utility expenses. Your startup operating expenses include more than just your office rent, lease payment, or mortgage. Depending on your business and location, your startup utility bills could also include:

Electricity

Heat and/or air conditioning

Telephone

Internet

Water

Condo fees

Talk to other business owners in the area to get an idea of the typical costs based on the square footage you’re considering.

Starting a new business is always a risk, but you can minimize your risk of failure and maximize your potential for success by realistically budgeting for all types of startup costs. This way you’ll be better prepared financially to handle the unexpected expenses that are bound to pop up.

How My Blog Made $12,201.67 in 8 Months

I speak quite frequently here on the topic of Side Hustles. When I talk about different ways you can generate additional income, I almost always mention blogging. So, in the spirit of transparency I am sharing my year-to-date blogging income (that is, January-August, 2021).

I speak quite frequently here on the topic of Side Hustles. This is probably one of the reasons you were lead to my blog in the first place. When I talk about different ways you can generate additional income, I almost always mention blogging. So, in the spirit of transparency I am sharing my year-to-date blogging income (that is, January-August, 2021).

I must preface by saying that when I started this blog my intention was never to make money from it. The goal has always been to educate and inspire young professionals to lead a balanced, purpose filled “UnOrthoDoc” lifestyle while on the path to personal, professional and financial development. As it turns out, while trying to do just and providing my audience with services and products that will help make life easier/better a positive side effect was that I indirectly pulled in some cash.

From January-August 2021, my blog has generated a total of $12,201.67

Here is the breakdown:

Sponsored posts $3,700.00 - a sponsored post is an article you write on behalf of a company that would like to get in front of your audience. The key for me where this is concerned is to only agree to write such articles when it is a product or service that I have personally used or can get behind. One such article has been this one for the company molekule. I personally use the molekule air purifier in my practice, love it and can get behind it.

Affiliate links $3,399.38 - On the resources page of this blog I have products and services listed that I have used myself and even carry in my practice. I like giving my patients options especially when it come to oral care products and I extend the same to my readers. When I promote a company’s products as an affiliate I earn a small commission for the referral.

Products $5,102.29 - A large percentage of this number comes from sales from my candle company. I love scented candles and started making them for myself, family and friends back when I was in dental school. Eventually as interest grew I turned it into a business. UnOrthoDoc Candle Company started as a hobby that over time became a side hustle for me. A much smaller percentage of this number comes from the sales of digital products.

I have shared this to show that it is indeed possible to generate money from your blog. Even though I have had to do some work in generating this money, I consider some of this income passive since I don’t actively seek out sponsored posts and I get the benefit of a small commission from products I recommend because my readers get the benefit of purchasing said products at a discounted rate.

Blogging however is not easy and it’s certainly not for everyone. It requires you to work for free for a long time while you build up your audience. I have been writing o this blog since 2017 and was only able to start generating income from it in 2020 (excpet for the candle company).

5 Secrets To Work-Life Balance

These days, especially with some of us working from home it seems almost impossible to have a little separation between your career and your life. In fact, for many people, their career is their life. But it doesn't have to be that way. Being happy and fulfilled requires making time for yourself just as much of a priority as your career.

These days, especially with some of us working from home it seems almost impossible to have a little separation between your career and your life. In fact, for many people, their career is their life. But it doesn't have to be that way. Being happy and fulfilled requires making time for yourself just as much of a priority as your career. Here are 5 secrets to a work-life balance:

Before You Say Yes, Pause - If you’re reading this there is no doubt that you are ambitious and driven and like to get things done! You also may feel like you can handle anything thrown at you. I am the same. While this all might be true, it’s important that you are careful to not take on too much. Time is a limited resource, saying yes to everything threatens this very limited resource and can often also lead to burn out. Protect your limited resources by first pausing to assess whether or not the ask is something that you really need or want to take on right now, if at all. If you are like I once was and struggle to say no, try saying things like, “Thanks for asking, let me check my schedule/calendar and get back to you.”

Manage Your Workload - Sometimes I feel like I have way too many things to do. I am constantly juggling an endless amount of balls and trying to keep them all in the air. Since having my newborn, I have come to the realization that I cannot do it all and still maintain a balance between my work and home life and that I can allow some of those less important balls to drop. Cue the checklist - I now have checklists for everything! I place things in order of priority doing the most important things first. Other items much lower on the list now gets outsourced. If it’s at work, I delegate some tasks to my office manager and at home I have learned to ask my husband for help. What I have found out is that these individuals are happy to help but they have never gotten the opportunity because I never asked.

Create Boundaries with Technology - Put the phone down! Digital burnout is a thing that a lot of us are affected by. For me this is social media and emails. I know I am not the only one that sometimes mindlessly scroll through the abyss of Instagram and Tik Tok and respond to emails after hours and on weekends. You must set boundaries where this is concerned. Instagram is a big part of my businesses - I do marketing for my Orthodontics practice and my candle company via the platform and also make partial income from it via sponsored and affiliate posts. I enjoy doing these but it also makes it easy for the line between healthy social media consumption and compulsive social media consumption to blur. What I do to combat that is set social time blocks, that is specific time(s) of the day when I go on Instagram to do a story, make a post or to engage. I also set a time limit via the apps’ time management tool to remind me when it’s time for me to close the app.

Take Your Vacation - I’m currently on vacation as I type this, but had it not been for pure exhaustion I probably would have kept going - this is also a reminder to myself. You may feel guilty about taking time off of work, especially when you have a lot going on but it’s so important. If you are like me, when you have a certain goal in mind you cannot stop until that goal is achieved. However, continuously going without a break only leads to burnout.

Take Control of Your Life - You are in the driver seat of your life! If you don’t like something, you can just decide that it doesn’t work for you and make the change. I know some things are easier said than done but, begin to work on the things that are easiest to implement. For example, if you need to get more sleep decide that you will go to bed an hour or two earlier. If there are certain things that gives you stress, figure out how to get rid of it (ie. set boundaries) or how to manage it.

There is such a thing as work-life balance and you CAN create a life that you absolutely enjoy! The key is to decide on the type of life you want to lead and take the necessary steps to achieving it. Start with the 5 steps above. I hope this helps.

Read This If You’re Thinking About Starting a Small Business

So, you have an entrepreneurial spirit and aren’t exactly sure what to do with it. You know that you want to start a business, but what kind will you start? And what exactly does it take to get a company off the ground that succeeds long term?

[This is a guest post from Alyssa Strickland of millennial-parents.com]

So, you have an entrepreneurial spirit and aren’t exactly sure what to do with it. You know that you want to start a business, but what kind will you start? And what exactly does it take to get a company off the ground that succeeds long term?

The UnOrthoDoc has some information to help you start your entrepreneurial journey strong. Here’s an overview of some of the simplest small businesses you can launch as well as some tips for the early stages:

Explore the Options

These days, there really is no limit to the types of businesses you can start, whether you want to work from home or at a designated location. Evaluate your interests and expertise, and research all the ideas that could bring you fulfillment and success. Here are a few of the easiest small businesses to get off the ground:

● Virtual assistance

● Social media management

● Web development or design

● Handyman services

● Landscaping

● Woodworking

● Personal training

● Videography

● Property management

● Massage therapy

● Consultant

Handle the Legal Matters

Once you’ve determined what type of business you will start, it’s time to begin preparing for the legal side of things. For example, you’ll need to create a unique and catchy business name and register it with the state. And you’ll need to choose a business structure that fits the needs of your company, whether that means an LLC, sole proprietorship, corporation, or partnership.

Use Tech Tools

There are so many technologies on the market today specifically designed to help small businesses succeed. The earlier you start researching these tools, the better able you’ll be to decide which ones will help you achieve your goals.

For example, you’ll need an effective payroll system when you start hiring staff. Don’t make the mistake that many other companies make of mismanaging payroll. This can lead to a variety of financial and legal problems.

Learn the ins and outs of processing payroll, and implement software that simplifies tasks like paying your employees, tracking time, and reporting your taxes. And as you put your payroll system in place, be sure to factor in federal and local labor laws as well as state overtime laws.

Furthermore, research all the other tools available that can help you successfully launch and grow your company. Many small business owners benefit from using software and apps for project management, collaboration, marketing, and human resources.

Constantly Improve Your Plan

You will have to take a lot of different steps when starting and managing your business. Embrace the mindset that you can always improve.

For instance, you’ll need to conduct market research to ensure that your business idea is viable, and you’ll need to continue doing research so that you can make informed decisions as your business grows. Also, prepare to create a thorough business plan before launching your business; this business plan will need to be modified over time as your goals and circumstances change.

Your business plan not only will help guide you through challenges on your journey but will also help you secure the funding you need to achieve your goals. As such, you should always keep re-strategizing as needed.

Stay Connected

=Lastly, networking is crucial for any type of business. Look for networking events in your area as well as in different states. Attend virtual industry conferences. Join your local chamber of commerce, and always look for opportunities to meet other business owners and professionals in your community. Building a strong network of support will prove invaluable through the ups and downs of entrepreneurship.

If you have a passion to be a business owner, take the time to determine what type of company you could thrive in the most. Then, plan and prepare diligently to lay a solid foundation upon which you can build your company. In no time, you could be leading a more fulfilling life while also fostering your career and financial health!

If you found this article helpful, you can read loads of other content on theunorthodoc.com!

My Interview With The Dental Marketer Podcast

I recently sat with Michael Arias, host of The Dental Marketer Podcast where I shared my story of becoming a practice owner and entrepreneur. We also spoke about, you guessed it, marketing!

I recently sat with Michael Arias, host of The Dental Marketer Podcast where I shared my story of becoming a practice owner and entrepreneur. We also spoke about, you guessed it, marketing!

You can find my episode (327) and the podcast on iTunes, audible. spotify, stitcher or directly on The Dental Marketer’s website.

MICHAEL’S 3 KEY TAKEAWAYS FROM OUR EPISODE:

WHAT WAS IT LIKE FOR DR. PATRICE ACQUIRING AND OPENING UP IN THE MIDDLE OF A WORLDWIDE PANDEMIC.

HOW SHE HAD SUCH A SMOOTH TRANSITION WITH ACQUIRING AN EXISTING PRACTICE AND MAKING ALL THE TEAM MEMBERS HAPPY.

HOW TO STRIKE A GOOD MIDDLE GROUND WITH YOUR EMPLOYEES BETWEEN BEING FRIENDLY BUT BEING FIRM.

About Michael

MY NAME IS MICHAEL ARIAS AND I’M HERE TO HELP PEOPLE FIND YOU.

FOR THE PAST FEW YEARS, I’VE HAD THE AMAZING PRIVILEGE OF HELPING HUNDREDS OF DENTISTS EFFECTIVELY MARKET THEIR PRACTICE. WITH AN OVERLOAD OF MARKETING OPTIONS, IT’S CHALLENGING TO KNOW WHERE TO START AND WHAT TO FOCUS ON. I’M HERE TO CUT THROUGH ALL THE NOISE, AND HELP YOU FIND THE MOST EFFECTIVE MARKETING APPROACHES TO FIT YOUR BUDGET, YOUR PREFERENCES, AND YOUR BRAND!

Balancing Motherhood & Professional Life

Mother - of all my titles, this is the one I am most proud of. I have been a mom for just under 2 months now and It has been one of the most fulfilling journeys, but it can be exhausting.

Mother - of all my titles, this is the one I am most proud of.

I have been a mom for just under 2 months now and It has been one of the most fulfilling journeys, but it can be exhausting. Keeping a tiny human alive and well is tough! Add work into the mix, and some days I feel as though I am stretched very thin.

As a new mom who owns a business and works full-time, I can definitely say that’s it’s been hard at times to balance them both without feeling overwhelmed or guilty. There are so many things throughout the day that vie for our time and attention, that it’s easy to feel as though we’re not excelling in any of our roles, at home or at work.

The perfect work-life balance sometimes feel unattainable, but I have figured out some strategies (with the help of some other moms) that I have implemented to maintain my sanity and my purpose as a full-time entrepreneur and mom. If you’re a mom, I hope these will help you too:

1. Set a Routine.

This will obviously look different for everyone, but establishing some sort of routine can help to make things run smoothly and to stay organized.

For me, I make sure my alarm is set for a time that allows me to get myself dressed and ready for work in the mornings with ample time to bond with my baby before leaving home. My husband typically gets dressed first. He cleans and sterilizes the baby’s bottles and spends some time with our son, and I typically get a feeding session in. When the work day is complete and we both are home, my husband is the first to get cleaned up and takes the baby. He does the feeding, taking him on walks and spends some quality time while I do the prep for dinner. After we eat then I spend time with baby while my husband gets some rest for the overnight shift.

2. Prioritize Tasks.

I use checklists! Rather than thinking of all the things I need to accomplish in the near future, I focus on action items with the highest urgency, and attend to those first. I make a list of tasks to get done per day and cross them off as I go. This helps me to stay focused, organized and provides satisfaction since I am making progress and reaffirms the fact that I am indeed capable of accomplishing multiple tasks in a day, both at work and at home.

3. Work Efficiently.

When I am at work I do my best to give it my full attention and stick to a schedule. It’s hard to stay away from social media but I schedule social media breaks and set a timer so I don’t go past a certain amount of time and end up aimlessly scrolling. I also build time into my schedule (every 3 hours) to facilitate pumping.

4. Be fully present.

My baby is at the point where he sleeps and wakes every 2-3 hours for feeding then goes right back to sleep. It doesn’t feel like a good work-life balance when I’m at work for eight hours each day then only catch a few glimpses of him before I have to do it all over again.

Because of this, when my baby is awake, I am in full mom-mode; my laptop stays closed and my cell phone is put to the side. I make the most of the time we do have each day by giving him my undivided attention during our precious hours together.

5. Outsource chores.

I am still working on this one but right now, my mom and husband pitch in at home wherever they can and my office manager and clinical staff has taken on more administrative work at the office. Before I had my baby, errands didn’t seem like such a hassle. Nowadays, it often feels impossible to squeeze those tasks into an already demanding schedule.

I have since decided to take advantage of services available, like online shopping for groceries. Instacart, Amazon and Target have become my best friends as these services save us from having to go to the store.

6. Get sufficient sleep.

This is a work in progress. Nighttime sleep can be extremely unpredictable as it completely revolves around baby’s sleep schedule. I am exhausted around the clock due to the frequent wakings and feedings which, to be honest can sometimes decrease productivity.

Because getting enough rest is crucial to performing well at work, I try to take naps whenever the baby is down for a nap himself and alternate between my husband and mom who keeps the baby each night. This ensures that I get enough rest and feel energized throughout the day.

7. Reevaluate other commitments.

Learning to say “no” is important. It’s one of the things I have gotten proficient at time. Time has become even more valuable now. My advice would be to not overload your schedule and lose out on time with baby. Obviously, you don’t need to turn down every work or social opportunity, but you do want to avoid putting so much on your plate that you can’t spend time with your family.

8. Enjoy some time to yourself.

You might want to spend most of your time outside of work with your family. Even so, it’s important to sneak a little me time. What that looks like for me is spending time solo doing something that is relaxing, such as getting my hair done, getting a manicure and pedicure or getting a massage/facial at the spa. These little mini self care procedures work wonders for not only the body but mind as well. Thankfully, my husband encourages me to do this and is happy to have some one-on-one time with our baby during these times.

Working moms face a unique set of struggles. Add being a business owner to the mix and the stress level is amplified. I want to be the best mom to my child, yet my time and energy are divided between my responsibilities at home and those at work.

What I try to remind myself is that I am setting a great example for my child. Not only am I providing financially for my family, but also demonstrating what it looks like to use my professional gifts and passions. From one working mom to another, I hope these tips help you feel confident in this challenging yet fulfilling journey.

A Step-by-Step Guide To Establishing a Gig-Based Business

According to Brodmin, the global gig economy is expected to grow to $455 billion by 2023. Want a piece of the pie? Establishing a successful gig-based business can give you extra money and greater financial stability.

[This is a guest post by Courtney Rosenfeld]

The gig economy is booming. From for-hire drivers to freelance ghostwriters, you can find people working all kinds of odd jobs all over the world. According to Brodmin, the global gig economy is expected to grow to $455 billion by 2023. Want a piece of the pie? Establishing a successful gig-based business can give you extra money and greater financial stability. The UnOrthoDoc invites you to learn how to establish your own gig-based business.

Choose a fitting business based on your skills, knowledge, and resources.

Keep your overhead costs low when you're starting your new business by utilizing existing resources, skills, and knowledge. Career Addict provides a list of gig-based jobs that can inspire you as you choose a fitting option. Possibilities include food delivery, pet sitting, personal shopping, virtual assistance, and more.

You can also scope out online platforms where gig-style jobs are advertised to get a sense of what skills are currently in demand. Small Biz Trends has a guide to gig platforms catering to diverse niches. Examples range from Uber and Lyft for driving to Airbnb for renting accommodation and ToolLocker for renting out equipment.

So what option is right for you? It depends on what resources you have at your disposal. If you own a car, enjoy driving, and love meeting people from all walks of life, Uber or Lyft can be a great pick. Alternatively, if you prefer a more active job that allows you to get outdoors, you might like something like dog walking.

You could also decide to go back to school to learn the ins and outs of business. Fortunately, you don’t need to drastically change your schedule to accommodate a course load; you could always further your education through an online school, one that offers bachelor’s and master’s programs designed to help you excel at your new venture.

Establish your brand and create a website.

Once you have a business idea in mind, transform it into a brand. Hubspot explains that a brand is basically the "face" of your business — the main way for people to recognize it. A strong brand like Coca-Cola can be identified by people around the world. From your logo to color palette to slogan, many components make up a brand.

With an idea of how you want to present your brand to the world, go ahead and create a website. According to Forbes, every business needs a website. A great website can help attract clients and boost return on investment (ROI). Don't stress: It's not too complicated to make a website with today's modern technologies.

WordPress is one option. This free website platform allows for custom coding, so you can create a site that reflects your unique brand. If you aren't a web pro yourself, you can find WordPress development experts on work-for-hire platforms like Upwork. Browse profiles based on criteria that matter to you, from price to delivery time.

Get creative with your marketing tactics.

Your website is technically a marketing tool. It introduces people to your gig-based business and encourages them to buy your products or services. You can promote your website using digital tactics like pay-per-click advertising and social media. However, there are many other creative ways to raise your startup's profile. Get creative with your marketing ideas.

WordStream offers a list of more than 60 marketing concepts to jumpstart your brainstorming. For example, you can try old-school urban marketing tactics and pass out flyers on the streets or create sidewalk ads with chalk writing. You can also run fun competitions like photo contests.

Collaborating with other creatives can help you find more ways to enhance your brand's success. For example, a do-it-yourself photo shoot with a local model can help show off your products or services.

The gig economy offers many chances to increase your earnings. The key to success is finding a business model that fits your skillset. Follow the above steps to help pave the path toward successful entrepreneurship.

How One Doc Is Repaying $575K of Student Loan Debt in 7 Years

You’ve got to center your plan around your goals, your personality, your lifestyle, and your comfort level. Don’t ignore the emotions, but also, consult the numbers. Understand your options and be a continual learner.

A Q&A Session with Dr. Samantha Tillapaugh aka The Debtist

Q: Thank you for agreeing to answer some questions on your journey to financial independence. Please, tell us a bit about yourself.

A: At my core, I am an extremely multi-faceted person – the Jill of many trades with no intention to master any one of them. Since I was a child, I have had a short attention span, and I think that is why my mom was so adamant on teaching me how to focus. I thank her, because now I am very efficient with my output, but I still haven’t lost my curiosity.

I am the truest definition of a Gemini, intermingled with a Type I Personality on the Enneagram scale, and an INFJ. My biggest goal in life is to constantly learn and experience something new, and my biggest fear is standing in the same place. I LOVE movement, as well as creative thinking, which explains why my favorite hobbies include motion and thinking on your feet. I guess that makes dentistry a good fit for me.

I am a part-time dentist who owes a ridiculous amount of student loans, hell-bent on not allowing finances to impede my wish to live life to the fullest, explore my interests, and retain full autonomy over my day-to-day life.

Professionally, I am also a blogger for my website, thedebtist.com and others’, a wholesale director for a bakery called Rye Goods, an occasional speaker on the topic of student debt, as well as a temp for other random events such as teaching lunch-and-learns for companies, or dog-sitting for traveling pet parents.

Privately, I am a real nerd. I am an avid reader, I depend heavily on my planner, and I still write analog. Writing helps me process my thoughts; organizing the house keeps me calm. I take piano lessons and boxing classes. I love to sleep, but hate to waste time, so I mitigate that with my love for coffee. I also like to travel, take photographs, and bake.

I practice slow-living and minimalism because I naturally gravitate towards a fast-pace and a maximalist life.

Q: What made you interested in dentistry?

A: It’s hard to say when the true point of inception occurs, but I have been saying I wanted to be a dentist since I was 8 or 9 years old. When I was younger, I thought it was destiny. I was born on the Philippine Islands and when we would vacation on beaches, I would play with fish teeth. My parent’s actually have a video of me, at 2 years old, holding a dead fish in my hand, and literally playing and inspecting its mouth. Gross, huh?

I also have a video of me floating in the ocean with a floaty in the shape of a Colgate toothpaste tube. I loved wearing fake Dracula teeth for Halloween in elementary school. And I always liked the dentist. As I got older and started considering which medical profession I would pursue, it was the lifestyle of a dentist that attracted me. It was not until college that I learned my great-grandfather on my mom’s side was a dentist, too.

My mom wanted to be a doctor, actually. She never had the ability to pursue that dream because student loans did not exist in the country I was born in. You either came from a rich enough family to pay for medical school on your own or not. In that respect, I understand the privilege I had of having student debt. Now that I am older, I think subconsciously, or maybe even consciously, my mom’s unfulfilled dream got translated and handed down to me, eventually becoming my own.

Q: You graduated with a hefty amount of student loan debt. If you don’t mind, please tell us how much. Was this from undergrad as well as dental school and residency?

A: I absolutely don’t mind sharing this at all! I graduated with a sum total of just over $575,000 in student debt. More than half a million dollars! This was mostly from dental school. In undergrad, I chose a university to which I could commute from home and I lived at home all four years. I also worked three jobs and graduated in three years. All of this was part of my plan to save as much money as possible. I had no help with paying for undergrad, so I still graduated with about $15,000 in student debt. I did not go to residency.

Q: What repayment plan did you choose and why?

A: Choosing the repayment plan for me has been quite the adventure. As aggressive as possible was our repayment choice, although we have switched between repayment plans and we also have plans to exit the loan forgiveness umbrella in the near future. Before I go into the minor details as to our repayment thus far, I will answer the question “Why?”.

Most people don’t know this, but when you do the math, aggressively paying down debt was the cheapest path. Actually, paying it in the standard 10-years was cheaper than waiting 25 years to forgive the loan by over $100,000! And you save 15 years! To me, that’s a no-brainer. The reason as to why it is cheaper is simple.

The government banks on your income growing over time. Since you pay a small percentage of your income to them, you will be paying more to your loan over time, as well. However, your income payment will unlikely exceed the interest that is being added to your debt. Under the federal loan forgiveness plans, the interest rates are high (mine is 6.8%). Which means that each month, my loan of $575,000 is accruing $3,258 in interest.

Assuming my program requires me to pay 10% of my income, for me to cover interest, I would need to be making about $391,000 per year. And mind you, that doesn’t even touch the Principle Amount. Therefore, unless you do make over $400k a year, your loan is growing for 20-25 years.

Now, where the government benefits is on the tax bomb at the very end, which shockingly, some people do not know about. In short, whenever the loan is forgiven, the debtor will be charged taxes that tax year as if they earned that much income.

To give a finite example of this, if I was on the IBR plan, my loan of $575,000 would have increased to about $1.4 Million. They would consider $1.4 Million to be income I earned that year. Which means my tax bomb would be about $420,000 (plus whatever my taxes are on what I ACTUALLY earned that year doing dentistry) – a sum I would have to pay that year. When you add this amount to the minimum payments I would have made throughout the course of the program, I would have paid about $750,000 in total. When we pulled the numbers, paying off the debt in 10 years would have only cost me $650,000.

Here’s the kicker. I knew we could do it in less than 10 years!

So now that I have answered why we chose to pay it down aggressively, let me go through our ever-changing repayment plan.

When I was just exiting dental school, I was visiting the financial aid office constantly. The one at school kept telling me that my wish to pay off student debt “did not make sense.” They said that between the house I would want to buy and the new car I would want to get and the vacations I wanted to take, I would not have the income to pay back the debt, even with my husband who was working at the time as a mechanical engineer! Which is funny because I never told them about a house, or car, or vacation.

I remember running through the numbers and not understanding why they couldn’t see that the income could cover the debt. I even had my husband (who I was engaged to at the time), come into the school with me to look at the Excel sheet the financial aid admin had created. She painted a picture that said it was impossible, and she recommended I sign up under the IBR repayment program. With a heavy sigh, we did.

But I just couldn’t sit with this notion that I was going to be in debt for what feels like FOREVER, and I wanted to get my finances in shape. I also did not believe the admin HAHA. I hired a financial planner who happened to be the husband of a fellow dental classmate. He helped me get rid of all my credit card debt and set up our finances in the few months between starting work and getting married at the end of 2016.

After we were married and all the credit cards were paid off, my financial planner started noticing that we were setting aside about $8k a month. Which is when he told us that paying back my loan is a possibility for us. In order to do a 10-year repayment plan, we would need to make payments of about $6,300 per month. We were worried about the risk refinancing into a 10- year program would entail, especially if one of us lost our jobs. In order to have the flexibility of decreasing our monthly payments should life throw lemons our way, I stayed in IBR and started paying back my debt aggressively. The plan was to get the loan to a smaller, more manageable number that would give us a lower interest rate when we refinance, as well as a more comfortable minimum monthly payment that we knew we could achieve should our income ever change.

It was not until I talked to Travis Hornsby from Student Loan Planner (who I BTW recommend to every grad who has student debt), that I learned I could optimize my plan by switching to REPAYE. This is because REPAYE subsidizes the interest and pays 50% of it for the first three years. So I switched to REPAYE a year into my loan repayment journey. By taking advantage of REPAYE’s interest discount, we technically achieved the interest rate we would get if we had refinanced, while retaining the flexibility. We hung onto the ability to stop making massive monthly payments in cases of emergency.

And boy were we glad we did! The pandemic came in March of 2020 and REPAYE’s 3 years was going to end for me on November 2020. My husband ended up losing his job for ten months during the pandemic and the pause on federal loan payments have been a real blessing!

However, we are still sticking to our real plan, which was to refinance at the end of 3 years. Since student loans are on pause currently and at 0% interest, I am waiting for whenever they resume to refinance. At that time, we will make a large lump sum payment, bringing our loan from the OG $575,000 to around $340,000. This will hopefully land us a better interest rate than if we refinanced in the beginning (since the total is much lower). Our target interest rate is less than 3%, which would be an improvement from the current 6.8%.

Q: What is your strategy for tackling your student loan debt (please break down).

A: We are doing all sorts of fun and creative things to pay it down. I look at the task as a game– kind of like Mike and I versus the world. We made a pact to live off of one income, because both our parents supported us in that way. The income we live off of is my husband’s, whose wish in life is to live comfortably without sacrificing what makes life worth living. His income is enough to maintain our lifestyle. Which leaves 100% of my earnings to go towards student loans – after maximizing a 401K first, of course. (I could be throwing this extra 19.5K into paying down student debt, but our motto is centered around not sacrificing the NOW for the LATER. (We are such millennials, am I right?)

We implement a number of other tactics in order to maximize what we can put towards loans. First, we budget to keep our spending on the minimum. We travel hack to be able to see the world, without spending post-tax dollars on flights, and hotels. We also house hack, which helped us save money to buy our property, as well as reduce the amount we spend on putting a roof over our heads. Between 2017 and now, we have reduced our housing expense by $1,000 – not an easy feat in Orange County, California.

I also try to have the hobbies I pursue make money for me. I find that so many people do things they like without trying to monetize it. A few things I like to do that I’ve turned into side hustles are write, bake, and be around animals and pets. I also like to teach and take photographs and have been paid for both before. I like coffee shops, which is why my new role as the wholesale director of a bakery works well for me. I get to meet all sorts of coffee shop owners and probe their brains on how to source the best cup of coffee! Plus I use my blog to sponsor my lifestyle. Companies that I promote send me products to try, and instead of buying things for myself, I reach out to the company and ask if I can trade a post for a product review. It’s a win-win situation, and I get high-quality items without spending hard-earned dollars!

We love the idea of passive income and remote work. This is because our dream is to travel the world. We are working on both. During the pandemic when Mike did not have a job in mechanical engineering, he completed a course on coding so that we could make remote a reality. Little did we know that the pandemic would change our lives! He returned to mechanical engineering at the beginning of this year, and just this week, he was offered the option of coming in as little as once a quarter (aka 4 total days a year)! Meanwhile, my work as the wholesale director, writer, and blogger is all remote. And the blog and the wholesale directing gives me passive income – which I define as income that I continually receive without me doing additional work. The blog is the best because content I’ve written in the past can still bring in revenue in the future through affiliate links.

Our strategy is not “work as hard as you can, as many hours as you can.” On the contrary, as a slow-living advocate, I am quite the opposite. I like working as few hours as I can while receiving the most output. Ways in which that can happen is to create continuous revenue from a product (like the blog), earn commission through a past sale (like the wholesale directing), or place your dollars in something that would grow in value (like our home). Even during the pandemic, we paused our loan payments but moved all our money to a high yield savings account. Since we planned to put our savings into the loans right when the relief ended, we wanted a short-term solution that would still have our dollars working for us. The HYSA gives a 0.7% return versus the typical 0.01% return with a bank. So on the side, it is earning us a few hundred dollars.

Q: With your current breakdown, how long would it take you to pay down your entire student debt load?

A: As described in the previous question, we went from IBR to REPAYE. We will soon refinance for a lower interest rate and hope to be in the low to mid $300,000’s when we do. After that, I hope to get rid of the debt within 3 years! EEEK!

The pandemic definitely slowed us down, but the student debt relief has greatly helped. We are on track to finish sometime between the 7 to 8 year mark.

Q: Does any part of your life suffer because of your aggressive debt repayment?

A: This question is why I embrace my work as TheDebtist. I want to show people that my choice does not hold me back from living my life. I mean, look at me! I work 2 days a week in dentistry. I get to call my own shots at the dental office, and control which days I work, as well as how many patients to book. I work remote for blogging and the bakery, choosing my own hours. I like the flexibility of that. My husband and I have traveled to 10 international countries, as well as all over the United States. I opened a bakery and a dog sitting business between now and when I graduated. I’ve experienced so many things, and since that’s my life goal, then No, I do not suffer.

I do find this question really painful to answer, because it is asked often and insinuates this common belief that paying back debt leads to deprivation. That’s why I care about sharing the story of my student debt repayment journey. That fear of deprivation and inability to live life was in me, too. I had no one to look up to and it was lonely, as well as scary, to take the leap.

The people around us feed off of this consumerist energy and paying back debt obviously means offsetting it with less consumption. So I choose to show people that a minimalist life in terms of material goods can also mean a maximalist life in terms of experiences. It’s just about being fueled by different things, that’s all.

Q: Do you have other debt and if so, what is your mindset towards those?

A: We do not! Except for our mortgage. My mindset on that is clear. I would rather pay for a home, earn equity and use it for house hacking and my business (my entire bakery operated in my kitchen!) than rent a home from someone else and contribute to their wealth instead.

Q: What is your approach to spending and your psychology about money?

A: I have been socially brainwashed to spend money, so it is natural for me and most people to spend. My natural instinct is to hold tight to money, but when I see other people around me buying things, I start to want things too. I work very hard to stick to a budget and stay a minimalist.

My psychology around money has changed significantly over the past four years. I used to have a scarcity mindset around money. I worked many hours to attain it because I thought hours worked equated to money earned. Now I have an abundance mindset around it, investing money into things that will give more output with less input. I am also trying to be more generous with money, having adapted to the idea that generosity is repaid tenfold.

I used to be scared of not having enough money but that’s what this journey gave me. Paying back student debt aggressively gave me the confidence to overcome my fear of money. Now I understand that I am in control of it, and not the other way around.

Q: If you had to do it all over, would you pursue a career in dentistry?

A: Yes. I wouldn’t have said Yes in 2017, but I have since changed my mind. Told you I was a Gemini!

A: Dentistry gives me autonomy over my work. I have full control of how much I work and for whom and how. Some people have to work 9-5, 5 days a week in order to have a job. I don’t. I also have the freedom to own my own dental office or work for one. I have the ability to work around the world. I can choose which community I serve, and can refer people out if I feel they and I are not a good match. I meet all sorts of fun people and have watched children grow into teenagers since I have been at the same office since 2010.

I have found that while some people on my path are motivated by wealth or money, I am not. I thought I was, but I realize that I am most motivated by freedom. Wealth and money might help get me there, but that’s not what I care about. During the pandemic, I quit a job that made a lot of money and honestly carried me and my husband while he was out of a job for ten months. I worked four days a week and made as much money as when we both worked. But I did not have freedom over how I did my work. I couldn’t decide the days I wanted to work. And I was very unhappy. So I left.

I think I answered differently in a podcast interview back in 2017. That was before I realized the flexibility I had with this job. That was before I realized I could call my own shots. That was before I started thinking positively; before I viewed dentistry as a power instead of a crutch.

Q: What advice would you give other health professionals/ health profession students on handling debt and student loans?

A: Tune out all the noise. Then look deep inside your very heart and ask all the hard questions. And hear all the terrible answers. March to the beat of your own drum. Not everyone will pay it back aggressively because it doesn’t fit everyone’s lifestyle. But don’t be afraid of the choice that you know is right for you. Where there’s a will, there’s a way – actually, a million ways!

You’ve got to center your plan around your goals, your personality, your lifestyle, and your comfort level. Don’t ignore the emotions, but also, consult the numbers. Understand your options and be a continual learner. Study ways to earn money and make money. Pivot when you have to and don’t box yourself into one way. Lastly, consult professionals, or friends like Patrice and me!

About Dr. Sam: The Debtist

I am a debtist – a dentist who graduated with a lot of student debt. After four years of undergrad and four years of dental school, I ended up with a debt of over $550k, which I then had to start paying back. This led me to a series of life changes and discoveries about myself in my late twenties that shaped my lifestyle into what it is today. Saving money required us to be more frugal, and being more frugal opened up the doors to finding alternative ways to find happiness in things that don’t require consumerism. I now embrace a simple life. I live in OC with my husband, although we prefer to be traveling, and do so when we can. We focus more on experiences rather than material things. Being selective when it comes to purchasing consumer goods, we spend most of our money and time acquiring new skills, picking up new hobbies, learning about new cultures, and exploring the globe. I’ve become more intentional with my life decisions, and am currently working towards buying my freedom from my massive loan, but not at the expense of giving up my life in exchange for grueling work hours. Open to questioning society’s standards of success, I am finding ways to reach my life goals by refusing some things that we take for granted as the norm. Balance is key, and this is my journey towards financial freedom, in the process of discovering what life is really about.

Follow along with Dr. Samantha’s debt free journey over on her blog thedebtist.com. Also check her out on Instagram here and here!

Corporate Dentistry vs Private Practice

There are pros and cons of corporate dentistry. Like any business, the owners want a reliable pool of labor that’s perfectly happy with good benefits, a predictable income, and the illusion that working for someone else is safer than working for yourself.

An opinion piece by Travis Hornsby of the Student Loan Planner

Corporate dentistry wants your student loans to make you afraid of taking risks. I’m not accusing DSOs of anything devious but there are pros and cons of corporate dentistry. Like any business, the owners want a reliable pool of labor that’s perfectly happy with good benefits, a predictable income, and the illusion that working for someone else is safer than working for yourself.

Decades ago, there were 3,000 graduating dentists a year. Today, there are more than 6,000 new dentists each year. Dental student loan balances have also skyrocketed.

Regulations and declining insurance payouts have drastically reduced the income of an average dentist as well. In 2005, that average stood at almost $220,000. In 2015, the average dentist salary had fallen to about $180,000.

Here’s what I’ve learned from making student loan plans for hundreds of dentists. The higher your student loan balance, the more you should want to own your own dental practice.

What About Student Loans Makes Dentists Afraid of Running their Own Practice?

Most dentists tell me the first time their loans got real was in the first month or two after graduation when their loan servicer sent them their statement. Interest rates as high as 8% on Grad Plus loans are ridiculously high. You probably have tens of thousands of accrued interest, too.

If you owe over $300,000, your payments need to be higher than $3,000 a month just to make a meaningful impact on the principal balance. A typical new grad starts their career as an associate working for someone else earning around $120,000. Many dentists think about paying back their loans, but how do you do that when you’d be paying about 40% of your take-home pay?

Since you receive a letter in the mail every other week from a bank telling you to refinance, you might be tempted to pull the trigger. Thus, your big payments get locked in. Can you take the refinancing risk and then borrow to buy a practice too?

It makes many of my clients terrified. Instead of buying a practice, they might work for years at Heartland, Pacific, Aspen, Comfort, etc. as an associate just to have a guaranteed income to pay down their student loans.

Why Student Loan Repayment Benefits from Corporate Dentistry Make You Too Comfortable

Remember that the goal of any employer is to give you just enough that you won’t want to leave. That can lead to complacency on the part of employees. One of the fast-growing ways to make new grads feel attached to their jobs (in general not just in dentistry) is student loan payment benefits.

As humans, we are prone to the fear of loss. It’s why we hold onto a bad investment even though the rational action might be to sell it. Fear of loss is why we keep a lousy house, car, or vacation property even though we know we should get rid of it.

I just saw a case of a doctor on Facebook who was having a really hard time getting out of a $600,000 house he knew he shouldn’t have bought. The reason? He didn’t want to lose $15,000 on it. That’s extreme loss aversion. He’s cool flushing tens of thousands down the toilet rather than downgrade to a more affordable house just because he doesn’t want to psychologically admit the mistake and take the financial hit.

Likewise, there is a negative psychological impact when you leave a job with a student loan repayment benefit. If your employer offers $20,000 a year towards your student loans, it hurts to give that up for an uncertain ownership path.

Other Ways Corporate Dentistry Profits from Dentists

Corporate dental groups use other methods to make employees not want to leave. They realize that many dentists would get restless without a seat at the table in their practice, so they’ve invented a lot of hybrid ownership structures.

Pretend Dave is a new grad and associates for a practice in a random part of the country. His starting salary is $120,000 with a 10% to 30% bonus based on how the practice does. His office produces $1.2 million after three years on the job.

The dental practice does not want to lose Dave, so they show him this amazing projection of income that tops $300,000. All he must do is buy 50% of the practice and stay for 10 years.

He’ll be a majority owner, and the DSO will handle all the marketing, hiring, billing, and operations. They want him to pay at a valuation of 75% of revenue, and they’ll have him take out a loan for 50% of this price to purchase 50% of the shares.

Why Do I Dislike Joint Ownership Ventures with Corporate Dental Groups? (for the Dentist)

Dave has a lot of student loans, so he really likes the idea of having the DSO handle all these business functions for him so he can focus on dentistry. The high projected salary they show him makes him feel confident that he’ll be able to pay his loans off one day.

Why is this not a great deal financially for Dave?

Here are a few reasons:

He’s spent years building the valuation of the practice by increasing its revenue and now must pay a higher multiple for the business

Anything less than 100% ownership of a practice is harder to sell

He could get 100% financing on his own without the corporate dental group

He could procure the business services much cheaper than equity financing by paying for them directly

Building the Valuation for Someone Else

Many new associates are hungry to prove themselves, which often results in much higher practice revenue within a few years.

Many dentists turn around and take an even bigger loan out to buy this increased production from themselves basically. You can prevent this with an option to buy a practice at an agreed upon % of revenue at your start date.

Don’t Pay 40% of the Business Valuation for 40% of the Practice

Another common pitfall happens like this: an accountant tells you that the whole dental practice you’re looking at is worth $1 million. The ownership group then offers you a 40% stake for $400,000. While this sounds fair, it’s not.

If you had to sell a minority interest on the open market to someone not affiliated with the dental practice, you would have to accept a discount on the price because they’re not getting full control.

When ownership agreements include the exclusive right of a corporate dental group to provide business services (like marketing, HR, operations, etc.), you reduce your pool of buyers. Who wants to be saddled with a contract from the previous dentist? Perhaps the best buyers own the other shares, and thus they can offer you less for your shares.

Another thing to keep in mind is that majority control is often worth more than you think. If you control 51% of a dental practice, you have the power. You would not want to pay 49% of the practice valuation for 49% of the practice.

I could give more examples, but the point is that if you’re even thinking about entering a partnership agreement, you should run the contract by an accountant used to valuing dental practices. Otherwise, how can you know that the agreement is fair to both parties?

When you’re dealing with a sophisticated organization like a corporate dental group, any agreement you sign is likely to be biased against your interests without someone equally sophisticated in your corner.

Why Dentists Will Get All the Capital They Need to Become Owners

Another concern I see with dentists who partner with DSOs is that they don’t want to take on so much debt to own a practice. They look at the $600,000 to $800,000 price tag of many solid practices and get squeamish.

In terms of securing a practice loan, banks will be happy to give you most of what you could want, even with a bunch of dental student debt. The only issues I’ve seen are with loans for jumbo-sized operations (more than $2 million in revenue, then it might get tricky).

Of course, you need to have a track record of at least a year with solid production history for a bank to feel comfortable. That said, getting capital to buy 100% of the practice you want will not be a problem.

In terms of the fear of taking on more debt, I get it. You’re already feeling nauseous that you owe over $300,000 from dental school and you’d like to keep that debt as low as possible.

However, dental practice loans are a different animal. Almost all the loans get paid back. In the rare case that the dentist defaults, the primary culprits are alcohol and drug abuse, not bad business results according to the bankers I’ve spoken with.

While $800,000 of business debt can look very intimidating, a dental practice is going to pay for itself over time. The profits of the business pay off the practice loan, and eventually, you own an asset in full. The tens of thousands you had to pay towards your business loan you will recoup one day as additional income once the loan is gone. The bigger the practice that you buy, the bigger income number you will have all things equal.

How Dentists Drastically Overpay For Business Services For Their Practice

Finally, pretend you’re the kind of dentist who likes to turn off the lights and go home. This is one of the biggest reasons I hear from dentists who choose to be associates long-term or partner with DSOs.

As a dentist, you’re doing most of the work to keep the practice humming from a revenue perspective. Yes, corporate dentistry might bring in the patients, help with staffing, and run marketing, but what are these services truly worth?

What I find is that many dentists do not realize that they don’t have to do it all by themselves as practice owners. There is a huge industry of practice consultants and dental professionals that handle everything from collecting bad debts to billing to websites and more. They’ll run your marketing, assist with staffing issues, and even help with compliance. I heard of one company on the Millennial Dentist podcast the other day that even customizes chatbots for practice websites.

Many of these professionals might charge $10,000 or more for their services. While that seems steep, many dentists pay much more than that by partnering with a corporate dental group. Pretend the practice net income is $500,000 and you’re a 50/50 partner with a DSO that handles business functions.

We know that in more than 99% of cases, dentists successfully pay back practice loans. That means that the dental practice will pay for itself in time. Hence, the dentist is paying about $250,000 a year for the services the corporate dental group offers. What kind of team could you build to support your practice with that kind of money? Furthermore, many expenses might be front-loaded in set up costs.

If you set up the website, social media, and operating systems well, they might need only occasional maintenance for example.

While I understand the appeal of turning the lights off and going home as a fellow entrepreneur, you might as well capture the full benefits of your labor. Groups that help you outsource business-related tasks that take an ownership percentage are essentially doing the easy stuff while you do all the bread and butter dentistry that keeps the lights on.

The Simple Truth about Dental Student Loans and Working for Corporate

If you have no debt and want a flexible lifestyle with good benefits, working for a corporate dental group might be a great decision. If you absolutely cringe at the thought of talking to anyone about business, then perhaps you should work for a DSO as well.

I beg you though, please do not let your student debt influence your decision to become an owner or not. It shouldn’t deter you from the advantages of starting a private dental practice.

You should consider buying a practice as soon as you feel comfortable doing so if your goal is getting a good return on your educational investment.

Bankers consistently tell me the default rate in their dental practice loan portfolio is extremely low. That means there are big profits to be made in dentistry, even with the increasing number of graduates.

The headwinds of big student debt and ever declining insurance reimbursement rates make ownership scarier than it used to be, but too many dentists are not confident enough to take the leap and live the dream of ownership. The math is still stacked in your favor.

You can do this, especially if you owe a ridiculous amount of debt from dental school. If you know you’ll eventually refinance, use REPAYE and make prepayments until you’re firmly established in your practice. This will keep payments low and allow you to show a healthy cash flow profile to bankers.

If you want us to create a custom student loan plan for you that incorporates your career goals, we can do that for you. Click here.

If you know you’ll owe more than double your income for most of your career, the tax breaks and income optimization from practice ownership are invaluable. You can increase the financial security of your family while minimizing your taxable income and increasing the amount of loans forgiven.

I have nothing against corporate dental groups. They have contributed to innovation in the field and have provided a predictable stream of jobs for new grads to learn the ropes.

I just want to look out for the interests of my dentist clients exclusively when they compare corporate dentistry vs. private practice. As a solo practice owner, you can have a high, stable income with a degree of autonomy that’s rare for healthcare professionals.

Cede that autonomy with great caution to a DSO for an illusion of safety and security.

While I share some of the views and opinions in this article, they are not my own. Click here for the original and full article by Travis Hornsby - The Student Loan Planner.

Travis has helped thousand of dentists with customized plans to pay down their student debt and gain financial freedom. Visit his site here for a consultation.

Find Time for Self-Care While Balancing a Side Gig with This Guide

Finding time for ourselves is crucial these days, but it can be a challenge to do so when you have a lot on your plate. Those who are running a business and/or starting a side gig often feel pressure to hustle day and night, leaving little room for personal care.

Finding time for ourselves is crucial these days, but it can be a challenge to do so when you have a lot on your plate. Those who are running a business and/or starting a side gig often feel pressure to hustle day and night, leaving little room for personal care. There are a few simple ways to work it in, however, if you get creative. You can always take some cues from The UnorthoDoc, a blog by Dr. Patrice Smith that helps professional individuals find balance in their lives. It also helps to think of ways to save time — and energy — so you can focus on the big picture and take a few minutes for yourself. Here are some ideas to help you get started.

Give yourself peace of mind

Sometimes self-care is as much about your mental and emotional health as it is physical, and when you’re busy with professional tasks, it’s easy to forget the importance of protecting yourself from legal ramifications. Starting an LLC, or Limited Liability Company, is a great way to ensure that your personal assets are covered no matter what happens within your business, and it also offers tax benefits and allows you to run things your way. The regulations and formation steps vary from state to state, so read up on how to properly file for an LLC in your area. Keep in mind that you can save money by utilizing a formation service rather than an attorney.

Just breathe

Mental health, emotional health, physical health — it’s all connected. Side gigs come in many shapes and forms, but no matter how you choose to earn extra money, it’s easy to push yourself to the limit in order to make the most of every hour in the day. Slowing down and learning to relax in your current surroundings can help you banish stress or anxiety, so consider learning some breathing techniques such as those associated with yoga and meditation. If you can take five minutes out of your day to be mindful, you might be surprised at how much better you feel, especially when you’re being pulled in several directions.

Rest well

When you stay busy it can be difficult to get enough rest, but a lack of sleep can lead to problems with concentration, memory, and anxiety as well as a host of physical issues. Set limits for yourself when it comes to completing tasks, especially if you work from home; it’s often easy to put in unintentional overtime when you don’t punch a clock, so give yourself guidelines for answering emails and phone calls. Eliminate foods and drinks that can keep you awake, and set up your bedroom to maximize comfort by utilizing blackout curtains and soft bedding.

Make your workspace work

Your bedroom isn’t the only place that could benefit from a makeover. Take a look at your office or workspace and make sure it works for your needs. If possible, make it a place that’s distraction-free and comfortable, and give yourself all the tools you require to create a smooth workday. This might be anything from a wireless printer to software that helps you stay on track, so think about which resources you’ll need to make the day as stress-free as possible.

For busy professionals, it can be difficult to strike a good balance between work and life responsibilities. Self-care can help you find those little moments that allow you to feel recharged and reinvigorated so you can focus on what comes next.

[This is a guest post by Courtney Rosenfeld]

Have a question for The UnorthoDoc, or interested in a collaboration? Get in touch today.

How to Make Residual Income From Blogging

Blogging presents a big upside, but to be honest it’s not for everyone. The potential to make good money and turn it into something bigger than a side hustle is there. However, the downside to blogging is that you’ll almost definitely need to put in a lot of work and effort before you start to make money.

Some of you may not know this, but I have been blogging since 2008 and have had several blogs since. As an introvert, writing has always been my form of expression. My first several blogs ranged from inspirational and motivational pieces (perhaps because that’s what I needed for myself at the time) to chronicling my pre-dental and dental school experiences. It wasn’t until I was in dental school and approached by fellow students who expressed how my blog positively impacted their journey in applying to and getting accepted into dental school that I realized I was making an impact. That blog grew quite popular among pre-dental students and soon after different brands began reaching out to me for advertising space. At the time I knew nothing about calculating an advertising rate based on the analytics, metrics and reach of my platform. So I decided to charge each advertiser a flat monthly fee for the space and they gladly paid. Now I realize I was woefully undercharging.

The aim of any blog that I’ve started was never to make money from it but it sure is a plus since a lot of time and effort goes into planning and writing posts. Blogging has become very popular and quite a number of people have reached out to me asking questions on how to start a blog or how to monetize one. I’ll focus on ways to monetize a blog in this post.

One of the great things about a blogging side hustle is that there are endless possibilities. You can start a blog on any topic that you like. I’ve been blogging since 2008, and most of my blogs have fallen into areas that I consider hobbies. I will say this about blogging, don’t go into it with the sole purpose of making money. You will get bored of it and possibly find that it takes too much effort for the ROI. If you enjoy the topic that you’re writing about, blogging is a lot more fun and you’ll be more likely to stick with it.

There are a number of different ways you can go about making money from your blog:

Affiliate Income: You could promote products and offers as an affiliate and earn a commission for conversions. If you find a product or service that you like, you can link to it from your blog, and when people click and buy something from your link, you’ll get a small commission for referring them.

Create and sell your own product: This is a great way to monetize your blog, especially if your product fulfills a need or solves a problem. You can opt to sell physical or digital products so I decided to do both with my blog. The candle company has a special spot on the blog and is where most of the income for this platform is generated, followed by my “unorthodoc” apparel. I also produce digital products in the form of e-books, planners, and journals.

Publish sponsored content: Companies are interested in reaching your audience. Some companies will pay you to write product or service reviews. Be sure their brand is in line with your values because the content you write will be broadcasted to the masses. Others will provide content for you to place on your site at a cost so they can reach your audience. Be sure to thoroughly read and understand the content.

Sell a Course: As a blogger the more you know and can explain about a topic can make you an “expert”. If your blog is getting enough readers and visitors and they enjoy your content, they’re going to want more. Producing a course to give more detailed information is the way to go. The key is to provide helpful and insightful information to your audience beyond what you have written. There will be a segment of your followers who will happily buy the course you create.

Consulting: If you have a blog on a specific marketable topic/subject, you can offer yourself as a consultant for different businesses. Landing clients is the hardest part, but if the content on your blog is attracting the right people, it can be done.

Blogging presents a big upside, but to be honest it’s not for everyone. The potential to make good money and turn it into something bigger than a side hustle is there. However, the downside to blogging is that you’ll almost definitely need to put in a lot of work and effort before you start to make money. If you’re looking for a way to start making money right away, creating a blog is not your best option.

For great tips on how to start a blog, there are lots of resources on skillshare. I am a VIP member and I learn so much on a variety of topics. You can give it a try by signing up for a 7 day free trial, if you like it get 40% off your annual membership fee with this link.

How To Keep Your Teeth Clean With Braces

Braces aren’t dreaded like in the past; now they cool and fun and every teenager (even adults too) want in. Here are six ways to keep your teeth clean when wearing braces, along with some recommended products:

Congrats! You’re embarking on a journey of having a beautiful and healthy smile. Braces aren’t dreaded like in the past; now they cool and fun and every teenager (even adults too) want in. Now that you have braces, your teeth are a bit more tricky to keep clean. Brushing and flossing should be done at least twice per day, but with braces you should brush your teeth and/or rinse properly after every meal and snack. Always keep your toothbrush handy! Food particles and plaque can become stuck to the brackets which leaves you more at risk of tooth decay.

Here are six ways to keep your teeth clean when wearing braces, along with some recommended products:

1. Brushing, of course!

Rinsing your mouth with water or mouth rinse before brushing can help to break up loose food particles and make brushing much easier. Brush with a toothpaste that contains fluoride or nano-hydroxyapatite. Begin at the gum line and brush your teeth at about a 45-degree angle. Then brush the top of the brackets, followed by the bottom of the bracket. The goal is to brush every tooth at the gum line and along the brackets so that as much tooth surface as possible is cleaned.

Replace your toothbrush or brush head (if your toothbrush is electric) more frequently due to the wear and tear from the braces, ideally every 3 months. A good choice is Boka Brush, an electric toothbrush that uses sonic power to deliver a gentle yet effective clean. It is also recommended that you carry a travel toothbrush in your book bag or purse.

2. Flossing

Flossing is just as important as brushing! and it remains equally important when you have braces. Using a floss threader can make flossing a lot easier. Let’s admit, although very necessary flossing isn’t always fun, that’s why fruit or minty flavored floss like Ela Mint from Boka encourages flossing.

3. Water Flosser

A water flosser can also be used before/after brushing to remove any stubborn food particles that are stuck around the braces or between the teeth. I usually recommend a water flosser especially to my younger patients, but note that it is not a substitute for string floss.

4. Mouth Rinse

After brushing, use a mouth rinse to get rid of any remaining bacteria that can cause inflammation of the gums and cause decay. Not to mention, rinsing also helps your breath to remain fresh! Remember that rinsing is not a substitute for brushing and flossing.

5. Don’t Forget Your Tongue

Did you know 80-90% of the bacteria that causes bad breath reside on the tongue? In addition to brushing, flossing and rinsing, try using a tongue scraper to keep your breath smelling fresh and clean.

6. Braces-Friendly Diet

There are certain foods you will want to avoid when wearing braces. Foods and drinks with a higher acidic content are not as friendly to your teeth as those with a lower acidic content. For example, bananas are better for your teeth than oranges, water and milk are better than soft drinks, and so on. Ask your Orthodontist for a full run down of the foods you can and cannot eat with braces.

If you’re looking for an all-natural oral care product, try boka. Their toothpaste uses n-hydroxyapatite instead of fluoride, is SLS an parade free and their floss is made of vegetable wax. Use this link or enter code: theunorthodoc to get 20% off your purchase.

Brush, Floss, Rinse - Repeat!

This is a sponsored post and may contain affiliate links.

My Interview With The Black Doctor's Podcast

I recently sat with Dr. Steven Bradley, host of The Black Doctor’s Podcast where I shared my journey to becoming an Orthodontist, practice owner, entrepreneur, founder of UnOrthoDoc Candle Co. and co-founder of Dental Helping Hands.

I recently sat with Dr. Steven Bradley, host of The Black Doctor’s Podcast where I shared my journey to becoming an Orthodontist, practice owner, entrepreneur, founder of UnOrthoDoc Candle Co. and co-founder of Dental Helping Hands.

Dr. Bradley describes his podcast as being health and wellness for the culture. Interviews with leading minority professionals of this current generation where you hear how they overcame adversity to attain their goals. Dr. Bradley is inspired by the excellence represented by his peers who have overcome so many incredible obstacles to reach the pinnacle of success. His podcast provides an avenue to organize these stories for others to listen and learn from. Discussions had are mainly on medical ethics and culturally competent care with the goal of improving health outcomes and combatting healthcare disparities.

To hear my interview with him, click the image below:

As we continue to celebrate Women's History Month, we are thrilled to share the story of Dr. Patrice Smith, aka "The UnOrthoDoc". As a Howard University College of Dentistry trained Orthodontist, she has done an amazing job of excelling in her field while broadening her own horizons. In addition to opening her own practice, Dr. Smith also launched her own boutique candle line. She also manages a successful blog: The UnOrthoDoc