Write It Down & Make It Happen With Zebra Pen

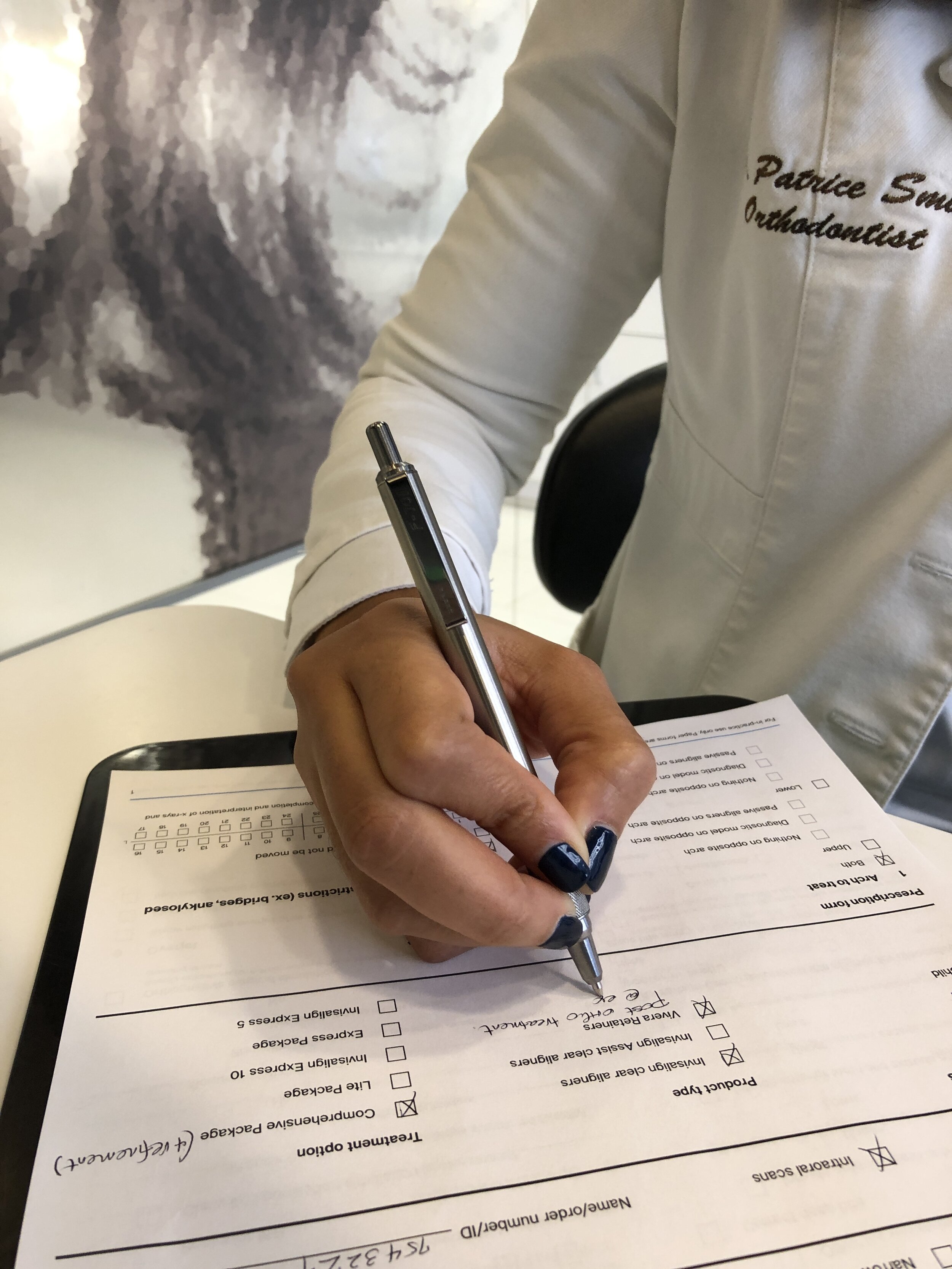

As an Orthodontist, blogger, philanthropist and side hustle extraordinaire, my life takes a certain level of organization and my writing utensil is a big part of that. From writing charts, treatment planning, signing documents, and creating content, I need instruments that will help to not only keep me on track but also offer reliability and efficiency. One Instrument I am very particular about is my pen.

This post has been sponsored by Zebra Pen. All thoughts and opinions are my own.

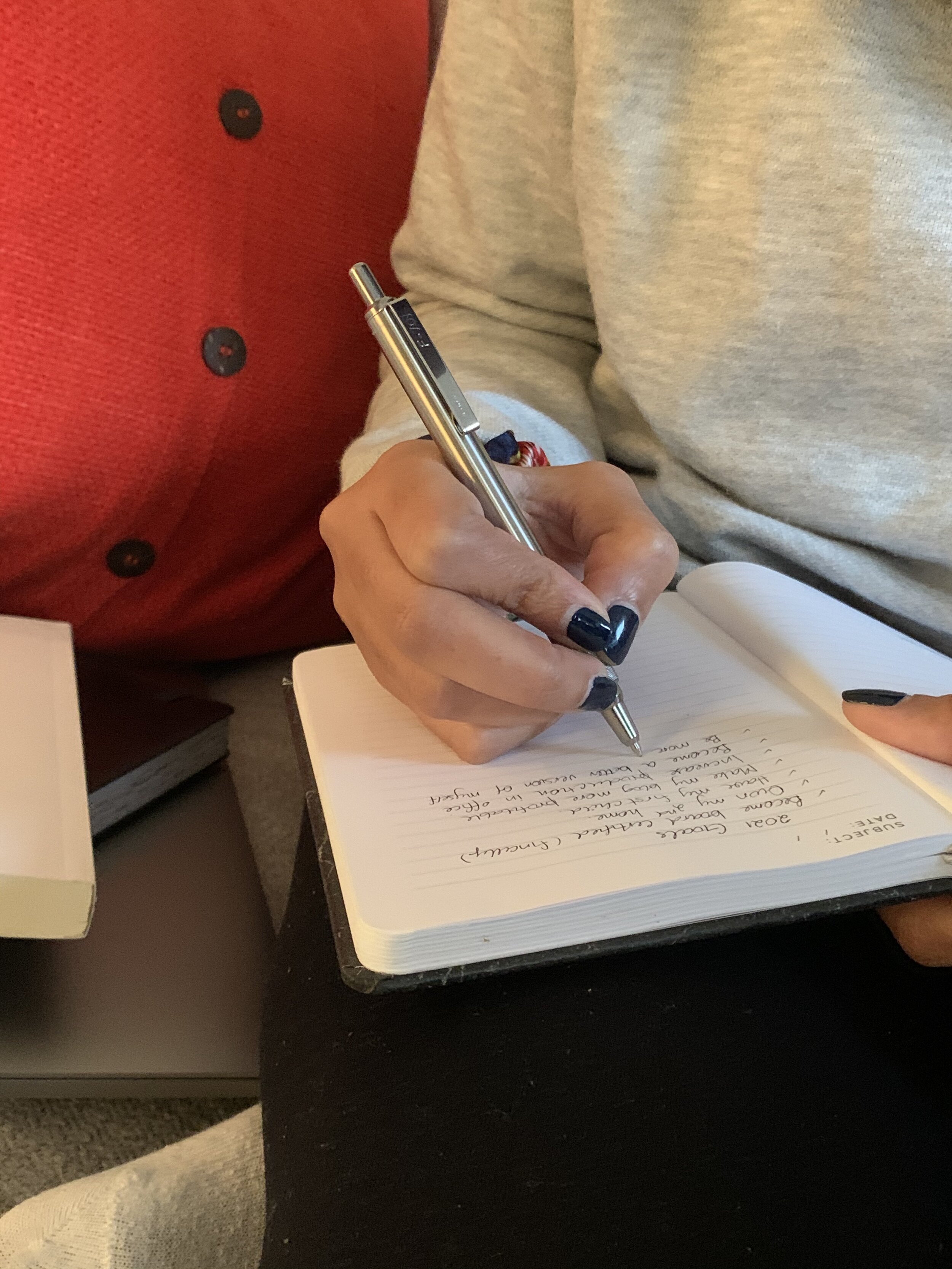

I don’t know about anyone else, but even though we are completely in the digital age, there’s just something about putting pen to paper that helps to clarify my goals and priorities. Whether it’s writing in my journal, scribbling down my daily to-do lists, scheduling meetings and due dates or scribing my treatments plans at work, there is something about the analog nature of writing things down with a real pen on paper that helps me to properly set my intentions and achieve my goals.

Writing things down forces our ideas to become real.

“When we write things down, we enter a world of possibility”

As an Orthodontist, blogger, philanthropist and side hustle extraordinaire, my life takes a certain level of organization and my writing utensil is a big part of that. From writing charts, treatment planning, signing documents, and creating content, I need instruments that will help to not only keep me on track but also offer reliability and efficiency. One Instrument I am very particular about is my pen.

My go-to writing utensil is the Zebra Pen STEEL F-701® ALL METAL Ballpoint Retractable Pen. Not only does it have a very stylish design but it also provides a high-quality writing experience that helps me stay organized and accomplish my goals. It’s rare that I come across high value items with great quality and style for a low cost. At under $10.00, this writing tool was made for the savvy and confident professional. This pen transitions well with my professional and personal style. Check out more information here to see how you can Choose Different.

HERE ARE A FEW OTHER REASONS TO LOVE THE ZEBRA STEEL F-701:

As an Orthodontist, I utilize pens to complete clinical charting and treatment planning for my patients. My notes require a premium quality pen, like the STEEL F-701, that does not smudge, has a convenient push clip, and that has a great grip. As a blogger, it is just as important in helping me to plan my blog and social media content.

This pen is housed in a silver stainless steel frame that I can easily clean and sterilize between uses. It is knurled, with a no-slip grip for ease of handle and it offers a smooth, even ink delivery from any portion of the ball tip. It is lightweight, durable, and easily clips to my white coat pocket. Best of all it contains an all-metal refill which is usually seen in pens with a hefty price tag. Its fast-drying ink prevents smudging on glossy prints and is great for writing on patient photographs and radiographs.

Blogging coupled with my other entrepreneurial endeavors takes quite a bit of planning. It seems I write on paper almost as much as I type. Needless to say, I always need a pen that’s reliable…. and stylish, of course.

I always carry the STEEL F-701 in my purse because it is practical, durable, reliable and long lasting.

3 Ways To Close Your Office From Christmas to the New Year

Whether you’re a practice owner or an associate doctor, structuring holiday hours can be tricky but something we must always consider when planning our year. There are generally three main schools of thought when it comes to closing a practice for the holidays

Whether you’re a practice owner or an associate doctor, structuring holiday hours can be tricky but something we must always consider when planning our year. There are generally three main schools of thought when it comes to closing a practice for the holidays:

Some docs hate to close the office because they fear they will lose production/money.

Some docs choose to take the week after Christmas for family time and vacation without worrying about the needs of the practice(production) or staff(no work no pay).

Some docs choose to take the week after Christmas off but planned ahead throughout the year to ensure they are able to meet the needs of the practice and staff(no work but vacation pay).

If you or the owner doc struggle with any of the first two schools of thought above, here are some ways to strike a balance:

Create a slightly longer work week

The truth is, most offices are slower towards the end of December. Create an end of year marketing plan for patients to book appointments in the first three weeks of the month. If you are currently working 4 days per week, consider moving to 5 days. The extra days can bring quality production.

Boost production in the preceding month/months

Identify the months where you can increase production to compensate to meet the practice needs for the last week.

Budget Ahead of Time

1)-Evaluate Your Payroll numbers (How much is needed to pay your staff and Bills) and determine the number of

days you need off;

and

2)-Set aside the amount of cash needed in advance (A little bit every month will do the trick)

Be mindful of your staff and compensate them. You will need their help to accomplish these goals. These are a few simple tricks we can employ to close our offices the week after Christmas. Hope this helps. Have a safe and Happy Holiday. See you guys in 2021!!!

Bad Boss Behaviors To Avoid

The truth is, bad boss behaviors lead to poor employee engagement and high turnover. When you have a manager who treats you with respect and has your back, you are more likely to give your best and stay longer in a company, but when you have a bad boss, you're much more likely to be disengaged, suffer from anxiety and want to leave.

One of my favorite leadership speakers is Brigette Hyacinth. I was reading her book “The Future of Leadership: Rise of Automation, Robotics and Artificial Intelligence” and she outlines some boss behaviors and qualities that are less than favorable. The bosses or individuals in leadership positions often mistake these qualities as good ones much to the chagrin of the workplace or company at large.

I can agree with all she outlined in her book having experienced some bad bosses/leaders myself.

The truth is, bad boss behaviors lead to poor employee engagement and high turnover. When you have a manager who treats you with respect and has your back, you are more likely to give your best and stay longer in a company, but when you have a bad boss, you're much more likely to be disengaged, suffer from anxiety and want to leave.

7 Worst Bad Boss Behaviors

These are complete deal breakers:

1. Micromanaging - This is the number one killer of creativity and innovation in the workplace. It fosters an environment of distrust as employees feel suffocated and confined. If you hired someone for a job, give them room to get it done.

2. Picking favorites - Hiring and/or promoting the wrong people. This is often noticed when a boss only recommend employees in their "inner circle" for assignments or growth opportunities. They surround themselves with sycophants or "yes" employees.

3. Taking the credit for employees' work or successes - Bad bosses will do anything to look good including taking credit for the employees work or ideas. Self-promotion is their top priority. There is nothing more demotivating than working hard to earn something only to have it unfairly taken away. This causes employee engagement to plummet.

4. Ignoring feedback/Not listening - Some bosses don't admit mistakes. They take negative feedback personally and treat those poorly who give such. So onlooking employees learn not to say anything. Worst than asking for feedback is not doing anything about it.

5. Not standing up for employees - Throwing employees under the bus. It's demotivating working for a manager who does not stand up for their team. If someone makes a mistake they turn into judge, jury and executioner. They are quick to point fingers.

6. Overworking employees. It's demoralizing working for such a boss as this. They have unrealistic expectations about what is possible from employees. Their main focus is on the bottom line. They hesitate to authorize personal days or they question the need for sick days.

7. Overlooking or not recognizing employees' contributions. - Two of the most basic human desires are validation and appreciation. People want to feel appreciated, respected and included. Lots of managers think that they've fulfilled their duty by providing a paycheck, but that's not enough if you want engaged and productive employees.

A manager's job is to facilitate a good working environment for his/her employees. Bad bosses create toxic work environments. Toxic environments drain employees emotionally, mentally, and physically. I have seen many employees in these circumstances become so disengaged to the point, they are only there for the paycheck until they quit.

Good bosses are few and far in between, and employees long for such bosses who will support, inspire and help them to grow. A recent study found that 65% of employees would rather have a better boss than a salary increase. There is nothing like having a boss who has your back. It's time that companies realize that all the money or perks, will not retain good staff if they have a bad boss. A good boss is without a doubt, one of the best incentives to keeping staff, happy and engaged.

If you are an employer/boss or are gearing up to be, I would suggest looking at the above bad behaviors and do your best to avoid them. Your team and your company or establishment will benefit tremendously.

Reasons Young Professionals Need a CPA

Spring is usually the time when we talk taxes! But, since 2020 has been an unprecedented year all around, tax time came a bit later this time. Taxes are a necessary evil that is the sobering reality for anyone earning a paycheck. But with each passing filing and with the rising trend of DIY everything, it seems like the younger generation are turning their backs on an accountant and instead trying to do it themselves.

Spring is usually the time when we talk taxes! But, since 2020 has been an unprecedented year all around, tax time came a bit later this time. Taxes are a necessary evil that is the sobering reality for anyone earning a paycheck. But with each passing filing and with the rising trend of DIY everything, it seems like the younger generation are turning their backs on an accountant and instead trying to do it themselves. With the help of google people are turning to software like Turbotax or an employee at H&R Block to prepare and file their taxes at the end of the fiscal year. Nothing against these methods of tax preparation, but not everything needs to be DIYed (side note: don’t get me started on DIY braces). However, in this economic climate CPA’s are more important to young professionals and businesses than ever.

The Rise of Contract Employees, Start Ups and Side Hustles

The economy is primed for startups. We’re at an age when people are constantly able to create and innovate to drive the world forward with the click of an app. But with all new business ventures comes great risk. There is incredible and inherent risk when starting a business and every dollar spent needs to be accounted for. So it’s no wonder that with the boom of the startup sector that there’s a rise in contracted employees. Contracting employees is cheaper. Not only that, but by contracting work, startups everywhere gain the flexibility to adapt and shift to the market needs. Independent contractors are the logical choice for emerging businesses. However for the contractor themselves, the line between employee and freelance can be blurry.

Yes, You Need An Accountant

Inexperience, mixed with the looming tax deadline creates panic for so many young people. An accountant can alleviate that stress - they understand tax laws and can help you save your hard earned money. The same thing can be said for entrepreneurs navigating the world of small businesses. CPA’s can help keep your financials on track, while advising you on taxes. “This may seem obvious, but keep in mind that rules and regulations change frequently, and it’s tough if not impossible for any business owner to keep up with it all. An accounting professional can take away your uncertainty and ensure your business stays compliant.”

So, are we at a time when it’s easy to file your taxes, all on your lonesome? Yes. But nevertheless, more and more people are turning to the side hustle to earn a little extra at the end of the month.

Conversely, a CPA firm that concentrates on the dental industry can not only review QuickBooks, provide tax reduction planning, and provide best practices benchmarking for a dental practice, but should also provide insight into the best local providers for:

Dental Law Firms

Dental Banking

Dental Real Estate

Dental Brokerage

Dental Insurance

Dental Practice Cost Segregation

If you are searching for a higher level of expertise at key points in your dental career, it really pays attractive dividends to align yourself with a CPA firm that is focused on the dental industry. Below are some of the most important inflection points for hiring a Dental CPA:

Incubator Stage – While working in Corporate Dentistry or attending dental school, it really pays to create the right professional relationships to overcome obstacles to dental practice ownership.

Growth Stage (first five years of ownership) – Decisions ranging from office location to practice type to office staff can have profound impact on production, cash flow, client acquisition, and debt reduction.

Adolescent Stage – Decisions focused on technology upgrades, remodeling, office design, improved work flows, and improving clientele quality.

Maintenance Stage – Most of this phase focuses on saving for retirement.

Exit Stage – Most of this phase is focused on maximizing the value of the practice for sale.

If you haven’t found a great dental CPA to work with, feel free to shoot me an email and I can offer my recommendation.

Virtual Visits Made Easy With alignFlow: A Review

Align flow is a powerful, easy to use virtual care platform that helps dentists and orthodontists make clear aligner treatments less complicated for their patients and more profitable for their practice. Their system works with all aligner brands and helps doctors and patients get fantastic results with fewer in office visits.

In light of the COVID-19 pandemic many industries and organizations have been forced to adapt and fast track digital transformation to continue providing services. Schools have adopted remote learning, many employees are working from home and dentists are using teledentistry services, like alignFlow to consult patients and offer virtual visits.

alignFlow is a powerful, easy to use virtual care platform that helps dentists and orthodontists make clear aligner treatments less complicated for their patients and more profitable for their practice. Their system works with all aligner brands and helps doctors and patients get fantastic results with fewer in office visits.

BENEFITS OF ALIGNFLOW

Live Patient Tracking: Quite a bit of my patients love the ease of wearing clear aligners. This app allows me to track patient’s progress virtually without an actual office visit. Patients can also use the app to track their progress and aligner wear time. They can also contact their doctor with any issues or questions, improving the doctor patient relationship.

Fewer Office Visits: Because I am able to track progress virtually, it means I can offer fewer in office visits which patients really appreciate since a lot of them are now working from home and their kids are doing virtual schooling. It’s a benefit to docs as well since less patients in the office means less chair time and less supplies being used which in turn means efficiency and a cut back on overhead expenses.

Is Convenient: Patients love the fact that they can still see and speak their doctor regardless of where they are. It also cuts down time away from work and thus helps patients to stay employed and avoid loss of income.

Less intimidating: Many individuals experience dental anxiety when going to the dentist. Being able to speak with or see a dentist or orthodontist in the comfort of their own home is a far more comfortable experience for some.

Frees up dentists’ time for clinical work: Many patients have minor dental problems and questions that do not need in person face-to-face time with the dentist. alignFlow helps to bridge the communication gap as patients can communicate with their doctor via text messaging or virtual face to face meetings. A major plus with this app is that it is HIPAA complaint.

Improves oral hygiene education: One of the key advantages of this app is the chance to educate patients on good oral hygiene practices. Doctors can upload videos or instructions into the resources tab. This can be used instead of providing paper instructions. This helps teach patients things like correct brushing and flossing, providing education and giving advice about health concerns can all be done using alignFlow.

Using teledentistry apps has been quite advantageous, especially during the pandemic to not only continue providing care for current patients but to also reach new patients. For more information on alignFlow, visit their website here and request a free demo. You can also find them on social media here.

This is a sponsored post by alignFlow

My Secrets to Building a Fulfilling, Multifaceted Career & life: An Interview with Whippy

Have you ever considered launching your own business from home or traveling abroad to give back to communities 5000 miles away, all while maintaining your practice as a dental or medical professional? Your career doesn’t have to be confined to one line of focus. Some people thrive when they juggle commitments that are very different from one another.

I had the wonderful opportunity to speak with Samantha from Whippy to speak on how I am building a balanced and fulfilling career and life, and to also lend some words of advice to young professionals. Her blog post is below:

Have you ever considered launching your own business from home or traveling abroad to give back to communities 5000 miles away, all while maintaining your practice as a dental or medical professional? Your career doesn’t have to be confined to one line of focus. Some people thrive when they juggle commitments that are very different from one another.

Meet Dr. Patrice Smith.

She’s an orthodontist who has mastered the art of time management. Her 9-5 schedule may consist of appointments with patients in the office, but her 6-10 is her time to manage her self-started candle business and blog.

Although born in Jamaica, Dr. Smith moved to the U.S. and attended dental school at Howard University in Washington D.C. It wasn’t until her third year of school that she decided she wanted to go into orthodontics. For her, orthodontics is the ideal practice because it allows her to “use both sides of (her) brain simultaneously: the analytical and the creative.”

“It allows me the freedom to express my personality, one that is very laid back (must be the island girl in me) but also type A when it comes to details, systems and organization,” she said.

It is the love for creative freedom and challenging herself in unique ways that, in part, inspired Dr. Smith to establish her own candle business called Unorthdoc Candles. As someone who always adored scented candles but couldn’t afford to purchase the high-end brand ones during dental school, Dr. Smith began making her own candles from scratch. What started out as a fun, relaxing hobby turned into a full-blown business as demand for her candles accelerated.

When I asked her how she finds the time to run her business in addition to practicing her profession, she told me she has an organized planner to keep a routine schedule. She only works in the ortho office 3 days a week and usually dedicates her evenings to Unorthodoc Candles.

Another major hobby of hers is blogging.

Back in 2008, she started chronicling her dental school journey through blog posts. “It was kind of like a diary where I documented everything and other people found it to use as a resource”, she admitted. Dr. Smith felt compelled to assist other dental students through their career journeys by sharing her own experiences.

Today, she runs an incredibly successful blog called TheUnOrthodoc (theunorthodoc.com), designed to help young professionals lead a balanced and purposeful life. The website also features resources such as student financing options as well as her favorite dental products!

Last, but certainly not least, Dr. Smith uses her professional skills to give back not only to her home community but communities across the globe.

She is the cofounder of Dental Helping Hands, a nonprofit organization dedicated to providing dental services to underserved communities in different countries.

“All of us share a passion for giving back to our communities and to the disenfranchised. With the exception of 2020, every year we travel to different countries and provide free dental care to those without access,” she said of her and her team.

Is there anything Dr. Smith can’t do?!

Here’s her 3 key pieces of advice for young professionals:

My 3 pieces of advice and the rest of my interview with Samantha can be found on the Whippy blog here.

Are Virtual Dental Visits Here To Stay?

In light of the COVID-19 pandemic many industries and organizations have been forced to adapt and fast track digital transformation to continue providing services. Schools have adopted remote learning, many employees are working from home and dentists are using teledentistry services to consult patients.

In light of the COVID-19 pandemic many industries and organizations have been forced to adapt and fast track digital transformation to continue providing services. Schools have adopted remote learning, many employees are working from home and dentists are using teledentistry services to consult patients. Although some businesses may revert to their former practices after the pandemic, many others will leverage new technology to provide additional benefits and attract new customers and patients.

What is teledentistry?

During the height of the pandemic, many dentists had to postpone elective and non-urgent dental procedures. In an effort to continue offering services, albeit limited, dentists had to adopt teledentistry (virtual dental visits) to reach patients. It was used typically for patients with dental problems in order to decide whether a face-to-face dental appointment was needed and in some cases keep in touch and follow up with patients after appointments. Now, it has evolved to where this is now how some dentists conduct initial consultations for patients before being seen in person.

Teledentistry has allowed patients and doctors to speak with each without risking exposure to the virus.

Benefits of Teledentistry

Teledentistry was already in place but many dentist were very slow to adopt it. However, the pandemic brought to light the many benefits of it. It is not hard to see how its adoption could continue to rise and be a mainstay in practices. Teledentistry:

Improves access to care: Patients in rural areas, who are home-bound and the elderly may have trouble finding and getting to a dentist. Tele dentistry helps to break down those barriers and gives these patients a chance to see and talk to a dentist about their dental problems.

Is Convenient: In essence, it cuts down time away from work and thus helps patients to stay employed and avoid loss of income.

Reduces cost: In may practices, virtual consultations are free of charge and subsequent appointments are of a lower cost to the patient. Seeing a patient remotely also means the dentist does not have to use up valuable resources like gloves, masks, gowns, other supplies and chair time.

Less intimidating: Many individuals experience dental anxiety when going to the dentist. Being able to speak with or see a dentist in the comfort of your own home is a far more comfortable experience.

Frees up dentists’ time for clinical work: Many patients have minor dental problems that do not need face-to-face time with the dentist. If using teledentistry can address those problems, dentists would have far more time to treat patients whose needs they can treat only in a face-too-face visit.

Improves oral hygiene education: One of the key advantages of teledentistry is the chance to educate patients on good oral hygiene practices. Teaching patients to brush and floss, providing education and giving advice about health concerns can all be done using teledentistry.

How Teledentistry Works

It’s never been easier to be able to communicate with a dentist and there are several methods of delivering dental care via teledentistry. A dentist and patient can use their computer with video that allows them to speak directly to each other or they can do so via an app with can be downloaded to their smartphone. With each option, the patient can take pictures of their teeth and smile so that the dentist can make treatment recommendations in real time. Doctors can also use it to communicate with each other (sending X-rays, photographs, etc) about mutual patients as most of these programs are HIPAA compliant.

Here To Stay

Because of the it’s advantages (listed above) and the effects of the pandemic of the field of dentistry, delivery of dental care via teledentistry has enormous potential, and thus I believe it is here to stay. Widespread internet access and the proliferation of smart phones also make it very easy to implement and adopt.

What are your thoughts?

The Truth About Contracts

We all have talents and gifts that are unique to us. When we enter into a situation, i.e job/workplace we give that organization governance over our talents and lessen our potential earnings (our abundance). That is, that situation gets to benefit from your talents, and often times a lot more than you do.

Contracts by definition is a mutually beneficial agreement. While you may be able to negotiate and come up with a “great deal”, more likely than not one party benefits more than the other.

Your talents unlock your ancestral abundance and thus when you sign contracts with people/organizations to govern over your talents you’re letting those said organizations govern over your ancestral abundance. You may need to read that again.

Ancestral abundance: The abundance that is due to you from the universe and your ancestors.

We all have talents and gifts that are unique to us. When we enter into a situation, i.e job/workplace we give that organization governance over our talents and lessen our potential earnings (our abundance). That is, that situation gets to benefit from your talents, and often times a lot more than you do. As an example, many doctors work for corporations and produce millions of dollars but only reap a small fraction of that production.

“When you sign contracts with people to govern over your talents you’re letting those organizations govern over your ancestral abundance. ”

More and more people are recognizing this these days and are choosing the route of independence and freedom. This is one of the reasons there are so many people going towards entrepreneurship and becoming a self brand.

This is not to say there’s anything wrong with working for/with corporations. They have their benefits and individuals who are early in their career find this option attractive. While ownership offers freedom (on many levels) and potentially enables you to have far greater earning potential, not everyone wants to be an entrepreneur.

If you do decide to work for someone or a corporation arm yourself with contract negotiating tactics.

To Negotiate like a boss, especially if you're female, will take some mindset changes to get what you want, what is fair and what you deserve.

1. Learn To Say NO

One of the greatest inhibitions in asking for your market value or what you think you're worth is the fear of rejection. Once you can get passed this fear you can move on to the negotiating table. Understand that the real negotiating doesn't start until someone says no! Never just accept what you're being offered. Quite often contracts are written with wiggle room for that reason. The goal of negotiating is to reach an agreement with someone whose interest may not necessarily be aligned with yours. In this context the word no is not a negative thing but offers grounds to problem-solve and come to a consensus and an agreement. The alternative is being stuck in a job with individuals who are happy to place their needs above yours.

2. Ask for More Than What You Want

It's a much better negotiating strategy to ask for more than you actually want or think you will get. Allow each party to say no a couple times before saying yes. People aren't necessarily happy when they get what they want. Think about it: You sit with your potential employer and say " I would like a 10% increase from my previous salary and a corner office" and his/her immediate response is "Sure, no problem!" You will likely suffer from buyers' remorse and wonder if you should have asked for a 20% increase instead.

3. Be Willing to Walk Away

A lot of negotiating is a mind game. The greatest bargaining advantage goes to the person who is perceived to have the least to lose. Establish your deal breaker or bottom line and be willing to walk away from a deal (or say you will). If you at least act like you're prepared to walk away if your bottom line isn't met then the other party will be more incentivized to meet your requirements.

4. Get a Lawyer

You have looked over your contract thoroughly but you need a second pair of eyes on it. There may be some legal jargon that you don't understand or have over looked. A lawyer will be able to point some things out to you that you may have missed and can even negotiate on your behalf. In my experience it has been worth the money pay a lawyer to do some of the heavy lifting for you.

I know contract negotiations aren't always easy. You must ensure that you ask the right questions upfront, learn to say no, don't get bullied into signing on to something you will regret later and be willing to walk away. I have negotiated several contracts throughout my career and I’ve learned something from each encounter. At the point where I am today in my career,I realize that even the best negotiating tactics where I felt like I was getting the best deal, still resulted in me coming up short in one area or another. At the end of the day, make sure that if you do work for someone/corporation that you are getting at a minimum a fair deal.

The Importance of A Self Brand

When we think of a brand, we typically think of a business and not necessarily ourselves, right? What if I told you that whether you're intentional about it or not, YOU are a brand! and everything you put out there is part of your brand story.

I remember several years ago when The UnOrthoDoc became a brand. It was between the completion of Orthodontic residency and the beginning months of my first job. Between patients I found myself reading and writing and wondered if this was normal. I love my profession but a few other passions were getting substantial amounts of my time. As I looked at my former classmates and colleagues expressing their love for their new career it dawned on me that we didn’t share the same feeling. Instead, I felt that I needed to find a way to harmoniously combine my career and my other passions to create balance in my life. Not long after, the name UnOrthoDoc was born - It was a clever spin on my title and one that I felt encompassed who/what I felt I was.

UN•ORTHO•DOC

(n): a doctor who does not subscribe to stereotypes of what he/she should be, do or look like

(adj): Contrary to what is usual; different

“You too are a brand. Whether you know it or not. Whether you like it or not.”

I recently read two books , You Are a Brand and Building A Story Brand, that brought the full picture of self branding into focus. I knew I was creating a presence on the web and on social media but I never quite called it branding. This blog and my social media platforms became the avenues where I could share my experiences and impart some of the knowledge I gained as a young professional. Hopefully my experiences, both good and bad, would become a reference to assist my peers, colleagues and those coming after me. Those books made me realize that I was unknowingly creating a self brand.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

When we think of a brand, we typically think of a business and not necessarily ourselves, right? What if I told you that whether you're intentional about it or not, YOU are a brand! and everything you put out there is part of your brand story. What do people say about you when you're not in the room? What will people find when they google your name? Best believe that if you're going on a date, going on a job interview, applying for a residency position (if you're a doc) the person on the other end has looked you up.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

I remember joining a practice after residency and being told by a fellow doctor I worked with that I didn't "seem like someone who would be working here." He said when he heard that I'd be joining the team he googled me and thought "why would SHE want to work here? I don't see her staying." Needless to say, I did not stay at that practice. But, whatever his perception of me was i.e what message I was portraying, did not fit the brand of the practice where I worked.

So why is a self brand important? Because the world is watching! How you present yourself, especially online makes a difference, even if you think no-one cares. It’s about managing your name — even if you don’t own a business.

Do a quick self check: google yourself and see what pops up. Take a look at your social media platforms and see if they represent you well. If not, it may be time to work on your self brand.

*This post and all content on The UnOrthoDoc blog is protected by copyright laws.

How Do You Know If Your Business Needs a Trademark?

Oftentimes business owners think that by simply forming their business entity (e.g. an LLC), that they own the rights to their brand. This isn’t the case. In order to protect the various aspects of your brand, you have to register your trademark.

GUEST CONTRIBUTOR: Trademark Attorney, Zara Watson. Owner of Zara Watson Law PLLC

Today, I’d like to touch on something that every business owner faces at some point….how do you know if you need a trademark?

If you own or manage a business, you have at least one trademark- the name of your company.

You may have others like product names, service names, logos, or slogans – these are all different trademarks. They are all valuable assets to your brand.

You’ll know that you need a trademark if you are using one of the above “branding elements” to market and advertise your products or services. The reality is that the more you advertise and market your brand, the more likely it is that someone else may copy or steal it to sell their own products and services.

If you’ve fallen in love with your business name, logo, or slogan and plan to use it for years to come, then you’ll need to do everything in your power to secure your rights.

You’ll want to register your trademark so that you can:

Feel secure knowing that you can stop others from copying your brand.

Stop others from benefiting from your advertising and marketing efforts.

Avoid consumer confusion from other “similar” brands.

Appear professional in the eyes of consumers and potential investors.

Oftentimes business owners think that by simply forming their business entity (e.g. an LLC), that they own the rights to their brand. This isn’t the case. In order to protect the various aspects of your brand (business name, logo, slogan, and even product packaging), you have to register your trademark.

If you’re ready to own and protect your trademark, book a discovery with Zara today!

Meet Zara Watson

I’m an award winning trademark attorney, philanthropist, writer, and legal educator. I help online business owners like you secure the rights to your trademark so that you can sleep better at night knowing that your brand is 100% yours.

After a year of working at a law firm that I wasn’t passionate about, the lightbulb clicked; I realized that I could use my legal expertise to help online business owners protect their businesses through the area of Intellectual Property Law.

Now, it's my mission to help you own your trademark so that you fully own the rights to your brand. I believe that no matter how big or small your business, owning the rights to your brand matters. In order to leave your mark in the world, you need to know how to protect it.

My Secret To How I Paid Off 200K of Debt in 3 Years!

For a long time, I didn’t know what kind of job or career I wanted. Like many millennials I was checking off the boxes, the “should” boxes, you know what they are…I realized I wanted out of this societal trap of shoulds. I realized that I was only checking off these boxes because I should and not because I wanted to.

This is a guest post by Jolene Stahn

For a long time, I didn’t know what kind of job or career I wanted. Like many millennials I was checking off the boxes, the “should” boxes, you know what they are:

✔get good grades so you can

✔go to a good university so you can

✔get a good job so you can

✔buy a car and

✔buy a house and

✔have a good retirement

I started all this and was fully in it. And fully in $200,000 in debt from student loans and a mortgage… But now that I had this house and life, I realized I wanted out of this societal trap of shoulds. I realized that I was only checking off these boxes because I should and not because I wanted to.

I wanted to be free. Free from these shoulds.

I wanted freedom. I didn’t want to be stressed out by this debt. And I surely didn’t want money to stress me out. I wanted to be in control of my finances.

I didn’t want to have to be limited when going out to eat or when deciding between having something or not whether it was a plant to decorate my house or (expensive) avocados for my favourite avocado toast!

So what did I do?

These desires led quickly to becoming obsessed over figuring out what exactly I wanted (so a lot of self-help books) and learning from all the money gurus! I wanted to not have any debt as soon as possible. And I wanted to learn about how I could make my money work for me! Now, let me tell you it wasn’t easy but I figured it out.

Download my secret to see what I figured out:

My results:

Because I was able to learn so much, diving head first into all the books and courses I could get my hands on.

I was able to pay off my debt of $200,000 in 3 years!

And because of this, I was able to have the freedom to quit my (“career” type) job, backpack throughout Australia with my boyfriend, and go on last-minute trips to places like New York and Costa Rica! I was also able to explore new passions that allowed me even more freedom like working online and finding other things I enjoy. And ultimately living the way I want to live.

I was able to do all of this by learning about personal development and managing my finances and the most amazing part is that I can always feel this freedom I truly desire, do the things I want to do, and not the things others/society says I should do!

I now feel free, in control, and love the luxury of doing what I want. And the best part, I now get to help others with their money, whether someone’s in debt, living paycheck to paycheck, or if you just want to make your money work for you!

I am so passionate about helping others get out of the situation I once was in with so much debt and lack of control in the finance department. I teach what I’ve learnt on my journey, what I wish I would’ve known, and use a combination of personal development and money management techniques. I simplify finances terms and personalize the best methods based on individual goals.

I love seeing the amazing results from clients who just paid off their credit card debt, the celebration, and to see how happy and less stressed they are! I’m so proud of each of them to be able to live without being controlled by money!

This is a guest post by Jolene Stahn.

About Jolene Stahn

Jolene figured out the secret to financial freedom, quit her corporate career, moved to Australia with her boyfriend and is living the life she desires!

Now she helps millennial figure out their finances to also live the life they want.

Follow Jolene on Instagram

4 Simple Ways To Keep Your Clear Aligners Clean

If you’re going through the process of aligning/straightening your teeth with clear aligners, like Invisalign or Clear Correct, you know first hand that it can get pretty dirty. As an Orthodontist I’ve seen my share of gunky aligners. If you’re having trouble keeping them clean, here are some tips to keep them fresh and free of gunk

If you’re going through the process of aligning/straightening your teeth with clear aligners, like Invisalign or Clear Correct, you know first hand that it can get pretty dirty. As an Orthodontist I’ve seen my share of gunky aligners. If you’re having trouble keeping them clean, here are some tips to keep them fresh and free of gunk:

1. Soap and Water

The simplest way to clean your aligners is to use gentle liquid soap with lukewarm water. Brush them gently with a soft bristled toothbrush or mix the solution in a cup to form suds. Soak your aligners in the soapy water for 20–30 minutes, then rinse with plain water.

2. Vinegar and Water

In a cup, mix one part white vinegar to three parts luke-warm water. Soak your aligners in the liquid for 15 minutes, then rinse in cool plain water.

3. Peroxide and Water

Soak aligners in a solution of equal parts hydrogen peroxide and luke-warm water for 30 minutes, then rinse thoroughly in plain water.

4. Retainer or Aligner Cleaner

Cleaners like Ever Smile White Foam or Retainer Brite are very good at keeping aligners clean. Ever Smile is a minty foam made with hydrogen peroxide that is spread on your aligners and put directly back in the mouth. The hydrogen peroxide destroys bacteria that causes bad breathand tooth decay and you get the added benefit of some whitening over time. Retainer Brite is great as well, they are dissolvable tablets that you place in a cup of water , leave the aligners there for about 30 minutes.

How *not* to clean aligners:

1. Hot Water

Never use hot water to clean your aligners. Hot water will warp and change the shape of the plastic making it unable to fit.

2. Mouthwash

Mouthwash is great to rinse your mouth with but never for your aligners. The coloring used in most mouthwashes can permanently stain your clear aligners.

3. Toothpaste

Contrary to popular belief, toothpaste must never be used to clean your aligners. Toothpaste has abrasive properties that will create scratches in the plastic. Scratched plastic will not look as clear and will be noticeable.

4. Other Solutions

Solutions like bleach, alcohol and other harsh chemicals can permanently warp your aligners.

Bonus tip:

Always brush and floss your teeth before putting your aligners in, and always give them a rinse when you remove them.

What Is That Smell?!

Picture this, you wake up ready to start your day, walk into the kitchen and smell a fresh pot of coffee brewing. That’s a nice surprise since you don’t remember even starting the coffee maker. You walk over to the living room, pull out your yoga mat to get a nice morning stretch in and get a whiff of fresh cut roses. You inhale deeply and smile…

Picture this, you wake up ready to start your day, walk into the kitchen and smell a fresh pot of coffee brewing. That’s a nice surprise since you don’t remember even starting the coffee maker. You walk over to the living room, pull out your yoga mat to get a nice morning stretch in and get a whiff of fresh cut roses. You inhale deeply and smile. You complete your 10 minute stretch and walk out to the balcony to get some fresh air and you’re immediately turned off by the smell of cigarette smoke - yuck! The morning was going so great.

The coffee must be done brewing by now, so you go back inside to pour you a cup, but there’s no coffee. Puzzled, you wander back to the living room and take a seat. Wait, where are the roses? And who was outside smoking? Nobody, since you live on a 5 acre lot and the nearest home is a half mile away. Strange, huh?

The brief episodes of smelling something that’s not there is called Phantosmia. That’s what Dr. Tonia Farmer, a board certified Otolaryngologist / Ear, Nose and Throat (ENT) Surgeon explains she suffers from. Her phantom smell or olfactory hallucination often presents itself in the form of smelling cigarette smoke.

As she explains, some common causes/triggers of phantosmia include:

Migraines

Seizures

Respiratory Infection

Inflamed Sinuses

Head Trauma

Brain Tumor

Parkinson’s Disease

The treatment typically depends on the etiology, which is sometimes unknown. Dr. Farmer mentions regardless of the cause there are several things which help to alleviate symptoms. Those include rinsing the nose with saline, using a natural nasal inhaler (like her very own Himalayan Pink Sea Salt Inhaler) or by masking the smell( essential oils or our UnOrthoDoc Candle Co. scented candles).

If you or someone you know suffers from related symptoms, see an ENT specialist like Dr. Farmer for a comprehensive evaluation.

Dr. Tonia Farmer, MD is a Otolaryngology (Ear, Nose & Throat) Specialist in Warren, OH and has over 24 years of experience in the medical field. Dr. Farmer has more experience with Upper Respiratory Conditions, Ear, Nose, and Throat Surgery, and Sleep-disordered Breathing than other specialists in her area. She graduated from Virginia Commonwealth University School Of Medicine in 1996. She is co-owner of the world-renowned Lippy Group for ENT and Lippy Surgery Center. She is affiliated with medical facilities such as Saint Elizabeth Youngstown Hospital and St. Joseph Warren Hospital. Dr. Farmer is also the owner Salt Me! a sinus and body care business she created using salt therapy to help her patients with sinus issues.

You can find Dr. Farmer on Instagram here and here.

How Systemic Racism and Cultural Bias Affects Our Oral Health

Race and ethnicity, unfortunately are important factors in oral health disparities in the US. Uneven distribution of dental care leads to a higher incidence of suffering among different racial groups. African Americans/ Blacks are more likely to suffer from untreated dental pain and decay causing chewing difficulties and tooth loss as compared to Whites.

Race and ethnicity, unfortunately are important factors in oral health disparities in the US. Uneven distribution of dental care leads to a higher incidence of suffering among different racial groups. African Americans/ Blacks are more likely to suffer from untreated dental pain and decay causing chewing difficulties and tooth loss as compared to White Americans. African Americans also report more financial difficulties and are less likely to seek dental care than their white counterparts.

factors that negatively IMPACT ORAL HEALTH

Social determinants can affect oral health more than genetics.

Social Determinants of Access to Care

Despite major improvements in oral health for the population as a whole, oral health disparities still exist for many racial and ethnic groups. Economic factors that often relate to poor oral health include access to health services (lack of clinics,transportation, etc.) and an individual’s ability to acquire and maintain dental insurance. Although Interventions such as community water fluoridation, school-based dental sealant programs, and incentive programs for dentists to live and work in deep rural areas have been implemented, it doesn’t fully off-set the need and the high demand of dental care in our communities.

Social Determinants of Nutrition & Health

Availability and proximity to grocery stores affects our ability to make healthy choices. Organic foods are usually priced at a premium so most will opt for the more affordable processed foods. Preservatives, such as salt, in those processed foods can cause elevated blood pressure levels. Those elevated levels are linked to higher incidence of periodontal disease which if left untreated can lead to early tooth loss. Communities of color are more likely to face food insecurity and lower levels of nutrition because our systems aren’t adequately meeting their needs.

Social Determinants of Equity

It is an unfortunate reality that US institutions have a long history of segregating communities of color, concentrating resources in white communities, and designing systems that benefit white people. This leads to preventable differences in oral health which is closely connected to our overall health.

Other additional ways that systemic racism shows up in oral health include an extreme lack of diversity in the dental health care workforce, accessibility of dental insurance and social bias. One study even showed that 22% of blacks avoided medical care in the US out of concerns about racial discrimination, compared to just 3% of whites. It’s also been shown that most health providers, regardless of their race, have implicit bias against people of color.

How One Doc Paid Off $200,000 in Student Loans in 4 years

One of the hot topics on this blog and among young professionals has been student loan debt. If you attended professional school, chances are you accrued some debt along the way. I was really excited meet our guest, Dr. Rania Habib via Instagram and learned that she repaid her six-figure student loan debt in a short amount time and is now financially independent. In this post she tells us how she did it.

One of the hot topics on this blog and among young professionals has been student loan debt. If you attended professional school, chances are you accrued some debt along the way. However, it is a stark reality that this debt has to be repaid. A known debate for many of us is whether or not to pay down debt aggressively and get rid of it quickly or to pay the minimums as designated by your loan servicer and have the rest forgiven after 20-25 years. I personally have had this debate and have gone back and forth on the two options, which why I was really excited meet our guest, Dr. Rania Habib via Instagram and learned that she repaid her six-figure student loan debt in a short amount time and is now financially independent. I reached out to her to find out just how she did it and she was happy to answer all my questions. I am hoping this will inspire you as it has inspired me.

Q: Thank you for agreeing to answer some questions on your journey to financial independence. Please, tell us a bit about yourself

A: Hi. My name is Rania A Habib and I am a board certified oral and maxillofacial surgeon (OMFS). I was born In Texas and raised in Minnesota. I obtained my BS in microbiology and completed dental school at the University of Minnesota. I then went on to complete a 6 year joint OMFS/MD program at University of Maryland in Baltimore. I worked in a busy private practice in the Maryland area while living in DC for two years. I then completed a one year fellowship in Pediatric Craniofacial Surgery at the University of Florida, Jacksonville. I love to teach and mentor students, so I found my calling in academic medicine

Q: You are an Oral & Maxillofacial Surgeon with a specialty in Pediatric Cleft & Craniofacial Surgery. Please tell us what your specialty entails.

A: Oral & Maxillofacial Surgery is a unique surgical specialty that crosses the realm of both dentistry and medicine. We specialize in the treatment of all conditions in the oral cavity, face, head and neck. In addition to performing dentoalveoalar surgery and treating oral benign pathology, there are several fellowships that include cosmetic facial surgery, craniomaxillofacial trauma, pediatric cleft & craniofacial surgery, head and neck oncology, microvascular reconstruction, temporomandibular joint deformities, orthognathic surgery, dental anesthesia and implantology. I am passionate about treating patients with congenital or acquired deformities in the craniofacial region with an emphasis on the pediatric population.

Q: What made you interested in that field and how long did it take?

A: I loved surgery from the moment I was exposed to it as an American Heart Association scholar in my senior year of high school. I was initially a pre-medicine student, but decided that dentistry offered the unique ability to combine artistry, surgery and engineering. While in dental school, I fell in love with oral and maxillofacial surgery. I completed my undergraduate degree in three years, dental school in 4 years, combined OMFS/MD in 6 years and one year of fellowship. My training took a total of 15 years post high school.

Q: Did you have student loans? And if you don’t mind, please tell us how much. Was this from undergrad as well as dental school?

A: I had student loans from my 4 years of dental school and my two years of medical school. For my undergraduate degree and first 2 years of dental school, I had in-state tuition that was offset by academic scholarships. My parents saved for my education, so I was fortunate that I did not have to take out loans for my undergraduate degree. I took out partial loans for my first 2 years of dental school and full loans my final two years of dental school and medical school to cover both tuition and board. My total debt was just under $200,000

Q: Did you get paid in residency?

A: Yes, 4/6 years.

Q: What was your strategy for tackling student loan debt?

A: For peace of mind, I wanted to eliminate my student loan debt as soon as possible. I opted to take a lucrative job in private practice to facilitate this goal prior to pursuing fellowship. After 10 years of straight post-high school training, I needed a break from the chaos of training. I hired a financial advisor to oversee my finances. He managed my malpractice insurance, disability insurance and helped me establish a budget based off of my salary and spending. We carefully documented my rent, utilities, car payments, car insurance, disability insurance, malpractice insurance, cell phone, groceries, gas, travel and fun. Based off that budget, I established an emergency savings fund to cover three months of living prior to aggressively paying off any student loans. When I first finished residency, I only paid my loans off according to the amount due until I was able to accumulate my emergency fund savings. Once I was done saving the emergency fund, I then began to aggressively pay off my student loans.

I did not live ultraconservative, but I did not overspend my means. I lived in a nice apartment with good amenities. I did not upgrade my car. It was paid off during residency, so keeping that car saved me a ton of money. As a coffee lover, I invested in a Nespresso machine, so that I was not paying $4-6 for coffee every day. I limited eating out at restaurants to only once a week. I am a big advocate for meal prep, so I usually prepared my own breakfast, lunch and dinner. Eating out is extremely expensive, so learning to cook will save you a ton of money. I did not deprive myself of anything, but I was extremely practical about my spending. I still enjoyed my money, but I eliminated consistent extravagance.

Q: Did you have other debt and what was your mindset towards those?

A: I was lucky in that I did not have any other debt. I did not buy a home, nor did I upgrade my car.

Q: In a nutshell, how did you achieve financial independence?

A: I set my long-term financial goals, hired a financial advisor and lived according to a budget that we designed as a team. I did not overspend my means.

Q: What is your approach to spending and your psychology about money?

A: I am a strong believer that you should do what makes you happy. I enjoy experiences over extravagant items. I would rather pay for a beautiful trip around the world then regularly spend a $1000 on a pair of shoes. That being said, I still enjoy finer things. When my loans were paid off, I opted to finally lease a luxury car. Every once in a while, I will buy a nice pair of shoes, a tailored suit, an expensive purse or jewelry. I just do not find myself drawn to spending my liquid income on expensive, luxury items on a regular basis. I enjoy spending my extra income on family, charities and people in need.

Q: What advice would you give to other health professionals/ health profession students on handling debt and student loans?

A: I would recommend that you invest in a financial advisor who has adequate experience with student debt from the medical/dental profession. These are different than the average financial advisor. They will understand how to incorporate your malpractice and disability insurance in addition to investing. It is not a bad idea to have a financial advisor to handle malpractice and disability and a second financial advisor to invest. Your financial advisor needs to devise a plan that includes a spending budget, an emergency fund, retirement, and your end goals. When you finish school/training, you will have the option to pay off your existing school loan interest as a lump sum. If you have the financial ability to pay that lump sum, then do it! If you do not, you will accumulate interest on that interest. Depending on your interest rate, you may be eligible to consolidate your loans and pay them off more aggressively in a shorter time frame by applying for an outside loan agency geared towards medical professionals. If paying off your loans is a financial goal, consider these companies to help you pay them off in a shorter time, at a lower interest rate. Always consider your own financial picture before making these decisions. If you have other sources of debt such as a home mortgage or car loan, you may not be able to pay off student loans as aggressively as I did. Utilize your financial advisor to help make these decisions based on your personal goals and what makes the most financial sense for your situation and lifestyle.

Dr. Rania Habib attended the University of Minnesota for undergraduate and dental school and the University of Maryland for medical school, General Surgery internship and Oral & Maxillofacial Surgery (OMFS) residency. She worked in a busy OMFS private practice for 2 years, then completed a full scope Pediatric Cleft and Craniofacial Surgery Fellowship at University of Florida, Jacksonville. She became the first female attending surgeon in the Department of Oral & Maxillofacial Surgery at LSU, NOLA where she was appointed as an Assistant Professor with a primary focus in Pediatric Cleft and CranioMaxillofacial Surgery. Her main surgical interests include pediatric/adult OMFS, cleft, craniofacial, orthognathic, facial trauma, obstructive sleep apnea, benign head/neck pathology and facial reconstructive surgery. She is now full time faculty at University of Pennsylvania. She is an active volunteer with Smiles International and the Global Smile Foundation where she provides cleft and craniofacial surgical care internationally. In her spare time, Dr. Habib enjoys traveling, rock climbing, biking, cooking, attending live music/art events, volunteering, reading and spending time with her family and friends. She is a master level SCUBA diver who is also a fitness fanatic.

You can find Dr. Rania on Instagram @raniahabib.md.dds

My First Podcast Experience

It was an honor being a guest on The Dental Diaries Podcast with Dr. Jessica Emery and a great way to experience my first podcast interview. In the episode we discussed my multi-passionate nature which includes Philanthropic projects, Candle Making, Blogging and Orthodontics - lending to the name The UnorthoDoc.

Last year I considered starting a podcast after getting several requests from readers to implement an audio version of my posts so they could listen on their commute to work or while at the gym. The requests came with a lot of excitement because it was proof that people were reading my blog posts and found them valuable enough to want to listen. I showed the emails to my husband and like the supportive person he is, he immediately took to the internet to research and compare podcasting equipment. Within a week I was fully equipped with a microphone and headset along with a wealth of knowledge about podcasting platforms. I even subscribed to a few newsletters that offered information on starting and building a podcast. We recorded my first episode and I remember disliking the sound of my voice. Feeling discouraged I decided not to publish the recording and instead took a break with hopes of picking it back up later. As we know, time goes by quickly and I realized almost a year had passed.

It would be February 2020 before the idea of podcasting came up again. I had a format, a layout of topics to discuss and a short list of initial guests. After realizing how much work was required I once again put it down and expressed to my husband that my desire was to just be a guest on others’ podcast rather than have my own.

As the Universe would have it, about two months later I was contacted by Dr. Jessica Emery. If you’ve never heard of her, she is the owner of two 7-figure dental practices in Chicago (Sugar Fix Dental Loft and WhiteHaute) and is the creative genius of Dental Soiree, a Boutique Digital Dental Marketing Agency where she helps other dental professionals brand and market their businesses. She is literally a Jill of all trades and one of the very few people that I truly admire and thinks of as #goals.

During our conversation she mentioned she had been watching me on social media and was impressed with my endeavors and wanted us to chat. She then mentioned that she would be airing our conversation on The Dental Diaries, her podcast . This would be my first podcast appearance.

It was an honor to chat with her and a great way to experience my first podcast interview. In the episode we discussed my multi-passionate nature which includes Philanthropic projects, Candle Making, Blogging and Orthodontics - lending to the name The UnorthoDoc.

Click below to listen to the episode or search for The Dental Diaries on Apple podcast, Spotify or other podcasting platforms.

5 Natural Cycles of A Career

Everything in life has a natural life cycle, including our careers. We do not have to follow and worship the ones who push so hard, we can slow down and enjoy each cycle as we go through it.

I was listening to a Podcast that made me pause and reflect on the different cycles in a person’s career and in life generally. It gave me pause as I consider and reflect on my own career life cycle.

It mentioned that, it’s natural to want to continuously push yourself to be better. As doctors we are competitive by nature. We are always striving to be the best. As business owners we aim to make in profits more than we did the previous year, to have a larger practice than the next person, etc. But, the podcaster urged listeners to slow down and realize that life happens in cycles and to often times pause and appreciate those cycles. Our relationships with each other whether friends or spouses change over time as we change and grow; the first date will be very different from the twenty first date, the first year of marriage will be different from the fifth year and so on. If we are speaking in terms of our businesses and practices, one that has been open for 6 months is going to be different from one that has been open for 6 years and 16 years.

Here are the cycles, with the analogy of an actor’s career:

Who is this Brad Pitt? - This is when you are young and just starting out in your career. You are trying to build a following/reputation or trying to get patients to trust you, but they don’t know you yet.

Get me Brad Pitt - You build a following or a patient base and become very successful.

Get me someone like Brad Pitt - You become even more successful, but people now aren’t able to afford you.

Get me a Young Brad Pitt - You are still very successful but you’ve gotten older and are being replaced by younger talent.

Who’s Brad Pitt? - Another generation has come about and you are no longer the household name. Someone else has taken your place.

Everything has a natural life cycle. We do not have to follow and worship the ones who push so hard, we can slow down and enjoy each cycle as we go through it. In practice, enjoy the quiet times and work on systems instead of growth . Seek Peace, not the rush.

Student Loan Relief During Coronavirus (COVID-19)

Most of us are facing reduced or slashed income due to the coronavirus. Keeping up with bills may become increasingly challenging especially for those of us with federal student loans, like healthcare professionals who have some of the highest student loan debt in the workforce. Recent legislation via the Coronavirus Aid, Relief and Economic Security Act (CARES) passed by the federal government is offering support and some relief for borrowers.

*Updated on December 9, 2020

On August 8, 2020 The US President signed an executive order suspending student loan payments until the end of the year! This is a pretty big deal. During the height of the pandemic this was especially helpful to many of us since income was decreased and unemployment rose. If you follow me on social media (Instagram), you may have seen my most recent IG Live with Millenial Money Coach Jolene Stahn (She paid off $200K Student loans in 3 years) to speak on all things student loans. I briefly spoke about what I did with my money this year that would have gone towards student loans and how I plan to tackle it once repayment resumes. In a nutshell, I suggested taking advantage of this time of no payments and no accrued interest by putting the money you would have paid towards your student loans in a high yield savings account where your money would grow over the next several months. I also suggested putting money into a short term investment vehicle where more aggressive growth can be achieved. This way, once you’re required to start paying again you can put lump sums of money down and really put a dent in your loans.

Here are the details of the executive order:

Most of us are facing reduced or slashed income due to the coronavirus. Keeping up with bills may become increasingly challenging especially for those of us with federal student loans. Recent legislation via the Coronavirus Aid, Relief and Economic Security (CARES) Act passed by the federal government is offering support and some relief for borrowers.

1.Payments on Federal Student Loans are Suspended Through December 31, 2020 (was September 30, 2020)

Payments on most federal student loans have been halted until December 31, 2020. Interest does not accrue during this time, and not making payments will not hurt your credit. Each suspended payment will be reported to the credit bureaus “as if it were a regularly scheduled payment,” according to the text of the bill.

The following types of federal student loans qualify for payment suspension.

Direct Unsubsidized Loans

Direct Subsidized Loans

Direct PLUS Loans

Direct Consolidation Loans

Federal Family Education Loans (FFEL) held by the federal government

Federal Perkins loans

2. Some Private Student Loan Lenders Are Offering Relief

Unfortunately, the CARES Act doesn’t cover private student loans, including any federal student loans you refinanced through a private lender like Earnest, SoFi, Laurel Road, CommonBond, etc .

If you are not able to make payments on your private student loans, contact your lender as they may be willing to work with you by offering a forbearance, which will temporarily suspend your payments, prevent your loans from defaulting, and protect your credit.

Check out other student loan refinance options here.

3. Suspended Student Loan Payment Count Towards Forgiveness

Under the CARES Act, months in which payments on qualifying federal student loans are suspended will count toward loan forgiveness for borrowers who are pursuing it.

Federal student loan borrowers may be eligible for loan forgiveness through one of two programs:

Public Service Loan Forgiveness (PSLF) promises to erase (tax-free) the remaining balance on federal Direct loans after you make 120 qualifying monthly payments while working for the government or a qualifying nonprofit.

Income-driven repayment plans, of which there are four, cap monthly payments at 10%, 15%, or 20% of your discretionary income. They also stretch your repayment timeline from 10 years to 20 or 25 years. If you have a balance remaining after this extended repayment period, the rest is forgiven (but it’s taxed as income).

4. Student Loan Collection & Garnishing Tactics Have Been Suspended

If your federal student loans are in default, that is if you’re 270 days (or more) behind on your payments, the government can no longer garnish your wages, tax refund, Social Security checks, or other federal benefits in order to collect what you owe. Additionally, the Department of Education instructed private collection agencies to stop contacting borrowers by phone or mail.

5. Employers are Incentivized To Help Pay Student Loan Debt

The CARES Act allows employers to make tax-free payments of up to $5,250 in 2020 toward employees’ student loan payments. Employers can make these payments to employees or directly to their lenders.

PS: The above information is accurate as of August 12, 2020 (was April 3, 2020). As the COVID-19 Pandemic is a rapidly changing situation, it is important to stay current on updated government regulations. The federal government has an FAQ page for students, borrowers and parents that is continues to be updated.

Although the above solutions offer temporary relief from your student loan obligations, you will need to get back on track after December 31st. If you need help figuring out steps to tackle your student loan debt, I highly recommend Travis Hornsby of Student Loan Planner. Being a healthcare professional and having gone through specialty training, I have a lot of student debt. Travis has helped me figure out a strategy to get rid of student debt in a specified amount of time and is saving me thousands of dollars! Schedule a call with him to analyze your situation and and get clarity so you can devise a plan of action to get rid of student loan debt once and for all.

Balancing Productivity and Self Care During Quarantine

It’s easy to separate your work life from your home life. But finding and maintaining a balance between the two can get difficult. While it may seem counterintuitive, taking breaks while working can increase productivity and creativity. It allows your mind to refresh itself after the stress and exhaustion of being “on” for hours.

As we continue to quarantine/practice social distancing and adjust to the new normal of being at home I aim to be as productive as possible. With all this newfound “free time” and not being able to work as an Orthodontist, it seemed like an appropriate time to occupy my days with things that under normal circumstances I wouldn’t have time for. Most of my time has been spent blogging, working on things behind the scenes of this platform, and taking courses on Coursera and Skillshare on a variety of topics ranging from epidemiology, entrepreneurship, and digital marketing/branding. I have also been catching up on continuing education classes, joining zoom conference meetings, working tirelessly in the candle shop (which surprisingly has gotten a lot busier since the shut down), updating (and engaging) on my social media platforms and helping to home school my niece. It has all been tiring and I found myself drained this week.

I shared this on my Candle Company’s Instagram yesterday because this is how I felt. I needed to check in with myself.

It’s easy to separate your work life from your home life. But finding and maintaining a balance between the two can get difficult. With the COVID-19 outbreak, a lot of us are working from home - which means the line between work and home has been blurred. A healthy work-life balance is important to address any stress or anxiety you may have.

I am not a parent but with the experience I have with home schooling my niece, I feel for the parents who have to balance working from home and educating their kid(s). Shortly after making my niece breakfast and getting her settled in to start her school work, my first zoom meeting began but she still required quite a bit of help. I found myself multitasking - helping her with school while trying to pay attention in my meeting. During this time her teacher called (as she does everyday) to recap the morning lesson for the day. The first zoom meeting ended and another one started just as we were scheduled to begin her science session. After my meetings, I fulfilled about a dozen orders from my candle company, ran the packages to the post office, returned home and made lunch(whew!). I was so exhausted afterwards that I ended up taking a 2 hour nap.

While it may seem counterintuitive, taking breaks while working can increase productivity and creativity. It allows your mind to refresh itself after the stress and exhaustion of being “on” for hours. Similarly, taking time away from your desk can shape you into a more well-rounded professional.

With everything going on because of the coronavirus crisis – working from home, finding new routines, and a staying up to date with all that is happening – it’s difficult not to feel overwhelmed. But that doesn’t mean we can’t handle it. Think of this as an opportunity to take control of your stress. While it may impact us all differently, it is important to manage and reduce stress to live a happier and healthier life. Stress is not limited to work, school or family. It is all-encompassing and can be both positive and negative. The best thing to do is to identify the stressors in your life and address them.

I shared this on my Instagram yesterday. At the end of the day, I was happy to have completed my tasks ,even if they weren’t done to perfection.

While accuracy and precision are crucial, perfection cannot be an expectation. Mistakes can happen and should not be something you dwell on. Instead, you should take those situations and turn them into lessons.

Today I am finding balance. I am still being productive but also keeping stress at a minimum.

These are the ways I am balancing Productivity + Self-Care:

I am taking classes on Skillshare - This is an online community of educational tools to spark creativity. Learn new skills like photography, digital marketing, calligraphy, etc. You will get your first 2 months free by using this link. Use your computer or download the app to your phone.

I am taking courses on Coursera - This is an online learning platform where you can build skills by learning from Top Universities including Yale, Harvard, Michigan, UPenn, etc. Sign up using this link. Access courses using your computer or download the app.

I like to cuddle up and relax with a great book. I am currently reading two books, The Upside of Being Down, which seems to be quite fitting for the current atmosphere, and Jessica Simpson’s Open Book which is surprisingly very good!

Taking naps - I am listening to my body and shutting it down when I feel it’s time to take a break. Besides, taking naps increases energy, helps you to be more productive and can fuel creativity.

I don’t always make it outside for a run but I try to stay active with the FitOn app. Some days I do hard core cardio and HITT and other days I take it easy and only manage to do a yoga session.

Affirmations and quotes get me through tough times. I am a big fan of Lalah Delia and currently reading her book and using affirmation cards from Starlight + Love.

Warm bubble baths and candles - At least once or twice per week, I draw a warm bath, light a candle and relax. Candle light elicits calm is soothing and has the ability to help in reducing stress (depending on the fragrance). The warm bath helps muscles to relax and stimulates blood flow.

While it may seem that there is no point in planning, I know there is a light at the end of this tunnel and so I continue to plan. I also keep myself organized by planning my daily activities: blogging, scheduling posts, meeting and conference calls.

In the spirit of transparency: This post may contain affiliate links.

Managing Job/Career in light of the Coronavirus

We are all feeling the impact of this virus in some way or another. Some are being laid off from their jobs and businesses are shutting their doors without certainty of when they will be able to re-open after the quarantine period. Those individuals who have been released from their jobs are taking to job boards to send out applications for new positions. .

On March 11, 2020 the Coronavirus (COVID-19) was declared a global pandemic by the World Health Organization (WHO). The entire country (and world) was put on lockdown and instructed to quarantine and/or practice social distancing to avoid further spread of the virus.

We are all feeling the impact of this virus in some way or another. Some are being laid off from their jobs and businesses are shutting their doors without certainty of when they will be able to re-open after the quarantine period. Dental offices in particular are being told by state boards to remain closed for a period of 3 weeks to 3 months.