An Honorable Distinction: Selected for Incisal Edge's Top 40 Under 40 Dental Specialists

I am thrilled and deeply honored to share some exciting news – I have been selected as one of Incisal Edge's Top 40 Under 40 Dental Specialists in the United States. This recognition is a significant milestone in my career, and I am humbled to be counted among the most talented and forward-thinking young dental specialists across the nation.

I am thrilled and deeply honored to share some exciting news – I have been selected as one of Incisal Edge's Top 40 Under 40 Dental Specialists in the United States. This recognition is a significant milestone in my career, and I am humbled to be counted among the most talented and forward-thinking young dental specialists across the nation.

For the 13th consecutive year, Incisal Edge, Benco Dental's award-winning magazine, is shining a spotlight on the 40 best general dentists and 40 best specialists in the United States. This esteemed recognition acknowledges the most innovative, clinically adept, and ambitious dental professionals who are pushing the boundaries of dental care.

Being part of this elite group of dental specialists is not only a personal achievement but also a testament to the dedication and hard work of my entire team. It's a recognition of the countless hours spent in pursuit of clinical excellence, the commitment to staying at the forefront of dental technology, and the passion for making a positive impact on the lives of our patients.

As I reflect on this honor, I am reminded of the responsibility that comes with it – the responsibility to continue providing the highest quality care, to remain at the cutting edge of dental innovations, and to inspire the next generation of dental specialists.

I want to express my heartfelt gratitude to all my patients, colleagues, mentors, and the entire dental community for their unwavering support and encouragement throughout this journey. I am excited about the future and the opportunity to contribute to the advancement of dental healthcare.

Here's to a future filled with more remarkable achievements and a commitment to excellence in dentistry.

Things to Consider When Starting a Private Practice

For healthcare professionals, the idea of opening a private practice in the medical field is both thrilling and potentially life-changing. Whether you are a doctor, therapist, dentist, or another type of healthcare professional, operating your practice holds out the prospect of both personal and professional pleasure. However, this project demands careful preparation and reflective consideration. Therefore, here are a few things you need to know before launching a solo practice, so take these things into consideration right now.

A guest post by Emma Joyce

For healthcare professionals, the idea of opening a private practice in the medical field is both thrilling and potentially life-changing. Whether you are a doctor, therapist, dentist, or another type of healthcare professional, operating your practice holds out the prospect of both personal and professional pleasure. However, this project demands careful preparation and reflective consideration. Therefore, here are a few things you need to know before launching a solo practice, so take these things into consideration right now.

Comprehensive Business Plan

Making a thorough and well-organized business plan is one of the key building blocks of starting a solo practice successfully. This strategy should cover the core values, aims, and goals of your practice. The target patient population and the area of expertise you want to concentrate on should also be specified. Examine where your practice is located since location matters, especially if you want to create a strong brand. Size issues are crucial in terms of both physical space and patient capacity. Include painstakingly produced financial estimates, an itemized spending plan, and a clear schedule for accomplishing your objectives.

Legal and Regulatory Requirements

When starting a private practice in the healthcare industry, you must manage the complex web of legal and regulatory regulations with skill. Depending on where you live and the specialty you decide to pursue, these requirements could change dramatically. Getting the required licenses, permissions, and certificates is a crucial factor. The choice of your practice's legal form—a sole proprietorship, partnership, limited liability company (LLC), or corporation—must also be carefully considered. Health Insurance Portability and Accountability Act (HIPAA) compliance is a requirement that cannot be negated. It is crucial to protect patient privacy and uphold the highest ethical standards because any legal problems could seriously impede the expansion of your practice.

Practice Management and Technology

A successful private practice is built on effective practice management. The maintenance of patient records, billing, and appointment scheduling are just a few of the administrative processes that can be streamlined by purchasing reliable practice management software. Maintaining a leading edge in your field's technical developments is equally important. This is why using a practical dental review management solution might turn out to be very important in the setting of dental practices. This entails keeping an eye on and managing internet reviews and feedback from patients, which have a direct bearing on your practice's reputation and patient satisfaction levels. Adopting technology improves operational effectiveness while also enhancing patient care and the success of the practice as a whole.

Financing and Budgeting

The success and durability of your private practice are based on sound financial planning, which is its lifeblood. You must first determine the up-front expenses related to starting your practice. These could include the cost of renting or buying office space, purchasing equipment, getting insurance, and hiring necessary personnel. It is likely that obtaining funding via grants, loans, personal investments, or a combination of these will be required. Both beginning and ongoing operational costs should be included in a well-structured budget. These continuous costs could include utility bills, employee wages, marketing campaigns, and prescription drugs. They could also include rent or mortgage payments. If you want to keep your practice financially stable and ready for expansion, you must maintain a consistent and healthy cash flow.

Staffing and Training

The success of your private practice is greatly influenced by the quality of your team. It is crucial to work with people who share your values and passion for patient care, and who are highly skilled and qualified. Make sure prospective team members are thoroughly vetted to make sure they adhere to the culture and values of your practice. Equally important is making ongoing investments in your staff's professional development. By doing this, you can be confident that your team is always up to date on the most recent developments in your industry and that they are also well-equipped to deliver the best possible patient care. For employee retention and ultimately patient satisfaction, a positive workplace culture where team members feel appreciated and involved is crucial.

Marketing and Patient Acquisition

For private practitioners, finding new patients and keeping them on board are continual problems. It is crucial to develop a thoughtful marketing plan. To reach and engage your target audience in an efficient manner, your plan should include both online and offline media. An effective internet marketing effort must include building a credible website, having a significant social media presence, and spending money on search engine optimization (SEO). Nevertheless, it's critical to acknowledge the lasting power of patient referrals and word-of-mouth advertising, which frequently attract excellent, devoted patients. Grow these organic development channels while enhancing them with clever marketing initiatives.

Starting a solo practice in the healthcare sector is a big project that requires careful planning, smart thinking, and unrelenting dedication. You may start your private practice journey with confidence by thoughtfully addressing these important factors, setting up your business for long-term success in the fast-paced and cutthroat healthcare industry.

About the Author:

Emma Joyce is a writer who likes to share her experience with fellow enthusiasts. When she's not writing, she is reading about new trends in the business world and learning how to implement them into her work and writing. She is a regular contributor to https://bizzmarkblog.com/

Establishing Your Own Practice: My Interview with Canvas Rebel Magazine

Recently I had the opportunity to sit with Canvas Rebel Magazine for an interview as part of their “Establishing Your Own Firm or Practice series.” This series is meant to highlight business owners and there journey of opening their practices, to speak on the inspiration behind it, the wins, woes and everything in-between.

Recently I had the opportunity to sit with Canvas Rebel Magazine for an interview as part of their “Establishing Your Own Firm or Practice series.” This series is meant to highlight business owners and there journey of opening their practices, to speak on the inspiration behind it, the wins, woes and everything in-between.

I have written about my practice journey here on the blog and was honored to be able to share my experience on a wider platform. Here is a snippet of my interview:

We caught up with the brilliant and insightful Patrice Smith a few weeks ago and have shared our conversation below.

Patrice , appreciate you joining us today. Setting up an independent practice is a daunting endeavor. Can you talk to us about what it was like for you – what were some of the main steps, challenges, etc.

Ever since the thought of becoming a dentist crossed my mind as a teenager, I envisioned having a practice of my own. The thought of working for someone conflicted with my desires because many people close to me worked for themselves. I can recall my parents owning supermarkets, my dad running multiple businesses and even being privy to practice ownership through my high school mentors. Those formative years led me to this moment. A few years post-residency, armed with a variety of experience in the field of dentistry, my dream of opening my own dental practice would soon take shape.

There are many confusing and overwhelming factors involved in opening your own dental (orthodontics) office. When deciding on opening a dental practice, you must first decide whether you want to start your own dental practice from scratch (build out) or if you want to purchase an existing practice (acquisition). My knowledge of acquiring a practice was limited but with the help of a small team of professionals the process was made much easier.

The decision to go the acquisition route was based on my personal needs and priorities. This will look different for everyone. Although I was not opposed to the idea of a practice start up, I wanted to get into a practice with an existing patient base but also one that allowed me to grow into it. Because of this criteria, finding a practice was not easy. It took months of research and once the “ideal” practice was found, several months of negotiations.

Sources from the internet will tell you that it takes on average 9-12 months from the start of your acquisition search to opening your business. It took me about half that time (including down time due to COVID), mainly due to the buyer and seller’s eagerness to come to an agreement fairly quickly.

I actually wrote about my process in this blog post

Great, appreciate you sharing that with us. Before we ask you to share more of your insights, can you take a moment to introduce yourself and how you got to where you are today to our readers

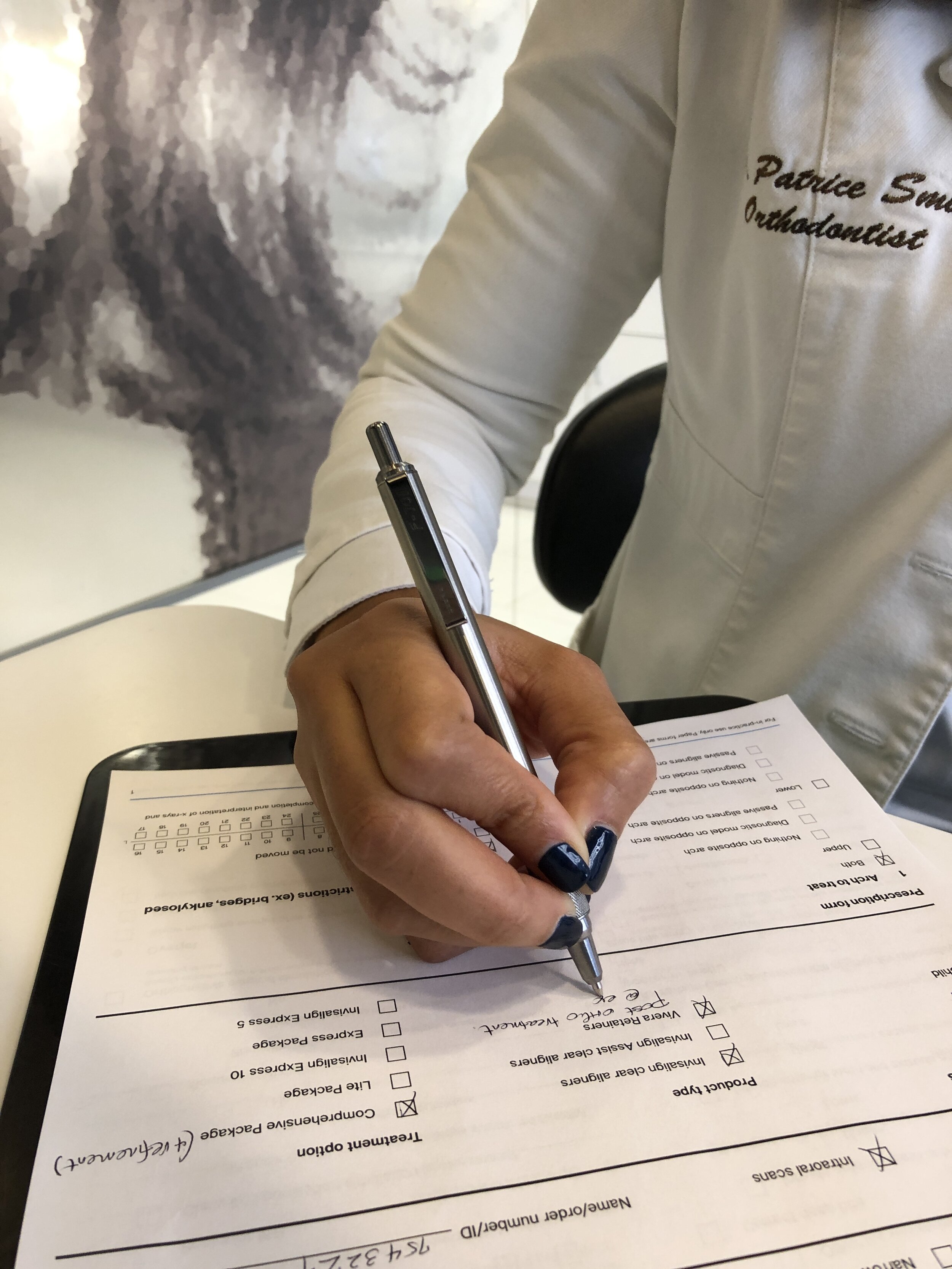

I’m Dr. Patrice Smith, an Orthodontist who is multi-passionate. I pride myself on being a bit “UnORTHOdox” and have dubbed myself The UnOrthoDoc.

I was born and raised in beautiful Jamaica! I moved to New York City where I completed my undergraduate studies and was later accepted into Dental School in the nation’s capital (Washington, DC) where I received my Doctor of Dental Surgery (DDS) degree from Howard University. I am obsessed with esthetics, perfectly aligned teeth and beautiful smiles and as such pursued a career in Orthodontics. I am a practicing Orthodontist in Washington, DC where I create beautiful smiles in my boutique private practice, Infinity Orthodontics.

I enjoy writing and have had several blogs where I share my experiences as I go through life balancing all aspects of my professional career, entrepreneurship, creative side hustles and motherhood. When I am not creating smiles and meddling in a host of entrepreneurial endeavors, I’m blogging, traveling, participating in various philanthropic projects and creating divinely scented candles for my candle company, UnOrthoDoc Candle Co.

My aim is to inspire young professionals like myself lead a balanced, purpose filled “UnOrthoDoc” lifestyle while on the path to personal, professional and financial development.

10 Ways to Stay Inspired as an Entrepreneur

Many entrepreneurs suffer from creative blocks due to being so wrapped up in tasks. To a large extent, we all have to let the processes of creativity and inspiration come to us from the outside because it is not always an internal process we can count on. Inspiration waxes and wanes along any person’s journey to success. Yet, there are many ways to stay inspired through outside sources to keep our engines of motivation and excitement roaring.

Entrepreneurs are a unique group of people. Many attributes set us apart from others -- the deep levels of desire, independence, needs for freedom, levels of dedication and a willingness to take risks.

However, many entrepreneurs suffer from creative blocks due to being so wrapped up in tasks. To a large extent, we all have to let the processes of creativity and inspiration come to us from the outside because it is not always an internal process we can count on. Inspiration waxes and wanes along any person’s journey to success. Yet, there are many ways to stay inspired through outside sources to keep our engines of motivation and excitement roaring.

1. Read

Keep one or more motivational books or readings with you at all times. Sometimes it only takes one sentence to get your mind in gear on what you want to achieve in your day, your business and the bigger picture of your life. Reading something that hits home reminds you that your path to success is worth the hard work. Having a book on hand is like having a pocket coach. When you need it you can reach for it at a moment’s notice.

2. Rest or Time alone

The majority of time in your life will be spent in the consistent company of other people on a regular basis. Even when the connections you have are positive, it is still taxing on your energy to be constantly giving out. It is vital to the human spirit to have a certain amount of time alone to detox and re-energize. Inspiration cannot come from a dry well of energy resources. It is important to refuel and take time for yourself.

3. Money

Money is a great motivator; not the root of all evil. Money is a tool and resource which can be used for so much good. Money is also one of the greatest rewards acknowledging your hard work. It is not wrong to work for money, or to have making more money as a priority and important goal in your life. You should always strive to make more money. Increases in money often come hand-in-hand with increases in status and position; all which build confidence. With money comes the freedom to do more things. Having this type of freedom brings more happiness. You are never more inspired than when you are happy.

4. Music

Music can be one of the most direct ways to find inspiration. Inspiration is a drive, but as much as it is a drive, is also an emotion. You either feel inspired or not. Emotions, the full range of them, make up inspiration. If you’re hurt or angry, the right song can inspire you to succeed. If you have a creative block the right music can open your mind. It has been proven that music is in sync with our brain waves, and when people listen to Mozart before taking intelligence tests they score up to 10 points higher. So if you want to find some inspiration, listen to some great music.

5. Exercise

Getting outside, moving your body, getting fresh air and working up a sweat are highly creative ways to find inspiration. When you are at work, your mind is only focused on the task at hand, which leaves very little room for your right brained activities such as inspiration to come forth. When you exercise, the left brain is distracted by the task of exercising, allowing the more right brained emotions and ideas to come through. Further, when you push yourself physically you learn how strong you are emotionally, and this helps to keep you inspired and believing in your capacities to continue pressing forward.

6. Gratitude

Wherever there is gratitude there is a spark of life, wherever there is a spark of life there is inspiration. The more grateful you are for what you have the more motivated it makes you to want to sustain and elevate above your current level of success. Abundance is a beautiful thing. A great way to practice gratitude is to write thank you on every check and every receipt as a way to remind yourself of how blessed you are to have the abundance to spend the money you spend. When you are grateful you become plentiful. The feeling of being in abundance is inspiring because it is not a feeling you want to lose. You become more deeply committed to all you do when you treasure what you have. There is no room for complacency when you are grateful.

7. Vision

If you lose inspiration, go back to the drawing board and either create the vision of what it is that you want, or be brave and flexible enough in your mindset to reinvent the vision you currently work from to more effectively move forward. Having a vision is a way of creating a future benchmark of achievement that sits out luminously in front of you; you knowing you won’t be satisfied until you achieve it. A vision inspires the willingness to strive for what you want. It inspires you to live your dream.

8. (Healthy) Competition

Competition breeds inspiration, whether you’re competing with yourself, a score, a dollar amount, another person, for a raise, a bonus etc. Competition inspires you to get to that next level. It motivates you to prove yourself to yourself and to those others who matter when pushing yourself forward. Getting to that next level will require hard, work, training, and motivation. There is nothing more inspiring than wanting to win. You will naturally do nearly anything to feel that sense of accomplishment.

9. Other people’s stories

A great way to find inspiration is to study other inspirational people. Read their biographies, watch movies that are touching. The last book that I read that was really inspiring was Will, by Will Smith. There is something so intoxicatingly inspiring about the underdog having a major comeback or victory. If you feel low on inspiration take a day to read, watch a film, or otherwise study others who others have made it against all odds. Emulate in your life, what inspires you about these people and these stories.

10. Give

When you give and you see the fruits of your labor. Seeing the significance of your impact on the world is so moving it inspires you to work more, and make more in order to give more. Giving is the greatest gift that gives back. To see that what you contribute to the world makes a huge difference in the lives of others. It is what inspiration is all about.

Part of the problem with inspiration for entrepreneurs is creating a healthier work-life balance. Many entrepreneurs often don’t give enough attention to their physical, mental, or emotional well-being. We work at all hours, eat whatever is closest to us, and blindly finish tasks under taxing conditions. This type of lifestyle is a recipe for burnout. The state of mind which allows us to find inspiration becomes more elusive if we aren’t addressing our own needs along the way.

Tax Write-Offs For New Business Owners

As a new business owner, you may not know all the tax write-offs available to you. I sure did not, but with the help of my trusted CPA I am getting more and more familiar the more seasoned I become. I am going to share with you a few that I have come to know quite well over the last several months.

As a new business owner, you may not know all the tax write-offs available to you. I sure did not, but with the help of my trusted CPA I am getting more and more familiar the more seasoned I become. I am going to share with you a few that I have come to know quite well over the last several months.

But first, What is a write-off anyway? A write-off is an accounting action that reduces the value of an asset while simultaneously debiting a liabilities account. It is primarily used in its most literal sense by businesses seeking to account for unpaid loan obligations, unpaid receivables, or losses on stored inventory. Generally, it can also be referred to broadly as something that helps to lower an annual tax bill.

Here are 5 Write-Offs to take advantage of if you’re a business owner:

1. Startup And Organizational Costs

As a new business owner, there are certain costs associated with getting started in business called startup and organizational costs. Be sure to keep a record of these deductions because the IRS allows you to write off up to $5,000 worth of startup expenses made in the first year of business. If you spend more than $5,000 in your business the first year, the amount in excess would be considered amortized expenses and is able to be written off over the course of 180 months. So until your business is considered “operational” you are not able to take 100% of your expenses but are limited to $5,000 worth of expenses.

2. Equipment Costs

As a business owner, you have the ability to write off your equipment. This is a no-brainer if you are a dental professional. Even If you purchase items through Amazon or other stores of the sort for products and equipment, as long as those expenses are considered business equipment costs and not personal expenses, you can receive a tax deduction for it. At the beginning of my business, what became really important to me was that anything eligible I spent my money on was being written off by my business.

3. Business Meals

Thanks to the Tax Relief Bill that was implemented by the Trump administration as well as the Biden administration you are able to deduct 100% of your meals in the year 2021 as long as there was a business purpose for the meal. So, if you choose to conduct business in a restaurant or you are ordering food for the office, your business-related meals are now 100% deductible - hello dinner team meetings! Make sure that you keep a record of your business meals as well as the purpose of the meal.

4. Your Vehicle

If you saw this post you know that I am writing off my vehicle since I use it for my business. If you have a vehicle that you are using for a business, it's so important to understand how to take a vehicle deduction and how to properly depreciate your vehicle. There are two ways to go about writing off your vehicle, you can

choose to depreciate your vehicle (e.g., taking the purchase amount of your car and writing it off over the course of five years) or you can

choose to take mileage - the mileage is helpful if you drive frequently since there is a set amount, 57.5 cents, that you can deduct per mile of a business-related trip.

When you are depreciating your vehicle you are also able to write off all the expenses associated with that vehicle. When it comes to purchasing new vehicles, you might want to look at buying one that meets specifications (such as weighing more than 6,000 pounds). If a vehicle meets the criteria, including being used for business purposes more than 50% of the time, you may be able to deduct the entire purchase price of the vehicle – financed or not – in the year the car was purchased. What this means is, if you are someone who is in need of a new vehicle for work, you can purchase it and write off 100% of your vehicle purchase amount, whether you make a down payment on the car to finance or if you paid cash. Lastly, you can also write off a leased vehicle's car payments through the business. However, when you are leasing a vehicle you are not able to take the depreciation deduction.

5. Place Your Children On Payroll

Braxton is not of age just yet, but when he is I will definitely be putting him on payroll. If you have children that can do tasks that are ordinary and necessary for your business, this is a great time to grow money for your kids tax-free. Many of us know the benefits of having a Roth IRA and that children can have Roth IRAs, but many taxpayers aren't sure as to how to go about growing tax-free dollars for their children while leveraging a business. When you decide to put your children on payroll, there are no payroll taxes you have to pay on the amounts. You can pay your child up to the standard deduction, which is $12,400, without your child needing to file a tax return. Now as a business owner, you get a $12,400 deduction for putting your child on payroll, without having to file a tax return, and no payroll taxes get paid. On the backend, you can also set up a Roth IRA for your children, place them on payroll and fund the Roth IRA through the payroll #WIN.

Since becoming a business owner, my mindset towards money and taxes have completely shifted. When you are a business owner, you should always be thinking about how you can leverage savings on the things that you are already spending money on. You should definitely speak with your CPA or trusted tax advisor to ensure you are leveraging your business the right way.

The Mommy Truck: My Top 5 Picks

I was absolutely not in the market for a new car. I loved my small SUV, It was perfect for me and seemed to fit a carseat pretty comfortably. However, shortly after the birth of my son I quickly realized that I did not have quite enough space for all the things that I now needed.

Planning for the arrival of a new baby is one of the most exciting times of our lives!

I won’t lie, although exciting it was also nerve wracking and daunting, seeing as though we would be first time parents. There were so many things to think about, from designing a nursery to ensuring we had all the necessary items, that often we overlook some of the basic things like transportation. A newborn means an extra person, and this extra person (although very tiny) has an exorbitant amount of STUFF.

I was absolutely not in the market for a new car. I loved my small SUV - a Porsche Macan. It was perfect for me and seemed to fit a carseat pretty comfortably. However, shortly after the birth of my son I quickly realized that I did not have quite enough space for all the things that I now needed. Who knew a stroller (and all its parts), a car seat, baby luggage and my mom (or nanny if you have one) would take up so much space?

After too many times of having to pack, un-pack and re-pack the car so that everything could fit, I finally decided to purchase a bigger vehicle - my mommy truck.

The first thing to consider about your vehicle when you have a new baby on the way is the size. A baby car seat is not just a comfy chair for your tot but also a legal requirement. It helps to note also that you will be maneuvering the car seat in and out of the car quite often so you will need ample room for that.

My Top 5 Picks

My husband and I spent some time doing our research on different vehicles. My portion of the research involved talking with other moms to see the pros and cons of their vehicles then looking at the style and size of the ones that I liked. Hubby on the other hand, took a lot more into consideration.

After some time of visiting dealerships and test driving a few options. I decided on my top 5 (in no particular order):

Porsche Cayenne

Range Rover Sport

Mercedes GLS

Tesla Model X

Genesis GV80

Having a reliable car is paramount when you have a young family. What you are looking for is a vehicle that has excellent service history. Also, children, and especially young kids, come with a lot of accoutrements. In the early years, there will be the aforementioned baby carseat but as they age, you will need to fit booster seats. So, you need a vehicle that is adaptable to your children’s needs. It is also worth bearing in mind the fact that your kids will have friends, so you may need even more space to fit them in so that you can take them to their activities.

Ultimately, I decided on the Porsche Cayenne. I love Porsche! My previous truck was a Porsche and I was very sad to have to part ways with it because of it’s size. What I simply did was upgrade to the larger truck. The Cayenne is fun and exhilarating to drive, yet can be used as a practical SUV every day. It's a solid SUV that has great performance and a good degree of practicality. Right from the start, the Cayenne came loaded with technology designed to produce a luxurious ride combined with the nimble and responsive nature of a sports car. We love that the Cayenne is an excellent blend of off-road capable, family carrier and twisty corner master.

BONUS: There’s one other vehicle that quite a bit of parents raved about so I figured I’d give it an honorable mention. It’s the Honda Odyssey, a minivan so practical that it is all the rave among the more seasoned parents. I am told “It will change your life!” I am not a fan of the minivan, at least not yet. I am willing to forego this for the foreseeable and continue to make the most of the one I’ve chosen.

As we have learned, there are many things to consider regarding your car when you have a baby on the way. Having a reliable vehicle is crucial as you cannot afford any mishaps with a youngster on board and you need to ensure that it is of a suitable size for them to grow into, and also for the possibility of another child on the way. Make sure it is adaptable to all their needs. It helps too that is super cool and fun!

Lastly, here’s a financial tip: It’s a write off. If you own a business and use your vehicle for that purpose more than 50% of the time, you can write off 100% of the purchase price and any expenses associated with it on your taxes. Note that any vehicle used for business purposes should be at least 6000 pounds to qualify for a write off. Speak to your trusted CPA about this option if you’re considering going this route.

What are your top picks? Drop them in the comments below, I would love to know.

6 Expenses To Consider When Opening a Business

Are you thinking of starting up a new business? Fantastic! Whether it’s a dental practice, finally turning your hobby into a side business or another type of business, there are some expenses that we don’t necessarily give thought to.

Are you thinking of starting up a new business? Fantastic!

Whether it’s a dental practice, finally turning your hobby into a side business or another type of business, there are some expenses that we don’t necessarily think about. In all our excitement to launch, start marketing, hire staff, secure financing, and set up our websites, it’s easy to miss or misjudge a few important startup costs. Yet, neglecting these often-overlooked expenses could result in a cash crunch before our business even gets off the ground.

Here are six sneaky small business startup costs:

1. Business Insurance

While you hope nothing goes wrong when you’re launching a new business venture, the reality is sometimes it does. Not having business insurance in place could leave you struggling to pay for expenses you didn’t budget for while trying to finance a new business.

Every small business is different, so do your research and choose the insurance coverages best suited for your situation. Here are a few:

Business property insurance- this helps to protect your workplace location and property like tools and equipment, while

General liability insurance - this helps protect your new business from claims for bodily injury, property damage, and other personal claims.

Business income insurance - this helps protect income lost when you can’t operate due to covered losses such as theft or fire.

Life insurance and disability insurance - this is a no-brainer, it protects your family against income loss.

2. Fees and Licenses

Among other often-overlooked startup costs are the fees associated with establishing a business. You may have to pay to search and register your business name and even have it trademarked. Depending on your business location and the nature of the business, you may need federal, state, and/or municipal licenses and permits. If you’re a dental professional you will need to pay for the renewal of your license to practice dentistry, your licenses to prescribe controlled substances and professional dues almost on a yearly basis. The costs and requirements will vary.

3. Professional Expertise

Don’t underestimate legal fees and accounting fees when estimating the costs to start a new business. Paying for good advice regarding your business structure, legal agreements, and financial issues early on in your business can help you minimize or avoid costly future legal or tax entanglements. Get a few quotes so you’ll have a realistic idea of the costs you’ll incur.

4. Taxes

There’s no getting away from paying taxes. Find out what municipal, state, and federal taxes your startup must pay and when. State and municipal taxes vary, so visit the U.S. Small Business Administration website or ask your trusted CPA or tax lawyer about the details pertinent to your location. At the very minimum, expect to pay state income tax and state employment taxes if you have staff, plus your federal business taxes, depending on your corporate/business structure.

5. Payroll/Bookkeeping/accounting Fees

Whether you have an automated online system, a bookkeeper who visits your office, a virtual assistant, or a trusted CPA don’t forget to account for this important monthly cost. While a bookkeeper may charge a small fee per hour, a monthly flat-fee arrangement may be better, or you may opt for a subscription to an automated online payroll and bookkeeping program, such as Quickbooks or Gusto.

6. Utility Bills

While you probably studied the commercial rents or property values in your area pretty carefully when budgeting for your startup costs, an area often overlooked are monthly utility expenses. Your startup operating expenses include more than just your office rent, lease payment, or mortgage. Depending on your business and location, your startup utility bills could also include:

Electricity

Heat and/or air conditioning

Telephone

Internet

Water

Condo fees

Talk to other business owners in the area to get an idea of the typical costs based on the square footage you’re considering.

Starting a new business is always a risk, but you can minimize your risk of failure and maximize your potential for success by realistically budgeting for all types of startup costs. This way you’ll be better prepared financially to handle the unexpected expenses that are bound to pop up.

5 Secrets To Work-Life Balance

These days, especially with some of us working from home it seems almost impossible to have a little separation between your career and your life. In fact, for many people, their career is their life. But it doesn't have to be that way. Being happy and fulfilled requires making time for yourself just as much of a priority as your career.

These days, especially with some of us working from home it seems almost impossible to have a little separation between your career and your life. In fact, for many people, their career is their life. But it doesn't have to be that way. Being happy and fulfilled requires making time for yourself just as much of a priority as your career. Here are 5 secrets to a work-life balance:

Before You Say Yes, Pause - If you’re reading this there is no doubt that you are ambitious and driven and like to get things done! You also may feel like you can handle anything thrown at you. I am the same. While this all might be true, it’s important that you are careful to not take on too much. Time is a limited resource, saying yes to everything threatens this very limited resource and can often also lead to burn out. Protect your limited resources by first pausing to assess whether or not the ask is something that you really need or want to take on right now, if at all. If you are like I once was and struggle to say no, try saying things like, “Thanks for asking, let me check my schedule/calendar and get back to you.”

Manage Your Workload - Sometimes I feel like I have way too many things to do. I am constantly juggling an endless amount of balls and trying to keep them all in the air. Since having my newborn, I have come to the realization that I cannot do it all and still maintain a balance between my work and home life and that I can allow some of those less important balls to drop. Cue the checklist - I now have checklists for everything! I place things in order of priority doing the most important things first. Other items much lower on the list now gets outsourced. If it’s at work, I delegate some tasks to my office manager and at home I have learned to ask my husband for help. What I have found out is that these individuals are happy to help but they have never gotten the opportunity because I never asked.

Create Boundaries with Technology - Put the phone down! Digital burnout is a thing that a lot of us are affected by. For me this is social media and emails. I know I am not the only one that sometimes mindlessly scroll through the abyss of Instagram and Tik Tok and respond to emails after hours and on weekends. You must set boundaries where this is concerned. Instagram is a big part of my businesses - I do marketing for my Orthodontics practice and my candle company via the platform and also make partial income from it via sponsored and affiliate posts. I enjoy doing these but it also makes it easy for the line between healthy social media consumption and compulsive social media consumption to blur. What I do to combat that is set social time blocks, that is specific time(s) of the day when I go on Instagram to do a story, make a post or to engage. I also set a time limit via the apps’ time management tool to remind me when it’s time for me to close the app.

Take Your Vacation - I’m currently on vacation as I type this, but had it not been for pure exhaustion I probably would have kept going - this is also a reminder to myself. You may feel guilty about taking time off of work, especially when you have a lot going on but it’s so important. If you are like me, when you have a certain goal in mind you cannot stop until that goal is achieved. However, continuously going without a break only leads to burnout.

Take Control of Your Life - You are in the driver seat of your life! If you don’t like something, you can just decide that it doesn’t work for you and make the change. I know some things are easier said than done but, begin to work on the things that are easiest to implement. For example, if you need to get more sleep decide that you will go to bed an hour or two earlier. If there are certain things that gives you stress, figure out how to get rid of it (ie. set boundaries) or how to manage it.

There is such a thing as work-life balance and you CAN create a life that you absolutely enjoy! The key is to decide on the type of life you want to lead and take the necessary steps to achieving it. Start with the 5 steps above. I hope this helps.

My Interview With The Dental Marketer Podcast

I recently sat with Michael Arias, host of The Dental Marketer Podcast where I shared my story of becoming a practice owner and entrepreneur. We also spoke about, you guessed it, marketing!

I recently sat with Michael Arias, host of The Dental Marketer Podcast where I shared my story of becoming a practice owner and entrepreneur. We also spoke about, you guessed it, marketing!

You can find my episode (327) and the podcast on iTunes, audible. spotify, stitcher or directly on The Dental Marketer’s website.

MICHAEL’S 3 KEY TAKEAWAYS FROM OUR EPISODE:

WHAT WAS IT LIKE FOR DR. PATRICE ACQUIRING AND OPENING UP IN THE MIDDLE OF A WORLDWIDE PANDEMIC.

HOW SHE HAD SUCH A SMOOTH TRANSITION WITH ACQUIRING AN EXISTING PRACTICE AND MAKING ALL THE TEAM MEMBERS HAPPY.

HOW TO STRIKE A GOOD MIDDLE GROUND WITH YOUR EMPLOYEES BETWEEN BEING FRIENDLY BUT BEING FIRM.

About Michael

MY NAME IS MICHAEL ARIAS AND I’M HERE TO HELP PEOPLE FIND YOU.

FOR THE PAST FEW YEARS, I’VE HAD THE AMAZING PRIVILEGE OF HELPING HUNDREDS OF DENTISTS EFFECTIVELY MARKET THEIR PRACTICE. WITH AN OVERLOAD OF MARKETING OPTIONS, IT’S CHALLENGING TO KNOW WHERE TO START AND WHAT TO FOCUS ON. I’M HERE TO CUT THROUGH ALL THE NOISE, AND HELP YOU FIND THE MOST EFFECTIVE MARKETING APPROACHES TO FIT YOUR BUDGET, YOUR PREFERENCES, AND YOUR BRAND!

Balancing Motherhood & Professional Life

Mother - of all my titles, this is the one I am most proud of. I have been a mom for just under 2 months now and It has been one of the most fulfilling journeys, but it can be exhausting.

Mother - of all my titles, this is the one I am most proud of.

I have been a mom for just under 2 months now and It has been one of the most fulfilling journeys, but it can be exhausting. Keeping a tiny human alive and well is tough! Add work into the mix, and some days I feel as though I am stretched very thin.

As a new mom who owns a business and works full-time, I can definitely say that’s it’s been hard at times to balance them both without feeling overwhelmed or guilty. There are so many things throughout the day that vie for our time and attention, that it’s easy to feel as though we’re not excelling in any of our roles, at home or at work.

The perfect work-life balance sometimes feel unattainable, but I have figured out some strategies (with the help of some other moms) that I have implemented to maintain my sanity and my purpose as a full-time entrepreneur and mom. If you’re a mom, I hope these will help you too:

1. Set a Routine.

This will obviously look different for everyone, but establishing some sort of routine can help to make things run smoothly and to stay organized.

For me, I make sure my alarm is set for a time that allows me to get myself dressed and ready for work in the mornings with ample time to bond with my baby before leaving home. My husband typically gets dressed first. He cleans and sterilizes the baby’s bottles and spends some time with our son, and I typically get a feeding session in. When the work day is complete and we both are home, my husband is the first to get cleaned up and takes the baby. He does the feeding, taking him on walks and spends some quality time while I do the prep for dinner. After we eat then I spend time with baby while my husband gets some rest for the overnight shift.

2. Prioritize Tasks.

I use checklists! Rather than thinking of all the things I need to accomplish in the near future, I focus on action items with the highest urgency, and attend to those first. I make a list of tasks to get done per day and cross them off as I go. This helps me to stay focused, organized and provides satisfaction since I am making progress and reaffirms the fact that I am indeed capable of accomplishing multiple tasks in a day, both at work and at home.

3. Work Efficiently.

When I am at work I do my best to give it my full attention and stick to a schedule. It’s hard to stay away from social media but I schedule social media breaks and set a timer so I don’t go past a certain amount of time and end up aimlessly scrolling. I also build time into my schedule (every 3 hours) to facilitate pumping.

4. Be fully present.

My baby is at the point where he sleeps and wakes every 2-3 hours for feeding then goes right back to sleep. It doesn’t feel like a good work-life balance when I’m at work for eight hours each day then only catch a few glimpses of him before I have to do it all over again.

Because of this, when my baby is awake, I am in full mom-mode; my laptop stays closed and my cell phone is put to the side. I make the most of the time we do have each day by giving him my undivided attention during our precious hours together.

5. Outsource chores.

I am still working on this one but right now, my mom and husband pitch in at home wherever they can and my office manager and clinical staff has taken on more administrative work at the office. Before I had my baby, errands didn’t seem like such a hassle. Nowadays, it often feels impossible to squeeze those tasks into an already demanding schedule.

I have since decided to take advantage of services available, like online shopping for groceries. Instacart, Amazon and Target have become my best friends as these services save us from having to go to the store.

6. Get sufficient sleep.

This is a work in progress. Nighttime sleep can be extremely unpredictable as it completely revolves around baby’s sleep schedule. I am exhausted around the clock due to the frequent wakings and feedings which, to be honest can sometimes decrease productivity.

Because getting enough rest is crucial to performing well at work, I try to take naps whenever the baby is down for a nap himself and alternate between my husband and mom who keeps the baby each night. This ensures that I get enough rest and feel energized throughout the day.

7. Reevaluate other commitments.

Learning to say “no” is important. It’s one of the things I have gotten proficient at time. Time has become even more valuable now. My advice would be to not overload your schedule and lose out on time with baby. Obviously, you don’t need to turn down every work or social opportunity, but you do want to avoid putting so much on your plate that you can’t spend time with your family.

8. Enjoy some time to yourself.

You might want to spend most of your time outside of work with your family. Even so, it’s important to sneak a little me time. What that looks like for me is spending time solo doing something that is relaxing, such as getting my hair done, getting a manicure and pedicure or getting a massage/facial at the spa. These little mini self care procedures work wonders for not only the body but mind as well. Thankfully, my husband encourages me to do this and is happy to have some one-on-one time with our baby during these times.

Working moms face a unique set of struggles. Add being a business owner to the mix and the stress level is amplified. I want to be the best mom to my child, yet my time and energy are divided between my responsibilities at home and those at work.

What I try to remind myself is that I am setting a great example for my child. Not only am I providing financially for my family, but also demonstrating what it looks like to use my professional gifts and passions. From one working mom to another, I hope these tips help you feel confident in this challenging yet fulfilling journey.

Corporate Dentistry vs Private Practice

There are pros and cons of corporate dentistry. Like any business, the owners want a reliable pool of labor that’s perfectly happy with good benefits, a predictable income, and the illusion that working for someone else is safer than working for yourself.

An opinion piece by Travis Hornsby of the Student Loan Planner

Corporate dentistry wants your student loans to make you afraid of taking risks. I’m not accusing DSOs of anything devious but there are pros and cons of corporate dentistry. Like any business, the owners want a reliable pool of labor that’s perfectly happy with good benefits, a predictable income, and the illusion that working for someone else is safer than working for yourself.

Decades ago, there were 3,000 graduating dentists a year. Today, there are more than 6,000 new dentists each year. Dental student loan balances have also skyrocketed.

Regulations and declining insurance payouts have drastically reduced the income of an average dentist as well. In 2005, that average stood at almost $220,000. In 2015, the average dentist salary had fallen to about $180,000.

Here’s what I’ve learned from making student loan plans for hundreds of dentists. The higher your student loan balance, the more you should want to own your own dental practice.

What About Student Loans Makes Dentists Afraid of Running their Own Practice?

Most dentists tell me the first time their loans got real was in the first month or two after graduation when their loan servicer sent them their statement. Interest rates as high as 8% on Grad Plus loans are ridiculously high. You probably have tens of thousands of accrued interest, too.

If you owe over $300,000, your payments need to be higher than $3,000 a month just to make a meaningful impact on the principal balance. A typical new grad starts their career as an associate working for someone else earning around $120,000. Many dentists think about paying back their loans, but how do you do that when you’d be paying about 40% of your take-home pay?

Since you receive a letter in the mail every other week from a bank telling you to refinance, you might be tempted to pull the trigger. Thus, your big payments get locked in. Can you take the refinancing risk and then borrow to buy a practice too?

It makes many of my clients terrified. Instead of buying a practice, they might work for years at Heartland, Pacific, Aspen, Comfort, etc. as an associate just to have a guaranteed income to pay down their student loans.

Why Student Loan Repayment Benefits from Corporate Dentistry Make You Too Comfortable

Remember that the goal of any employer is to give you just enough that you won’t want to leave. That can lead to complacency on the part of employees. One of the fast-growing ways to make new grads feel attached to their jobs (in general not just in dentistry) is student loan payment benefits.

As humans, we are prone to the fear of loss. It’s why we hold onto a bad investment even though the rational action might be to sell it. Fear of loss is why we keep a lousy house, car, or vacation property even though we know we should get rid of it.

I just saw a case of a doctor on Facebook who was having a really hard time getting out of a $600,000 house he knew he shouldn’t have bought. The reason? He didn’t want to lose $15,000 on it. That’s extreme loss aversion. He’s cool flushing tens of thousands down the toilet rather than downgrade to a more affordable house just because he doesn’t want to psychologically admit the mistake and take the financial hit.

Likewise, there is a negative psychological impact when you leave a job with a student loan repayment benefit. If your employer offers $20,000 a year towards your student loans, it hurts to give that up for an uncertain ownership path.

Other Ways Corporate Dentistry Profits from Dentists

Corporate dental groups use other methods to make employees not want to leave. They realize that many dentists would get restless without a seat at the table in their practice, so they’ve invented a lot of hybrid ownership structures.

Pretend Dave is a new grad and associates for a practice in a random part of the country. His starting salary is $120,000 with a 10% to 30% bonus based on how the practice does. His office produces $1.2 million after three years on the job.

The dental practice does not want to lose Dave, so they show him this amazing projection of income that tops $300,000. All he must do is buy 50% of the practice and stay for 10 years.

He’ll be a majority owner, and the DSO will handle all the marketing, hiring, billing, and operations. They want him to pay at a valuation of 75% of revenue, and they’ll have him take out a loan for 50% of this price to purchase 50% of the shares.

Why Do I Dislike Joint Ownership Ventures with Corporate Dental Groups? (for the Dentist)

Dave has a lot of student loans, so he really likes the idea of having the DSO handle all these business functions for him so he can focus on dentistry. The high projected salary they show him makes him feel confident that he’ll be able to pay his loans off one day.

Why is this not a great deal financially for Dave?

Here are a few reasons:

He’s spent years building the valuation of the practice by increasing its revenue and now must pay a higher multiple for the business

Anything less than 100% ownership of a practice is harder to sell

He could get 100% financing on his own without the corporate dental group

He could procure the business services much cheaper than equity financing by paying for them directly

Building the Valuation for Someone Else

Many new associates are hungry to prove themselves, which often results in much higher practice revenue within a few years.

Many dentists turn around and take an even bigger loan out to buy this increased production from themselves basically. You can prevent this with an option to buy a practice at an agreed upon % of revenue at your start date.

Don’t Pay 40% of the Business Valuation for 40% of the Practice

Another common pitfall happens like this: an accountant tells you that the whole dental practice you’re looking at is worth $1 million. The ownership group then offers you a 40% stake for $400,000. While this sounds fair, it’s not.

If you had to sell a minority interest on the open market to someone not affiliated with the dental practice, you would have to accept a discount on the price because they’re not getting full control.

When ownership agreements include the exclusive right of a corporate dental group to provide business services (like marketing, HR, operations, etc.), you reduce your pool of buyers. Who wants to be saddled with a contract from the previous dentist? Perhaps the best buyers own the other shares, and thus they can offer you less for your shares.

Another thing to keep in mind is that majority control is often worth more than you think. If you control 51% of a dental practice, you have the power. You would not want to pay 49% of the practice valuation for 49% of the practice.

I could give more examples, but the point is that if you’re even thinking about entering a partnership agreement, you should run the contract by an accountant used to valuing dental practices. Otherwise, how can you know that the agreement is fair to both parties?

When you’re dealing with a sophisticated organization like a corporate dental group, any agreement you sign is likely to be biased against your interests without someone equally sophisticated in your corner.

Why Dentists Will Get All the Capital They Need to Become Owners

Another concern I see with dentists who partner with DSOs is that they don’t want to take on so much debt to own a practice. They look at the $600,000 to $800,000 price tag of many solid practices and get squeamish.

In terms of securing a practice loan, banks will be happy to give you most of what you could want, even with a bunch of dental student debt. The only issues I’ve seen are with loans for jumbo-sized operations (more than $2 million in revenue, then it might get tricky).

Of course, you need to have a track record of at least a year with solid production history for a bank to feel comfortable. That said, getting capital to buy 100% of the practice you want will not be a problem.

In terms of the fear of taking on more debt, I get it. You’re already feeling nauseous that you owe over $300,000 from dental school and you’d like to keep that debt as low as possible.

However, dental practice loans are a different animal. Almost all the loans get paid back. In the rare case that the dentist defaults, the primary culprits are alcohol and drug abuse, not bad business results according to the bankers I’ve spoken with.

While $800,000 of business debt can look very intimidating, a dental practice is going to pay for itself over time. The profits of the business pay off the practice loan, and eventually, you own an asset in full. The tens of thousands you had to pay towards your business loan you will recoup one day as additional income once the loan is gone. The bigger the practice that you buy, the bigger income number you will have all things equal.

How Dentists Drastically Overpay For Business Services For Their Practice

Finally, pretend you’re the kind of dentist who likes to turn off the lights and go home. This is one of the biggest reasons I hear from dentists who choose to be associates long-term or partner with DSOs.

As a dentist, you’re doing most of the work to keep the practice humming from a revenue perspective. Yes, corporate dentistry might bring in the patients, help with staffing, and run marketing, but what are these services truly worth?

What I find is that many dentists do not realize that they don’t have to do it all by themselves as practice owners. There is a huge industry of practice consultants and dental professionals that handle everything from collecting bad debts to billing to websites and more. They’ll run your marketing, assist with staffing issues, and even help with compliance. I heard of one company on the Millennial Dentist podcast the other day that even customizes chatbots for practice websites.

Many of these professionals might charge $10,000 or more for their services. While that seems steep, many dentists pay much more than that by partnering with a corporate dental group. Pretend the practice net income is $500,000 and you’re a 50/50 partner with a DSO that handles business functions.

We know that in more than 99% of cases, dentists successfully pay back practice loans. That means that the dental practice will pay for itself in time. Hence, the dentist is paying about $250,000 a year for the services the corporate dental group offers. What kind of team could you build to support your practice with that kind of money? Furthermore, many expenses might be front-loaded in set up costs.

If you set up the website, social media, and operating systems well, they might need only occasional maintenance for example.

While I understand the appeal of turning the lights off and going home as a fellow entrepreneur, you might as well capture the full benefits of your labor. Groups that help you outsource business-related tasks that take an ownership percentage are essentially doing the easy stuff while you do all the bread and butter dentistry that keeps the lights on.

The Simple Truth about Dental Student Loans and Working for Corporate

If you have no debt and want a flexible lifestyle with good benefits, working for a corporate dental group might be a great decision. If you absolutely cringe at the thought of talking to anyone about business, then perhaps you should work for a DSO as well.

I beg you though, please do not let your student debt influence your decision to become an owner or not. It shouldn’t deter you from the advantages of starting a private dental practice.

You should consider buying a practice as soon as you feel comfortable doing so if your goal is getting a good return on your educational investment.

Bankers consistently tell me the default rate in their dental practice loan portfolio is extremely low. That means there are big profits to be made in dentistry, even with the increasing number of graduates.

The headwinds of big student debt and ever declining insurance reimbursement rates make ownership scarier than it used to be, but too many dentists are not confident enough to take the leap and live the dream of ownership. The math is still stacked in your favor.

You can do this, especially if you owe a ridiculous amount of debt from dental school. If you know you’ll eventually refinance, use REPAYE and make prepayments until you’re firmly established in your practice. This will keep payments low and allow you to show a healthy cash flow profile to bankers.

If you want us to create a custom student loan plan for you that incorporates your career goals, we can do that for you. Click here.

If you know you’ll owe more than double your income for most of your career, the tax breaks and income optimization from practice ownership are invaluable. You can increase the financial security of your family while minimizing your taxable income and increasing the amount of loans forgiven.

I have nothing against corporate dental groups. They have contributed to innovation in the field and have provided a predictable stream of jobs for new grads to learn the ropes.

I just want to look out for the interests of my dentist clients exclusively when they compare corporate dentistry vs. private practice. As a solo practice owner, you can have a high, stable income with a degree of autonomy that’s rare for healthcare professionals.

Cede that autonomy with great caution to a DSO for an illusion of safety and security.

While I share some of the views and opinions in this article, they are not my own. Click here for the original and full article by Travis Hornsby - The Student Loan Planner.

Travis has helped thousand of dentists with customized plans to pay down their student debt and gain financial freedom. Visit his site here for a consultation.

My Interview With The Black Doctor's Podcast

I recently sat with Dr. Steven Bradley, host of The Black Doctor’s Podcast where I shared my journey to becoming an Orthodontist, practice owner, entrepreneur, founder of UnOrthoDoc Candle Co. and co-founder of Dental Helping Hands.

I recently sat with Dr. Steven Bradley, host of The Black Doctor’s Podcast where I shared my journey to becoming an Orthodontist, practice owner, entrepreneur, founder of UnOrthoDoc Candle Co. and co-founder of Dental Helping Hands.

Dr. Bradley describes his podcast as being health and wellness for the culture. Interviews with leading minority professionals of this current generation where you hear how they overcame adversity to attain their goals. Dr. Bradley is inspired by the excellence represented by his peers who have overcome so many incredible obstacles to reach the pinnacle of success. His podcast provides an avenue to organize these stories for others to listen and learn from. Discussions had are mainly on medical ethics and culturally competent care with the goal of improving health outcomes and combatting healthcare disparities.

To hear my interview with him, click the image below:

As we continue to celebrate Women's History Month, we are thrilled to share the story of Dr. Patrice Smith, aka "The UnOrthoDoc". As a Howard University College of Dentistry trained Orthodontist, she has done an amazing job of excelling in her field while broadening her own horizons. In addition to opening her own practice, Dr. Smith also launched her own boutique candle line. She also manages a successful blog: The UnOrthoDoc

In this episode, she talks about her pathway to the field of dentistry and her experiences at Howard. She also shares her passion for helping others that are less fortunate through the non-profit organization she started called, Dental Helping Hands. We really enjoyed speaking with Dr. Smith and we know you are going to LOVE this episode.

Dr. Steven Bradley is a board-certified anesthesiologist and medical ethicist with a passion for mentorship and increasing diversity in the healthcare workforce. As an assistant professor of anesthesiology, he combines his practice of medicine with educating medical students and resident physicians.

As the host and creator of The Black Doctors Podcast, Dr. Bradley interviews minority professionals in a variety of career paths. Each episode provides encouragement and motivation for listeners. Candid and transparent conversations enable listeners to identify with and be inspired by guests on the show.

My Journey to Practice Ownership

Ever since the thought of becoming a dentist crossed my mind as a teenager, I envisioned having a practice of my own. The thought of working for someone conflicted with my desires because many people close to me worked for themselves. A few years post-residency, armed with a variety of experience in the field of dentistry, my dream of opening my own dental practice would soon take shape.

Ever since the thought of becoming a dentist crossed my mind as a teenager, I envisioned having a practice of my own. The thought of working for someone conflicted with my desires because many people close to me worked for themselves. I can recall my grandparents owning supermarkets, my dad running multiple businesses and even being privy to practice ownership through my high school mentors. Those formative years led me to this moment. A few years post-residency, armed with a variety of experience in the field of dentistry, my dream of opening my own dental practice would soon take shape.

There are many confusing and overwhelming factors involved in opening your own dental (orthodontics) office. When deciding on opening a dental practice, you must first decide whether you want to start your own dental practice from scratch (build out) or if you want to purchase an existing practice (acquisition). My knowledge of acquiring a practice was limited but with the help of a small team of professionals the process was made much easier. In this blog post we will focus attention on acquisition more so than a startup. For information regarding a start up check out our earlier blog post, see this post.

The decision to go the acquisition route was based on my personal needs and priorities. This will look different for everyone. Although I was not opposed to the idea of a practice start up, I wanted to get into a practice with an existing patient base but also one that allowed me to grow into it. Because of this criteria, finding a practice was not easy. It took months of research and once the “ideal” practice was found, several months of negotiations.

Sources from the internet will tell you that it takes on average 9-12 months from the start of your acquisition search to opening your business. It took me about half that time (including down time due to COVID), mainly due to the buyer and seller’s eagerness to come to an agreement fairly quickly.

Here’s a 2-Step Breakdown of My Process:

Once I decided to purchase a practice I began the search with the help of my husband. We did a fair amount of research on practices that were available for sale in the locations we desired. The first practice opportunity we learned of was through word of mouth but after a few months of negotiating that deal fell apart during our “Due Diligence” phase. I thought it would be difficult to find another practice around my desired location but fortunately a better opportunity arose. This practice was not being advertised through a broker but several dental reps were aware the owner was interested in selling. In between doing our due diligence on this practice we continued researching and visiting other practices, none of which were to our liking. Once we decided to go forward with the practice acquisition the first thing we did was:

Step1 - Assemble Our Acquisition Team

Your acquisition team should include:

o Attorney

o Accountant

o Practice Broker

o Insurance Broker

o Lender

Your team is by far your biggest asset in this process. They are representing you in one of the biggest decisions you will make and should have your best interest at heart. It is important they have a full understanding of your desires and needs and also your financial background. My trusted CPA (who my husband and I have used for years) also has a practice brokerage firm and so it was a no brainer to go with this team. They helped us to assemble the rest of our team which included my attorney, lender and insurance broker. Together they worked diligently to ensure that the practice I was acquiring was financially healthy and that I received the best deal possible (value for the purchase price).

Step 2 - Due Diligence Investigation

This is the bulk of the acquisition process and involves looking into the financial, legal and practice management aspects of the practice. My team and I worked relentlessly on this process. You typically do this investigation after a letter of intent (LOI) is signed but before a purchase agreement.

My attorney performed the legal due diligence and drew up all the legal paperwork. Legal due diligence must be done to ensure the practice is in good legal standing with federal and state agencies. This process is about finding out as much as possible about what you are buying so as to minimize legal risks. During this time we evaluated and assessed the equipment, inventory, trademarks and intellectual property, accounts receivable, real property (either leased or owned), lien status - that is no liabilities/expenses including bank loans, employee benefits and bonuses, any licensing fees, and performed searches for any pending lawsuits.

Other areas evaluated during this period:

Patient base- It gives a snapshot into the demographics of the practice. This is important for several reasons. As an Orthodontist, what I factored in was the percentage of adult versus child patients. Some Orthodontists have a preference in the age group they they want to treat.

Current number of active patients - this is done to determine not only the size of the practice but to gauge room for growth.

Patient records to ensure they are complete and up to your standards.

Staff - this is very important as the staff are the bridge between the patients and the doctor. They are an integral part to a smooth transition and ultimately to retention of some patients.

Business and Financial Systems, which included the dental/orthodontic software that are being utilized, scheduling philosophy, payment methods and insurances accepted by the practice.

Location & Marketplace – when choosing a practice, location is one of the major decisions as it can have a direct affect on your marketing strategy and growth potential. You should always do your market research: describe the competition, check the number of doctors in the area (within a 1, 3, 5 mile radius) as this can affect your practice’s growth. You should know the population density of the area, consider access to parking, access to public transportation and signage (for visibility and marketing purposes).

Examination of the Facility - you have to like the space, but beyond just that you need to to predict and plan for future expenses. That means you must assess the design, the age of all equipment, the office layout, esthetics and conditions of each aspect of the office space to determine if there is room for growth (expansion).

Cash Flow – this is a big one! It not only tells you how healthy the practice is but plays a major role in the purchase price of the practice. Things we checked (and that everyone acquiring a practice should) included monthly production and collections reports, collections as a percentage of production, how much is owed to the practice’s accounts receivable, assessment of cash flow vs expenses.

Marketing – depending on the location your marketing may look different. While doing your due diligence be sure to check the practice’s referral sources, how marketing is done and whether it’s internal (word of mouth from existing patients) or external.

Why I Chose Downtown Washington, DC for My Practice

I attended Dental School and Orthodontic Residency in Washington, DC and it is one of my favorite cities because of its culture, diversity and overall progressiveness. Even though I have lived in other cities, DC felt like home and I always had plans to move back when it was time to open my own practice. It helped also that my husband is a DC area native, so the decision to move back was easy.

Downtown Washington, DC has a population of 714, 153 residents according to 2020 demographic data, of which is 45.4% are black, 42.5% are white, 4.1% are Asian and the other 8% a mix of various races. It is also home to a lot of businesses, dental practices included. According to 2020 dental demographic information, there are currently 33 Orthodontics practices in Washington, DC each servicing an average on 4,279 residents each. According to this data, even though there is a high number of Orthodontists the population is there to create less of a competitive atmosphere among us specialists. Of the practicing Orthodontists in the downtown Washington, DC area there aren’t very many female Orthodontists and when you narrow it down to black female Orthodontist there weren’t any, until now. This is where I fill a void.

The practice was located in a medical high rise building of just 4 floors with a balcony and a place for signage(great for marketing) on the front of the building. It encompasses an entire floor of the building and even has parking spots(definitely a premium in DC). Now that we have it, the real work of keeping it and being profitable are at the forefront.

If you are looking to purchase a practice, whether an acquisition or start up/build out, I am willing to share my contacts with you. Just shoot me a quick email here.

Clean, Purified Air with Molekule

In the dental setting air quality has always been a concern but now that Covid-19 has become a pandemic we must be more conscious for ourselves and our patients. We want the best for our patients so we search for the best and most innovative ways to help protect them. One of my best investments during this pandemic for my practice was the Molekule Air Purifier.

In the dental setting air quality has always been a concern but now that Covid-19 has become a pandemic we must be more conscious for ourselves and our patients. Many offices are trying to adjust to the new changes by increasing their levels of screening and by mandating a greater amount of Personal Protective Equipment (PPE). We want the best for our patients so we search for the best and most innovative ways to help protect them. One of my best investments during this pandemic for my practice was the Molekule Air Purifier.

The Molekule is a professional-grade air purifier that uses patented photo electrochemical oxidation (PECO) technology that utilizes free radicals to break down pollutants at a molecular level. The use of nanotechnology allows it to eliminate pollutants 1000 times smaller than the particle size tested as part of the criteria standard filters must meet to qualify as high-efficiency particulate air (HEPA). PECO works like this: as air passes through the device larger particles are captured by the filter while microscopic pollutants such as bacteria, mold, allergens, VOC’s, allergens and viruses are safely destroyed - thus providing clean air. Some of the other air purifiers that I researched collects air pollutants but Molekule actually destroys these pollutants with their PECO technology. No air purifier can eliminate the risk of exposure to a virus, but I appreciate that Molekule’s products destroy the viruses and other pollutants it collects from the air.

Molekule carries four sizes to accomodate your practice or home needs: The Air Mini, Air Mini+, Air and Air Pro. I went with the Molekule Air Pro because it provides the widest coverage range and is ideal for open floorplans and office settings. I truly love my Molekule Air Pro. Its whisper quiet functioning and sleek design allow it to blend into any room or space. I would recommend choosing based on your room size.

A few colleagues and friends have reached out with questions and here are a few most frequently asked

1.Where should I place my Molekule?

- Molekule air purifiers will work in any room, best in a central location. Molekule Air Mini or Mini+ should be placed on a shelf, stand, or table to help maximize air intake. It’s recommended that it’s placed close to your bedside at night in what is known as the “sleep breathing zone.”

2. How often should I use my Molekule?

- It is recommended that you run your Molekule 24/7 for optimal air quality. Silent Mode offers reduced fan speed at a quieter level, while Boost allows for a speedier clean. You can adjust accordingly throughout your day, on the device or through the Molekule app

If you have questions or are interested in Molekule devices, feel free to reach out to me - I am happy to share more of my experince with it, or visit the Molekule webiste.

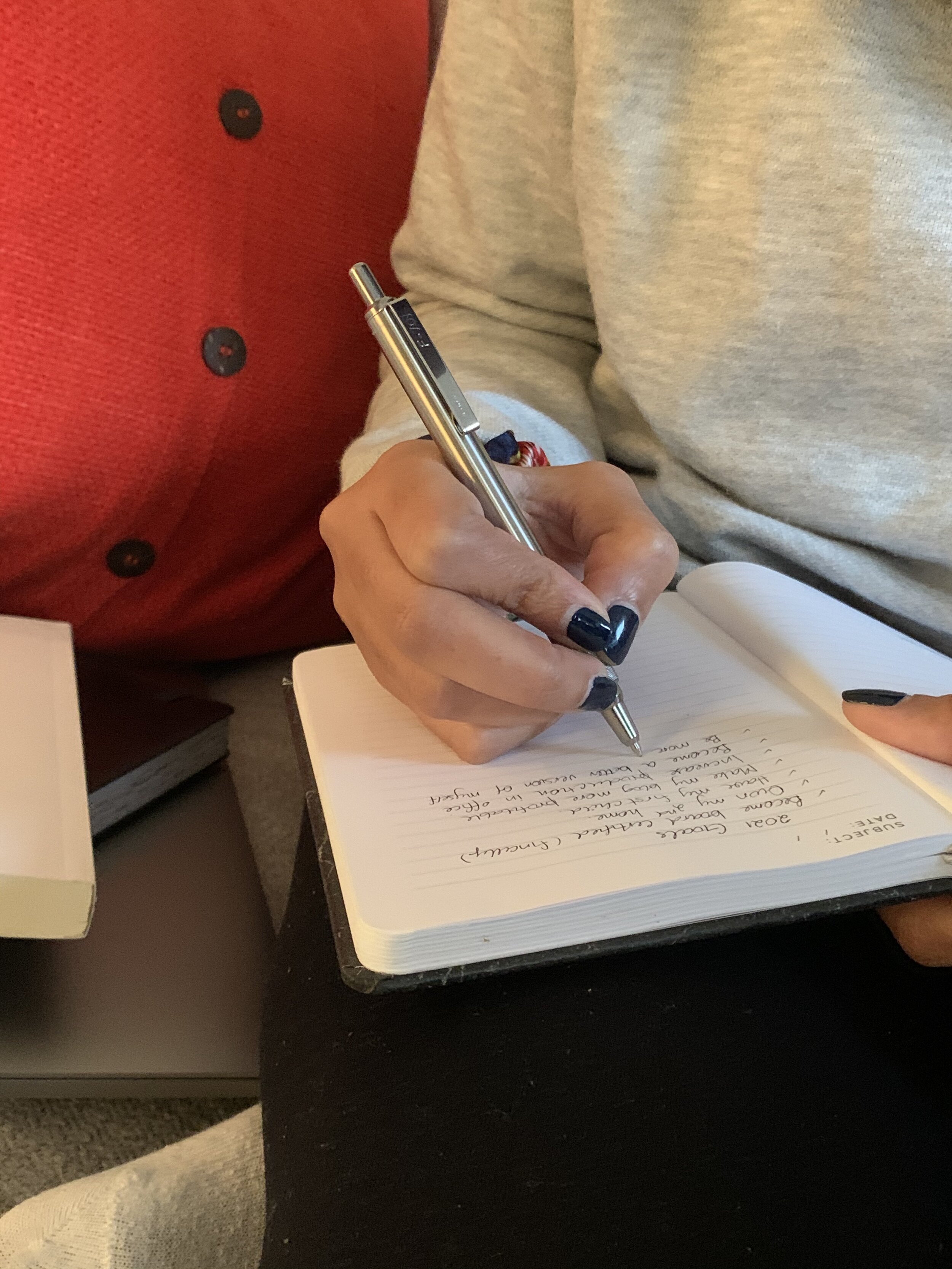

7 Steps to Smashing Your Goals in 2021

As we optimistically set out to achieve great things at the beginning of the year, we must break our goals down into small manageable, attainable and realistic ones. Setting new year resolutions has been a long time tradition but did you know that statistics show that only about 10% of people actually stick to their new year resolutions past the month of January?

Beginning a new year is such a hopeful time. Whether we break out an unblemished calendar or merely scroll over to the month of January on our smart phones, there’s the sense of being given a fresh start every January. We make notes, either mentally or on paper, of New Year’s resolutions we’re determined to accomplish. Goal setting is a powerful process for thinking about your ideal future, and for motivating yourself to turn your vision of this future into reality by smashing your goals in 2021. The process of setting goals helps you choose where you want to go in life. By knowing precisely what you want to achieve, you know where you have to concentrate your efforts. You’ll also quickly spot the distractions that can, so easily, lead you astray.

With that said, as we optimistically set out to achieve great things at the beginning of the year, we must break our goals down into small manageable, attainable and realistic ones. Setting new year resolutions has been a long time tradition but did you know that statistics show that only about 10% of people actually stick to their new year resolutions past the month of January?