A Step-by-Step Guide To Establishing a Gig-Based Business

According to Brodmin, the global gig economy is expected to grow to $455 billion by 2023. Want a piece of the pie? Establishing a successful gig-based business can give you extra money and greater financial stability.

[This is a guest post by Courtney Rosenfeld]

The gig economy is booming. From for-hire drivers to freelance ghostwriters, you can find people working all kinds of odd jobs all over the world. According to Brodmin, the global gig economy is expected to grow to $455 billion by 2023. Want a piece of the pie? Establishing a successful gig-based business can give you extra money and greater financial stability. The UnOrthoDoc invites you to learn how to establish your own gig-based business.

Choose a fitting business based on your skills, knowledge, and resources.

Keep your overhead costs low when you're starting your new business by utilizing existing resources, skills, and knowledge. Career Addict provides a list of gig-based jobs that can inspire you as you choose a fitting option. Possibilities include food delivery, pet sitting, personal shopping, virtual assistance, and more.

You can also scope out online platforms where gig-style jobs are advertised to get a sense of what skills are currently in demand. Small Biz Trends has a guide to gig platforms catering to diverse niches. Examples range from Uber and Lyft for driving to Airbnb for renting accommodation and ToolLocker for renting out equipment.

So what option is right for you? It depends on what resources you have at your disposal. If you own a car, enjoy driving, and love meeting people from all walks of life, Uber or Lyft can be a great pick. Alternatively, if you prefer a more active job that allows you to get outdoors, you might like something like dog walking.

You could also decide to go back to school to learn the ins and outs of business. Fortunately, you don’t need to drastically change your schedule to accommodate a course load; you could always further your education through an online school, one that offers bachelor’s and master’s programs designed to help you excel at your new venture.

Establish your brand and create a website.

Once you have a business idea in mind, transform it into a brand. Hubspot explains that a brand is basically the "face" of your business — the main way for people to recognize it. A strong brand like Coca-Cola can be identified by people around the world. From your logo to color palette to slogan, many components make up a brand.

With an idea of how you want to present your brand to the world, go ahead and create a website. According to Forbes, every business needs a website. A great website can help attract clients and boost return on investment (ROI). Don't stress: It's not too complicated to make a website with today's modern technologies.

WordPress is one option. This free website platform allows for custom coding, so you can create a site that reflects your unique brand. If you aren't a web pro yourself, you can find WordPress development experts on work-for-hire platforms like Upwork. Browse profiles based on criteria that matter to you, from price to delivery time.

Get creative with your marketing tactics.

Your website is technically a marketing tool. It introduces people to your gig-based business and encourages them to buy your products or services. You can promote your website using digital tactics like pay-per-click advertising and social media. However, there are many other creative ways to raise your startup's profile. Get creative with your marketing ideas.

WordStream offers a list of more than 60 marketing concepts to jumpstart your brainstorming. For example, you can try old-school urban marketing tactics and pass out flyers on the streets or create sidewalk ads with chalk writing. You can also run fun competitions like photo contests.

Collaborating with other creatives can help you find more ways to enhance your brand's success. For example, a do-it-yourself photo shoot with a local model can help show off your products or services.

The gig economy offers many chances to increase your earnings. The key to success is finding a business model that fits your skillset. Follow the above steps to help pave the path toward successful entrepreneurship.

How One Doc Is Repaying $575K of Student Loan Debt in 7 Years

You’ve got to center your plan around your goals, your personality, your lifestyle, and your comfort level. Don’t ignore the emotions, but also, consult the numbers. Understand your options and be a continual learner.

A Q&A Session with Dr. Samantha Tillapaugh aka The Debtist

Q: Thank you for agreeing to answer some questions on your journey to financial independence. Please, tell us a bit about yourself.

A: At my core, I am an extremely multi-faceted person – the Jill of many trades with no intention to master any one of them. Since I was a child, I have had a short attention span, and I think that is why my mom was so adamant on teaching me how to focus. I thank her, because now I am very efficient with my output, but I still haven’t lost my curiosity.

I am the truest definition of a Gemini, intermingled with a Type I Personality on the Enneagram scale, and an INFJ. My biggest goal in life is to constantly learn and experience something new, and my biggest fear is standing in the same place. I LOVE movement, as well as creative thinking, which explains why my favorite hobbies include motion and thinking on your feet. I guess that makes dentistry a good fit for me.

I am a part-time dentist who owes a ridiculous amount of student loans, hell-bent on not allowing finances to impede my wish to live life to the fullest, explore my interests, and retain full autonomy over my day-to-day life.

Professionally, I am also a blogger for my website, thedebtist.com and others’, a wholesale director for a bakery called Rye Goods, an occasional speaker on the topic of student debt, as well as a temp for other random events such as teaching lunch-and-learns for companies, or dog-sitting for traveling pet parents.

Privately, I am a real nerd. I am an avid reader, I depend heavily on my planner, and I still write analog. Writing helps me process my thoughts; organizing the house keeps me calm. I take piano lessons and boxing classes. I love to sleep, but hate to waste time, so I mitigate that with my love for coffee. I also like to travel, take photographs, and bake.

I practice slow-living and minimalism because I naturally gravitate towards a fast-pace and a maximalist life.

Q: What made you interested in dentistry?

A: It’s hard to say when the true point of inception occurs, but I have been saying I wanted to be a dentist since I was 8 or 9 years old. When I was younger, I thought it was destiny. I was born on the Philippine Islands and when we would vacation on beaches, I would play with fish teeth. My parent’s actually have a video of me, at 2 years old, holding a dead fish in my hand, and literally playing and inspecting its mouth. Gross, huh?

I also have a video of me floating in the ocean with a floaty in the shape of a Colgate toothpaste tube. I loved wearing fake Dracula teeth for Halloween in elementary school. And I always liked the dentist. As I got older and started considering which medical profession I would pursue, it was the lifestyle of a dentist that attracted me. It was not until college that I learned my great-grandfather on my mom’s side was a dentist, too.

My mom wanted to be a doctor, actually. She never had the ability to pursue that dream because student loans did not exist in the country I was born in. You either came from a rich enough family to pay for medical school on your own or not. In that respect, I understand the privilege I had of having student debt. Now that I am older, I think subconsciously, or maybe even consciously, my mom’s unfulfilled dream got translated and handed down to me, eventually becoming my own.

Q: You graduated with a hefty amount of student loan debt. If you don’t mind, please tell us how much. Was this from undergrad as well as dental school and residency?

A: I absolutely don’t mind sharing this at all! I graduated with a sum total of just over $575,000 in student debt. More than half a million dollars! This was mostly from dental school. In undergrad, I chose a university to which I could commute from home and I lived at home all four years. I also worked three jobs and graduated in three years. All of this was part of my plan to save as much money as possible. I had no help with paying for undergrad, so I still graduated with about $15,000 in student debt. I did not go to residency.

Q: What repayment plan did you choose and why?

A: Choosing the repayment plan for me has been quite the adventure. As aggressive as possible was our repayment choice, although we have switched between repayment plans and we also have plans to exit the loan forgiveness umbrella in the near future. Before I go into the minor details as to our repayment thus far, I will answer the question “Why?”.

Most people don’t know this, but when you do the math, aggressively paying down debt was the cheapest path. Actually, paying it in the standard 10-years was cheaper than waiting 25 years to forgive the loan by over $100,000! And you save 15 years! To me, that’s a no-brainer. The reason as to why it is cheaper is simple.

The government banks on your income growing over time. Since you pay a small percentage of your income to them, you will be paying more to your loan over time, as well. However, your income payment will unlikely exceed the interest that is being added to your debt. Under the federal loan forgiveness plans, the interest rates are high (mine is 6.8%). Which means that each month, my loan of $575,000 is accruing $3,258 in interest.

Assuming my program requires me to pay 10% of my income, for me to cover interest, I would need to be making about $391,000 per year. And mind you, that doesn’t even touch the Principle Amount. Therefore, unless you do make over $400k a year, your loan is growing for 20-25 years.

Now, where the government benefits is on the tax bomb at the very end, which shockingly, some people do not know about. In short, whenever the loan is forgiven, the debtor will be charged taxes that tax year as if they earned that much income.

To give a finite example of this, if I was on the IBR plan, my loan of $575,000 would have increased to about $1.4 Million. They would consider $1.4 Million to be income I earned that year. Which means my tax bomb would be about $420,000 (plus whatever my taxes are on what I ACTUALLY earned that year doing dentistry) – a sum I would have to pay that year. When you add this amount to the minimum payments I would have made throughout the course of the program, I would have paid about $750,000 in total. When we pulled the numbers, paying off the debt in 10 years would have only cost me $650,000.

Here’s the kicker. I knew we could do it in less than 10 years!

So now that I have answered why we chose to pay it down aggressively, let me go through our ever-changing repayment plan.

When I was just exiting dental school, I was visiting the financial aid office constantly. The one at school kept telling me that my wish to pay off student debt “did not make sense.” They said that between the house I would want to buy and the new car I would want to get and the vacations I wanted to take, I would not have the income to pay back the debt, even with my husband who was working at the time as a mechanical engineer! Which is funny because I never told them about a house, or car, or vacation.

I remember running through the numbers and not understanding why they couldn’t see that the income could cover the debt. I even had my husband (who I was engaged to at the time), come into the school with me to look at the Excel sheet the financial aid admin had created. She painted a picture that said it was impossible, and she recommended I sign up under the IBR repayment program. With a heavy sigh, we did.

But I just couldn’t sit with this notion that I was going to be in debt for what feels like FOREVER, and I wanted to get my finances in shape. I also did not believe the admin HAHA. I hired a financial planner who happened to be the husband of a fellow dental classmate. He helped me get rid of all my credit card debt and set up our finances in the few months between starting work and getting married at the end of 2016.

After we were married and all the credit cards were paid off, my financial planner started noticing that we were setting aside about $8k a month. Which is when he told us that paying back my loan is a possibility for us. In order to do a 10-year repayment plan, we would need to make payments of about $6,300 per month. We were worried about the risk refinancing into a 10- year program would entail, especially if one of us lost our jobs. In order to have the flexibility of decreasing our monthly payments should life throw lemons our way, I stayed in IBR and started paying back my debt aggressively. The plan was to get the loan to a smaller, more manageable number that would give us a lower interest rate when we refinance, as well as a more comfortable minimum monthly payment that we knew we could achieve should our income ever change.

It was not until I talked to Travis Hornsby from Student Loan Planner (who I BTW recommend to every grad who has student debt), that I learned I could optimize my plan by switching to REPAYE. This is because REPAYE subsidizes the interest and pays 50% of it for the first three years. So I switched to REPAYE a year into my loan repayment journey. By taking advantage of REPAYE’s interest discount, we technically achieved the interest rate we would get if we had refinanced, while retaining the flexibility. We hung onto the ability to stop making massive monthly payments in cases of emergency.

And boy were we glad we did! The pandemic came in March of 2020 and REPAYE’s 3 years was going to end for me on November 2020. My husband ended up losing his job for ten months during the pandemic and the pause on federal loan payments have been a real blessing!

However, we are still sticking to our real plan, which was to refinance at the end of 3 years. Since student loans are on pause currently and at 0% interest, I am waiting for whenever they resume to refinance. At that time, we will make a large lump sum payment, bringing our loan from the OG $575,000 to around $340,000. This will hopefully land us a better interest rate than if we refinanced in the beginning (since the total is much lower). Our target interest rate is less than 3%, which would be an improvement from the current 6.8%.

Q: What is your strategy for tackling your student loan debt (please break down).

A: We are doing all sorts of fun and creative things to pay it down. I look at the task as a game– kind of like Mike and I versus the world. We made a pact to live off of one income, because both our parents supported us in that way. The income we live off of is my husband’s, whose wish in life is to live comfortably without sacrificing what makes life worth living. His income is enough to maintain our lifestyle. Which leaves 100% of my earnings to go towards student loans – after maximizing a 401K first, of course. (I could be throwing this extra 19.5K into paying down student debt, but our motto is centered around not sacrificing the NOW for the LATER. (We are such millennials, am I right?)

We implement a number of other tactics in order to maximize what we can put towards loans. First, we budget to keep our spending on the minimum. We travel hack to be able to see the world, without spending post-tax dollars on flights, and hotels. We also house hack, which helped us save money to buy our property, as well as reduce the amount we spend on putting a roof over our heads. Between 2017 and now, we have reduced our housing expense by $1,000 – not an easy feat in Orange County, California.

I also try to have the hobbies I pursue make money for me. I find that so many people do things they like without trying to monetize it. A few things I like to do that I’ve turned into side hustles are write, bake, and be around animals and pets. I also like to teach and take photographs and have been paid for both before. I like coffee shops, which is why my new role as the wholesale director of a bakery works well for me. I get to meet all sorts of coffee shop owners and probe their brains on how to source the best cup of coffee! Plus I use my blog to sponsor my lifestyle. Companies that I promote send me products to try, and instead of buying things for myself, I reach out to the company and ask if I can trade a post for a product review. It’s a win-win situation, and I get high-quality items without spending hard-earned dollars!

We love the idea of passive income and remote work. This is because our dream is to travel the world. We are working on both. During the pandemic when Mike did not have a job in mechanical engineering, he completed a course on coding so that we could make remote a reality. Little did we know that the pandemic would change our lives! He returned to mechanical engineering at the beginning of this year, and just this week, he was offered the option of coming in as little as once a quarter (aka 4 total days a year)! Meanwhile, my work as the wholesale director, writer, and blogger is all remote. And the blog and the wholesale directing gives me passive income – which I define as income that I continually receive without me doing additional work. The blog is the best because content I’ve written in the past can still bring in revenue in the future through affiliate links.

Our strategy is not “work as hard as you can, as many hours as you can.” On the contrary, as a slow-living advocate, I am quite the opposite. I like working as few hours as I can while receiving the most output. Ways in which that can happen is to create continuous revenue from a product (like the blog), earn commission through a past sale (like the wholesale directing), or place your dollars in something that would grow in value (like our home). Even during the pandemic, we paused our loan payments but moved all our money to a high yield savings account. Since we planned to put our savings into the loans right when the relief ended, we wanted a short-term solution that would still have our dollars working for us. The HYSA gives a 0.7% return versus the typical 0.01% return with a bank. So on the side, it is earning us a few hundred dollars.

Q: With your current breakdown, how long would it take you to pay down your entire student debt load?

A: As described in the previous question, we went from IBR to REPAYE. We will soon refinance for a lower interest rate and hope to be in the low to mid $300,000’s when we do. After that, I hope to get rid of the debt within 3 years! EEEK!

The pandemic definitely slowed us down, but the student debt relief has greatly helped. We are on track to finish sometime between the 7 to 8 year mark.

Q: Does any part of your life suffer because of your aggressive debt repayment?

A: This question is why I embrace my work as TheDebtist. I want to show people that my choice does not hold me back from living my life. I mean, look at me! I work 2 days a week in dentistry. I get to call my own shots at the dental office, and control which days I work, as well as how many patients to book. I work remote for blogging and the bakery, choosing my own hours. I like the flexibility of that. My husband and I have traveled to 10 international countries, as well as all over the United States. I opened a bakery and a dog sitting business between now and when I graduated. I’ve experienced so many things, and since that’s my life goal, then No, I do not suffer.

I do find this question really painful to answer, because it is asked often and insinuates this common belief that paying back debt leads to deprivation. That’s why I care about sharing the story of my student debt repayment journey. That fear of deprivation and inability to live life was in me, too. I had no one to look up to and it was lonely, as well as scary, to take the leap.

The people around us feed off of this consumerist energy and paying back debt obviously means offsetting it with less consumption. So I choose to show people that a minimalist life in terms of material goods can also mean a maximalist life in terms of experiences. It’s just about being fueled by different things, that’s all.

Q: Do you have other debt and if so, what is your mindset towards those?

A: We do not! Except for our mortgage. My mindset on that is clear. I would rather pay for a home, earn equity and use it for house hacking and my business (my entire bakery operated in my kitchen!) than rent a home from someone else and contribute to their wealth instead.

Q: What is your approach to spending and your psychology about money?

A: I have been socially brainwashed to spend money, so it is natural for me and most people to spend. My natural instinct is to hold tight to money, but when I see other people around me buying things, I start to want things too. I work very hard to stick to a budget and stay a minimalist.

My psychology around money has changed significantly over the past four years. I used to have a scarcity mindset around money. I worked many hours to attain it because I thought hours worked equated to money earned. Now I have an abundance mindset around it, investing money into things that will give more output with less input. I am also trying to be more generous with money, having adapted to the idea that generosity is repaid tenfold.

I used to be scared of not having enough money but that’s what this journey gave me. Paying back student debt aggressively gave me the confidence to overcome my fear of money. Now I understand that I am in control of it, and not the other way around.

Q: If you had to do it all over, would you pursue a career in dentistry?

A: Yes. I wouldn’t have said Yes in 2017, but I have since changed my mind. Told you I was a Gemini!

A: Dentistry gives me autonomy over my work. I have full control of how much I work and for whom and how. Some people have to work 9-5, 5 days a week in order to have a job. I don’t. I also have the freedom to own my own dental office or work for one. I have the ability to work around the world. I can choose which community I serve, and can refer people out if I feel they and I are not a good match. I meet all sorts of fun people and have watched children grow into teenagers since I have been at the same office since 2010.

I have found that while some people on my path are motivated by wealth or money, I am not. I thought I was, but I realize that I am most motivated by freedom. Wealth and money might help get me there, but that’s not what I care about. During the pandemic, I quit a job that made a lot of money and honestly carried me and my husband while he was out of a job for ten months. I worked four days a week and made as much money as when we both worked. But I did not have freedom over how I did my work. I couldn’t decide the days I wanted to work. And I was very unhappy. So I left.

I think I answered differently in a podcast interview back in 2017. That was before I realized the flexibility I had with this job. That was before I realized I could call my own shots. That was before I started thinking positively; before I viewed dentistry as a power instead of a crutch.

Q: What advice would you give other health professionals/ health profession students on handling debt and student loans?

A: Tune out all the noise. Then look deep inside your very heart and ask all the hard questions. And hear all the terrible answers. March to the beat of your own drum. Not everyone will pay it back aggressively because it doesn’t fit everyone’s lifestyle. But don’t be afraid of the choice that you know is right for you. Where there’s a will, there’s a way – actually, a million ways!

You’ve got to center your plan around your goals, your personality, your lifestyle, and your comfort level. Don’t ignore the emotions, but also, consult the numbers. Understand your options and be a continual learner. Study ways to earn money and make money. Pivot when you have to and don’t box yourself into one way. Lastly, consult professionals, or friends like Patrice and me!

About Dr. Sam: The Debtist

I am a debtist – a dentist who graduated with a lot of student debt. After four years of undergrad and four years of dental school, I ended up with a debt of over $550k, which I then had to start paying back. This led me to a series of life changes and discoveries about myself in my late twenties that shaped my lifestyle into what it is today. Saving money required us to be more frugal, and being more frugal opened up the doors to finding alternative ways to find happiness in things that don’t require consumerism. I now embrace a simple life. I live in OC with my husband, although we prefer to be traveling, and do so when we can. We focus more on experiences rather than material things. Being selective when it comes to purchasing consumer goods, we spend most of our money and time acquiring new skills, picking up new hobbies, learning about new cultures, and exploring the globe. I’ve become more intentional with my life decisions, and am currently working towards buying my freedom from my massive loan, but not at the expense of giving up my life in exchange for grueling work hours. Open to questioning society’s standards of success, I am finding ways to reach my life goals by refusing some things that we take for granted as the norm. Balance is key, and this is my journey towards financial freedom, in the process of discovering what life is really about.

Follow along with Dr. Samantha’s debt free journey over on her blog thedebtist.com. Also check her out on Instagram here and here!

Find Time for Self-Care While Balancing a Side Gig with This Guide

Finding time for ourselves is crucial these days, but it can be a challenge to do so when you have a lot on your plate. Those who are running a business and/or starting a side gig often feel pressure to hustle day and night, leaving little room for personal care.

Finding time for ourselves is crucial these days, but it can be a challenge to do so when you have a lot on your plate. Those who are running a business and/or starting a side gig often feel pressure to hustle day and night, leaving little room for personal care. There are a few simple ways to work it in, however, if you get creative. You can always take some cues from The UnorthoDoc, a blog by Dr. Patrice Smith that helps professional individuals find balance in their lives. It also helps to think of ways to save time — and energy — so you can focus on the big picture and take a few minutes for yourself. Here are some ideas to help you get started.

Give yourself peace of mind

Sometimes self-care is as much about your mental and emotional health as it is physical, and when you’re busy with professional tasks, it’s easy to forget the importance of protecting yourself from legal ramifications. Starting an LLC, or Limited Liability Company, is a great way to ensure that your personal assets are covered no matter what happens within your business, and it also offers tax benefits and allows you to run things your way. The regulations and formation steps vary from state to state, so read up on how to properly file for an LLC in your area. Keep in mind that you can save money by utilizing a formation service rather than an attorney.

Just breathe

Mental health, emotional health, physical health — it’s all connected. Side gigs come in many shapes and forms, but no matter how you choose to earn extra money, it’s easy to push yourself to the limit in order to make the most of every hour in the day. Slowing down and learning to relax in your current surroundings can help you banish stress or anxiety, so consider learning some breathing techniques such as those associated with yoga and meditation. If you can take five minutes out of your day to be mindful, you might be surprised at how much better you feel, especially when you’re being pulled in several directions.

Rest well

When you stay busy it can be difficult to get enough rest, but a lack of sleep can lead to problems with concentration, memory, and anxiety as well as a host of physical issues. Set limits for yourself when it comes to completing tasks, especially if you work from home; it’s often easy to put in unintentional overtime when you don’t punch a clock, so give yourself guidelines for answering emails and phone calls. Eliminate foods and drinks that can keep you awake, and set up your bedroom to maximize comfort by utilizing blackout curtains and soft bedding.

Make your workspace work

Your bedroom isn’t the only place that could benefit from a makeover. Take a look at your office or workspace and make sure it works for your needs. If possible, make it a place that’s distraction-free and comfortable, and give yourself all the tools you require to create a smooth workday. This might be anything from a wireless printer to software that helps you stay on track, so think about which resources you’ll need to make the day as stress-free as possible.

For busy professionals, it can be difficult to strike a good balance between work and life responsibilities. Self-care can help you find those little moments that allow you to feel recharged and reinvigorated so you can focus on what comes next.

[This is a guest post by Courtney Rosenfeld]

Have a question for The UnorthoDoc, or interested in a collaboration? Get in touch today.

How to Make Residual Income From Blogging

Blogging presents a big upside, but to be honest it’s not for everyone. The potential to make good money and turn it into something bigger than a side hustle is there. However, the downside to blogging is that you’ll almost definitely need to put in a lot of work and effort before you start to make money.

Some of you may not know this, but I have been blogging since 2008 and have had several blogs since. As an introvert, writing has always been my form of expression. My first several blogs ranged from inspirational and motivational pieces (perhaps because that’s what I needed for myself at the time) to chronicling my pre-dental and dental school experiences. It wasn’t until I was in dental school and approached by fellow students who expressed how my blog positively impacted their journey in applying to and getting accepted into dental school that I realized I was making an impact. That blog grew quite popular among pre-dental students and soon after different brands began reaching out to me for advertising space. At the time I knew nothing about calculating an advertising rate based on the analytics, metrics and reach of my platform. So I decided to charge each advertiser a flat monthly fee for the space and they gladly paid. Now I realize I was woefully undercharging.

The aim of any blog that I’ve started was never to make money from it but it sure is a plus since a lot of time and effort goes into planning and writing posts. Blogging has become very popular and quite a number of people have reached out to me asking questions on how to start a blog or how to monetize one. I’ll focus on ways to monetize a blog in this post.

One of the great things about a blogging side hustle is that there are endless possibilities. You can start a blog on any topic that you like. I’ve been blogging since 2008, and most of my blogs have fallen into areas that I consider hobbies. I will say this about blogging, don’t go into it with the sole purpose of making money. You will get bored of it and possibly find that it takes too much effort for the ROI. If you enjoy the topic that you’re writing about, blogging is a lot more fun and you’ll be more likely to stick with it.

There are a number of different ways you can go about making money from your blog:

Affiliate Income: You could promote products and offers as an affiliate and earn a commission for conversions. If you find a product or service that you like, you can link to it from your blog, and when people click and buy something from your link, you’ll get a small commission for referring them.

Create and sell your own product: This is a great way to monetize your blog, especially if your product fulfills a need or solves a problem. You can opt to sell physical or digital products so I decided to do both with my blog. The candle company has a special spot on the blog and is where most of the income for this platform is generated, followed by my “unorthodoc” apparel. I also produce digital products in the form of e-books, planners, and journals.

Publish sponsored content: Companies are interested in reaching your audience. Some companies will pay you to write product or service reviews. Be sure their brand is in line with your values because the content you write will be broadcasted to the masses. Others will provide content for you to place on your site at a cost so they can reach your audience. Be sure to thoroughly read and understand the content.

Sell a Course: As a blogger the more you know and can explain about a topic can make you an “expert”. If your blog is getting enough readers and visitors and they enjoy your content, they’re going to want more. Producing a course to give more detailed information is the way to go. The key is to provide helpful and insightful information to your audience beyond what you have written. There will be a segment of your followers who will happily buy the course you create.

Consulting: If you have a blog on a specific marketable topic/subject, you can offer yourself as a consultant for different businesses. Landing clients is the hardest part, but if the content on your blog is attracting the right people, it can be done.

Blogging presents a big upside, but to be honest it’s not for everyone. The potential to make good money and turn it into something bigger than a side hustle is there. However, the downside to blogging is that you’ll almost definitely need to put in a lot of work and effort before you start to make money. If you’re looking for a way to start making money right away, creating a blog is not your best option.

For great tips on how to start a blog, there are lots of resources on skillshare. I am a VIP member and I learn so much on a variety of topics. You can give it a try by signing up for a 7 day free trial, if you like it get 40% off your annual membership fee with this link.

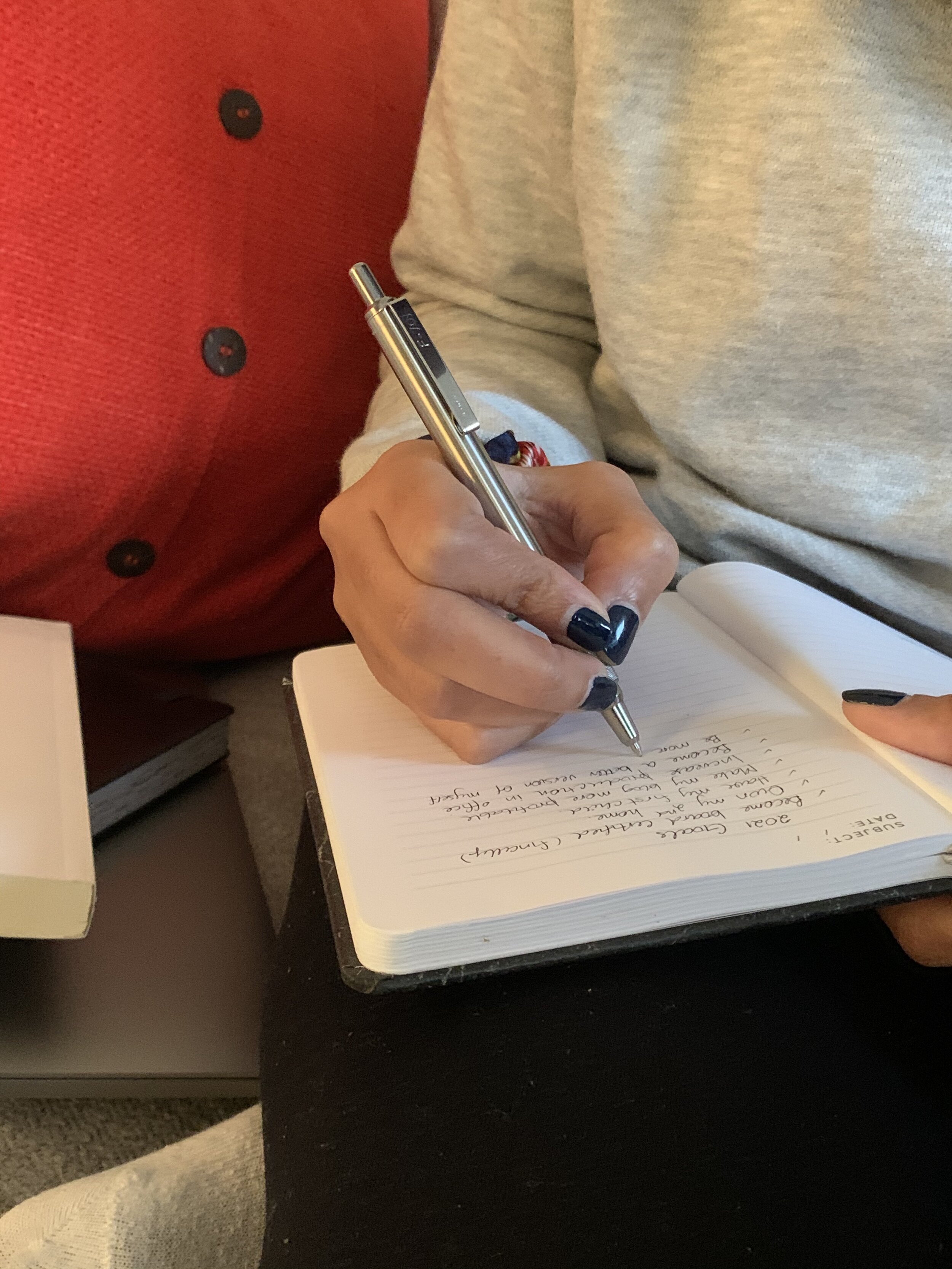

7 Steps to Smashing Your Goals in 2021

As we optimistically set out to achieve great things at the beginning of the year, we must break our goals down into small manageable, attainable and realistic ones. Setting new year resolutions has been a long time tradition but did you know that statistics show that only about 10% of people actually stick to their new year resolutions past the month of January?

Beginning a new year is such a hopeful time. Whether we break out an unblemished calendar or merely scroll over to the month of January on our smart phones, there’s the sense of being given a fresh start every January. We make notes, either mentally or on paper, of New Year’s resolutions we’re determined to accomplish. Goal setting is a powerful process for thinking about your ideal future, and for motivating yourself to turn your vision of this future into reality by smashing your goals in 2021. The process of setting goals helps you choose where you want to go in life. By knowing precisely what you want to achieve, you know where you have to concentrate your efforts. You’ll also quickly spot the distractions that can, so easily, lead you astray.

With that said, as we optimistically set out to achieve great things at the beginning of the year, we must break our goals down into small manageable, attainable and realistic ones. Setting new year resolutions has been a long time tradition but did you know that statistics show that only about 10% of people actually stick to their new year resolutions past the month of January?

I am a huge proponent of self improvement and and an even bigger proponent of setting goals that are actually measurable and attainable. With that said, let’s make 2021 the year we actually accomplish our goals with these 7 steps:

1. WRITE YOUR GOALS DOWN

A sure way to make things happen is to write it down. It sounds strange, but there is enormous power in putting things down on paper, and according to research you become 42% more likely to achieve your goals and dreams when it’s written. I always keep a physical (paper) planner even though I use the planner on my smartphone as well. After years of not being able to find the perfect planner, I have decided to create a goal planner and to share it with my readers.

2. PRIORITIZE YOUR GOALS

Identify the top priority areas that you want to work on. Is it health? Finances? Career? It could be all of the above, but pinpoint specific things in each category to work on. For example, if it’s finances a realistic goal would be to increase your monthly savings by 5% or to save $X amount for an emergency fund by X-date. This process of narrowing your goals down helps to weed out the ones you just aren’t that committed to.

3. MAKE YOUR GOALS S.M.A.R.T

So how exactly do you set intentions that you will actually stick to? Be SMART about it.

Before you set a goal, first figure out your “why.” By figuring out and articulating the reason you want to achieve something you are more likely to remain motivated to stick to it, rather than it being something you think you should do.

S - Small and Specific: Break your goals into smaller, more specific ones. For example, if your goal is to eat healthier in 2021, be more specific by making it about adding 1 fresh fruit or vegetable and a bottle of water per day for the month of January.

M - Measurable : All your goals must be measurable, that means you should be able to describe the physical manifestation of the outcome of your goal. Example, losing 2lbs per week by adding one fruit or vegetable and a bottle of water to our diet each day.

A - Attainable and Accountability: Is your goal attainable? Can you realistically achieve your goal? Another great way to stay on track is to find an accountability partner. Example, someone who will check in to make sure you had your fruit/vegetable each day or someone who will ensure you meal prep.

R - Relevant and Realistic: Is this goal relevant to you or even realistic? Ensure you’re not setting a goal that you really don’t care about and hence not realistic. Example, I dislike running. If i make it a goal of mine to incorporate running 1 mile/day I know I will fail. Instead, I ensure I get my cardio in by getting on the elliptical, bike or taking a Zumba class.

T - Timely: Make a tentative plan for everything you do. Don’t just make it a goal to exercise once per day. You know your schedule, you know if you’re a morning or late night person. Instead of saying you will work out once per day, say you will work out at 5:30 each morning for 1 hour before work/school.

4. FIGURE OUT HOW YOU WILL ACHIEVE YOUR GOALS

This is where we sometimes lose focus. We may know what goal(s) we want o accomplish but the steps in how to accomplish them might get blurry.

Say you want to increase your savings this year. As in the example above, you would start by committing to an extra 5% of your biweekly salary. To make this actually attainable would be to automate it. If 5% of your biweekly salary is $350 then automate that amount to go into your savings vehicle twice per month. A “set it and forget it” approach works well in this case.

5. TRACK YOUR PROGRESS, REFLECT AND RE-CALIBRATE

Resist the urge to freestyle your goals and actually check your progress as you go along. What can you improve? What isn’t working? At the end each month, take time out to analyze what you have achieved, what you failed to achieve and how to improve on this. Journaling as you go along and circling back at the end of each month can really help you to stay on track.

6. ADJUST TO LIFE’S LEMONS

Life gets in the way and can derail you. Things such as illness, family commitments, work, life emergencies etc can impact your goals. Take note of these things and adjust as you proceed.

7. ASK FOR HELP

Lastly, get an accountability partner. Have a friend or loved one you can lean on for moral support and encouragement, you will need it from time to time. If you need specific help, reach out to those who can offer any guidance or assistance. The internet and social media is a great way to make connections.

Bonus: Be your own D**n Cheerleader and eliminate self doubt. Figure out what keeps you motivated and inspired. I love quotes! I keep them everywhere - my phone’s wallpaper, sticky notes around the house, on my desk at work, on the bathroom mirror, etc. I listen to music, books and podcasts that are uplifting. I tolerate no negativity and try to stay away from it at all costs.

Remember, a goal without a plan is just a wish. By breaking down your goals into bite-sized, manageable actions and writing them down, setting goals and intentions for the new year that you can actually stick to becomes a much easier process.

Grab your planner and let’s smash our 2021 goals! Remember, a sure way to make things happen is to write it down.

Retirement Planning for Young Professionals in 2021

When speaking of saving for retirement, it is very important to have some knowledge of compounding interest to fully understand the benefits of starting early. This post will cover some retirement basics, contribution limits and what to do with extra money should you find yourself so lucky.

2021 RETIREMENT CONTRIBUTION LIMITS

If you’ve been a reader here for a while you will know that I always talk about saving for retirement. It is never too early to start saving towards retirement! 2020 was a doozy and some of us may have fallen short of our financial goals for one reason or another. However, 2021 is looking promising so it’s time to get serious about those saving and investing goals.

When speaking of saving for retirement, it is very important to have some knowledge of compounding interest to fully understand the benefits of starting early. This post will cover some retirement basics, contribution limits and what to do with extra money should you find yourself so lucky.

I must remind you that retirement planning is a long term investment. In most cases you will not be able to access these funds until around age 59 1/2 without severe ramifications (taxes + penalties). So, if you are investing and need to access your funds sooner than this, you may have to think of other types of investments. Take a look at other investment vehicles here, here and here.

There are many different accounts and plans available and choosing the right one is very important as they each have different benefits and advantages, especially when it comes to tax planning. Here are a few to help you get started:

Simple IRA (Savings Incentive Match Plan for Employees)

For the year 2021, participants can make employee contributions of up to a maximum of $13,500 per year if you are under 50 years old and $16,500 if you are older than 50. This is a retirement plan that is usually available to self-employed individuals, however both employee and employer contribute to this account. Contributions are non tax deductible.

Traditional IRA

Anyone can open a traditional IRA account - but honestly, if you are a dentist or physician (like most of my colleagues are), then there really is no use for this type of account. During residency you have the option to open a Roth IRA (more on that below) because your lower salary allows you to stay within the income restrictions. Later as you start your career and your salary increases you will most likely surpass the income caps and will have the ability to deduct your traditional IRA contributions. However, it’s worth understanding as it forms the framework for all other types of retirement accounts. A Traditional IRA is set up by you (not an employer) and the maximum contribution to this type of account is $6,000 if you’re under 50 years old and $7,000 if you’re older. The contributions are tax deductible and grows tax-free. If you withdraw the money prior to age 59 1/2, there will be ramifications of a 10% tax (penalty) as well as any income tax which would be owed on the money. After age 59 1/2, you just have to pay the income tax based on your tax bracket at that time. At age 70, you will be required to start withdrawing part of the money each year, the “Required Minimum Distribution (RMD).” This is age based and starts out at about 3.6% and increases to about 8.8% at age 90.

Roth IRA

I absolutely love a Roth IRA. However, there is a contribution income limit. If you make more than $124K (single) or $196K (married), you cannot contribute to a Roth IRA. However, there are ways to get around that with Roth IRA conversions, which we will discuss in a subsequent post. Anyone with earned income can open a Roth IRA and contribute up to $6000 per year. If income is sufficient, one can also open a Spousal Roth IRA and contribute another $5000. If you’re over 50, those limits are raised to $7000 per year.

The reason I love a Roth IRA is because you contribute with after-tax money, but it is never taxed again! You don’t pay taxes on capital gains and dividends as the money grows, and it comes out tax-free in retirement. You generally can’t access the money before age 59 1/2, but unlike a 401K or Traditional IRA there are no required minimum distributions beginning at age 70.

401K

If you are an employee of a company and your employer offers a 401K retirement plan, there’s absolutely no reason why you should not be participating. It is even more important that you participate if said company is offering a match. A match is basically free money! Do not leave free money laying on the table. The contribution maximum for the year 2019 is $19,500 and the great thing about a 401K is that you are investing pre-tax dollars. The not-so great thing is that when you go to retrieve your money (after age 59 1/2), you will be taxed on this (unlike with a Roth IRA).

If you're an Independent Contractor (not a W2 employee), you’re considered to be “running your own business.” In this case, you can also make an employer contribution of 20% of your net income up to $55,000.

SEP IRA (Simplified Employee Pension)

If you have your own practice, a SEP IRA may be a good option. This allows you to contribute 25% of your business profit or $57,000 per year, whichever is less. The contributions are tax deductible, and investments grow tax deferred until retirement.

If you find yourself with some extra cash, here’s what you can do with it:

Fund a Traditional Brokerage Account

Traditional brokerage accounts don't offer any sort of tax benefit for the money you put in, unlike IRAs and 401Ks. However, they offer flexibility in that you can withdraw funds at any time and for any reason. If you decide to retire early, like my husband did, you can use the money in your brokerage account to pay your living expenses. There are no income limits associated with funding a brokerage account.

Fund a Health Savings Account

HSAs are funded with pre-tax dollars, like traditional IRAs and 401(k)s. Withdrawals can be taken at any time, and they're tax-free as long as they're used to pay for qualified medical expenses. Any money not used immediately can be invested, just like in an IRA or 401(k). If withdrawals are taken for non-medical purposes, they will be subject to a 20% penalty.

However, once the contributor reaches the age of 65 funds can be accessed for any reason without being penalized. At that point, your HSA can serve as a general retirement savings account.

This is not a comprehensive list of retirement vehicles but certainly a great place to start. Everyone, as early as possible, should start contributing to one of the above. Speak with your financial planner or accountant for more clarification about which plan is best for you. Hope this helps in getting started.

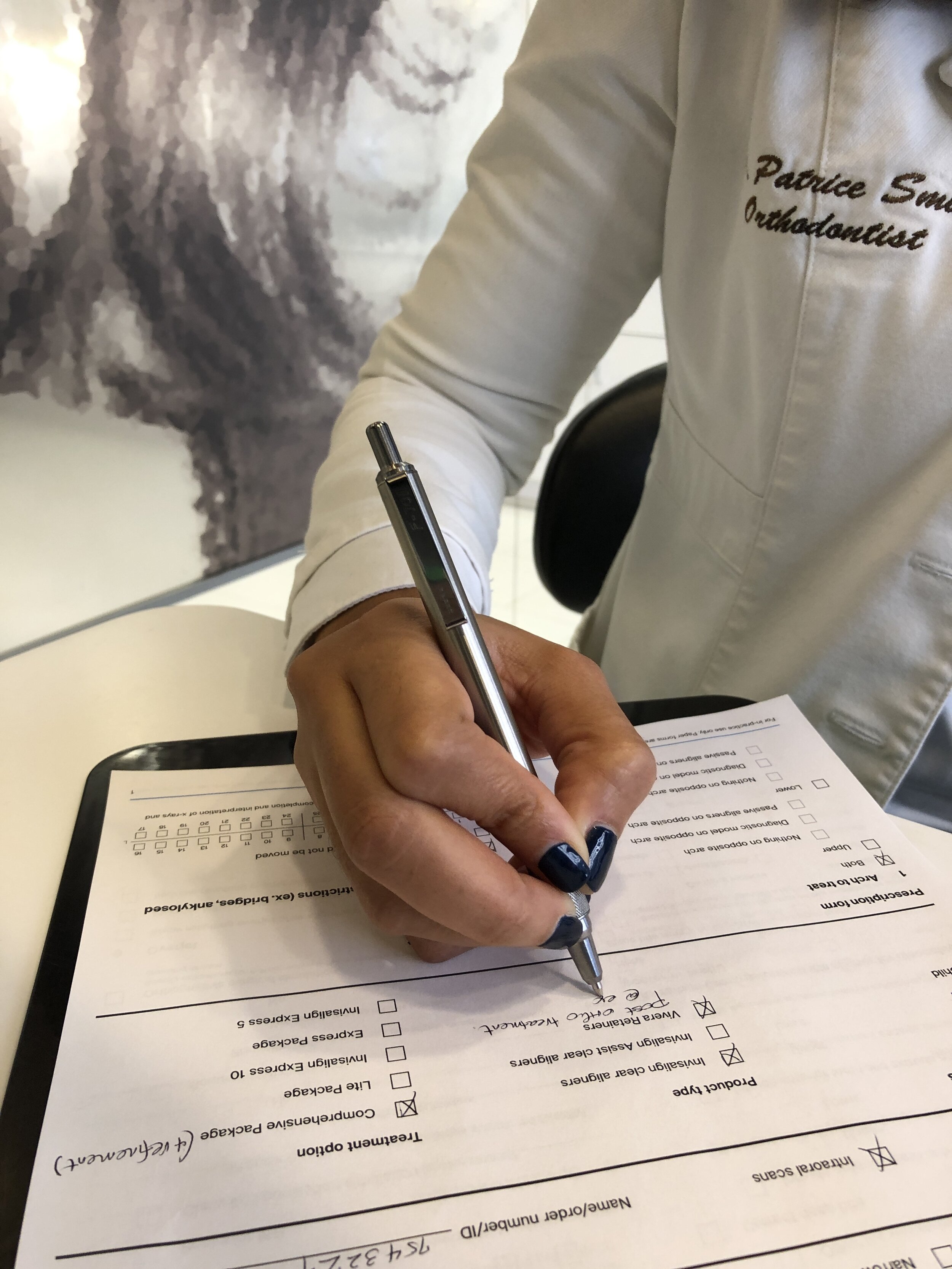

Write It Down & Make It Happen With Zebra Pen

As an Orthodontist, blogger, philanthropist and side hustle extraordinaire, my life takes a certain level of organization and my writing utensil is a big part of that. From writing charts, treatment planning, signing documents, and creating content, I need instruments that will help to not only keep me on track but also offer reliability and efficiency. One Instrument I am very particular about is my pen.

This post has been sponsored by Zebra Pen. All thoughts and opinions are my own.

I don’t know about anyone else, but even though we are completely in the digital age, there’s just something about putting pen to paper that helps to clarify my goals and priorities. Whether it’s writing in my journal, scribbling down my daily to-do lists, scheduling meetings and due dates or scribing my treatments plans at work, there is something about the analog nature of writing things down with a real pen on paper that helps me to properly set my intentions and achieve my goals.

Writing things down forces our ideas to become real.

“When we write things down, we enter a world of possibility”

As an Orthodontist, blogger, philanthropist and side hustle extraordinaire, my life takes a certain level of organization and my writing utensil is a big part of that. From writing charts, treatment planning, signing documents, and creating content, I need instruments that will help to not only keep me on track but also offer reliability and efficiency. One Instrument I am very particular about is my pen.

My go-to writing utensil is the Zebra Pen STEEL F-701® ALL METAL Ballpoint Retractable Pen. Not only does it have a very stylish design but it also provides a high-quality writing experience that helps me stay organized and accomplish my goals. It’s rare that I come across high value items with great quality and style for a low cost. At under $10.00, this writing tool was made for the savvy and confident professional. This pen transitions well with my professional and personal style. Check out more information here to see how you can Choose Different.

HERE ARE A FEW OTHER REASONS TO LOVE THE ZEBRA STEEL F-701:

As an Orthodontist, I utilize pens to complete clinical charting and treatment planning for my patients. My notes require a premium quality pen, like the STEEL F-701, that does not smudge, has a convenient push clip, and that has a great grip. As a blogger, it is just as important in helping me to plan my blog and social media content.

This pen is housed in a silver stainless steel frame that I can easily clean and sterilize between uses. It is knurled, with a no-slip grip for ease of handle and it offers a smooth, even ink delivery from any portion of the ball tip. It is lightweight, durable, and easily clips to my white coat pocket. Best of all it contains an all-metal refill which is usually seen in pens with a hefty price tag. Its fast-drying ink prevents smudging on glossy prints and is great for writing on patient photographs and radiographs.

Blogging coupled with my other entrepreneurial endeavors takes quite a bit of planning. It seems I write on paper almost as much as I type. Needless to say, I always need a pen that’s reliable…. and stylish, of course.

I always carry the STEEL F-701 in my purse because it is practical, durable, reliable and long lasting.

Branding Ideas For Your Passive Income Business

Earning passive income is a great way to pursue other goals and interests. Passive income means continuing to get paid, even when you’re not working. Basically, you don’t need to be present to earn money! If you want more financial independence, there are many ways to generate other income streams.

Earning passive income is a great way to pursue other goals and interests. Passive income means continuing to get paid, even when you’re not working. Basically, you don’t need to be present to earn money! If you want more financial independence, there are many ways to generate other income streams. Some popular options include:

Writing a blog and monetizing it with affiliate links;

Creating a digital product like a tool or app;

Selling pictures such as illustrations or stock photos;

Selling a helpful guide or online course;

Starting an ecommerce store;

Starting a YouTube channel;

Writing and selling an ebook (or audiobook).

However, there are lots of people looking to build passive income online. This means that, if you want to improve your chances of being successful, your brand needs to be memorable and distinctive to stand out. One way to do this is through clear communication and branding.

Here are some of the ways you can use branding to grow your passive income business:

1. Understand your customers

First and foremost, it’s essential that you understand your target audience. If you don’t do this, your branding efforts will be wasted. You need to know who your ideal customer is, and you can do this by creating a buyer persona.

Start by looking at your customer data, researching competitors, and carrying out market research. Then, you can find out who you’re targeting and understand their interests, motivations, and what problems you can solve for them.

2. Have a professional logo

Designing a professional logo is another must. This is important for businesses of all sizes, no matter how small. Whatever you’re selling, you need a logo that represents the brand.

You can hire a graphic designer or branding agency to do this. Or, if you’re on a budget, you can design one yourself using a free online tool like www.logocreator.io. Just ensure your logo is simple, memorable, versatile, and appealing to your audience.

3. Create a tagline or slogan

Next, we recommend creating a tagline or slogan to go with your logo. This should be a short phrase that shows the essence of your brand message and personality.

It doesn’t need to relate to your products directly. But, it should explain the key benefits of your brand and differentiate it from competitors. If in doubt, keep it short with a positive message!

4. Understand current trends

You can stay one step ahead of the competition by making sure you’re up-to-date with the latest trends in your industry. This is important for both new and established businesses.

By knowing what’s going on, you will be better equipped to sell to your target audience, as you will understand what will appeal to them.

You can find out about current trends by using Google or social media to research and find the latest data and statistics. Don’t get too caught up in this, though - you need to be consistent and always keep your brand message and values in mind!

5. Promote your brand

Lastly, people need to see your brand if you’re going to make sales! You can do this using a variety of promotion techniques, such as content marketing, email marketing, social media platforms, and paid online ads.

You should also make sure you have a user-friendly website that explains all the key information about your business and includes call-to-actions so visitors know what to do next. To simplify this, you can use a website builder like Ionos or Shopify.

This is guest post by Kyra Vazquez

Effective Strategies To Manage Your Wealth During The COVID-19 Pandemic

The COVID-19 pandemic has created severe economic downfall all over the world. But considering today's impact on the economy, it can be clearly seen that people, specifically investors should implement their own strategies to manage wealth, secure capital protection, and also get desired returns.

The COVID-19 pandemic has created severe economic downfall all over the world. Due to this reason, the majority of investors have suspended investing in many sectors. Apart from that many of the investment sectors are showing negative results, so it looks like a recession in the coming days is inevitable.

Financial experts around the world aren’t well aware of the fact that how much time it will take to emerge from this pandemic situation, and how much it will cost our financial future.

But considering today's impact on the economy, it can be clearly seen that people, specifically investors should implement their own strategies to manage wealth, secure capital protection, and also get desired returns.

Here we are going to discuss some tips about managing wealth during a pandemic which you might find helpful.

1. Prioritize to your financial goals as per the situation

What is the need for wealth creation in your life? The answer is simple! You want to have a financially secure life, all the comforts, an improved lifestyle, and want to fulfill your financial goals in time before retiring.

Due to the pandemic, most of the investment options are down and investors are getting deprived of the regular income streams. So, during such financial downtime, it is impossible to achieve all of your desired financial goals on time.

So, it is better to plan your financial goals again and decide which financial goals are still important to you and which aren’t. You should prioritize your financial goals to ensure that you can achieve the important goals first. Creating new financial goals will guide your wealth creation in a positive direction.

2. Target on building multiple sources to earn money

During this current situation, having multiple sources of income is the most crucial thing that you can imagine. Due to the economic downfall caused by the COVID-19 crisis, a majority of mid or low-income people have either lost their jobs or are about to face pay-cuts. It is too difficult to manage a job/creer in light of the Coronavirus pandemic. On the other hand, people with high-income and those who own businesses faced a huge decline in their income during the lockdown. It is still not clear when they can see a growth in their income even after the lockdown is lifted.

But, if you have multiple income streams, it would give you some financial flexibility and also help you to lower your dependency over your emergency fund or retirement accounts such as 401(k) or Roth ira. It would also keep you away from liquidating your essential investments if your main income source is in danger. Having multiple income sources can save you from falling into a new debt burden, and also help you to choose affordable solutions for debt.

So, apart from your regular business or the 9 to 5 job, you should focus on creating new income sources. During the lockdown, you may utilize more free time and use your hobbies to make money. Use your skills and provide online tuitions or work on freelance projects based on your expertise. Start affiliate marketing, or social media marketing business by using your personal computer, and make some good money without spending much. Doing such side hustles can be beneficial when you have limited income or going through a financial hardship.

3. Reorganize your budget to meet the essentials

Just think about the situation. Due to the pandemic, your income sources are getting limited and there is no sign of improvement in the economy for the time being. As a result, your purchasing power will be reduced and it may force you to pay a lot more money to buy the same thing that you bought at a cheaper rate, before the pandemic.

So, you should reorganize your budget in such a way that you may reduce low-priority or non-essential expenses, and focus only on the essential category to spend money on. Don’t forget to include contributions to emergency funds and investments towards retirement accounts. You need a solid emergency fund to meet unexpected financial obligations.

On the other hand, investing in a 401(k) or Roth IRA can help you to manage your financial expenses that come after retirement, such as taxes in retirement, medical expenses, urgent home repair, and renovation, etc. You should also make other investments to beat inflation in the long term.

4. Reconsider how much risk you can take

Due to the COVID-19 pandemic, many investors are facing financial hardship and their investment portfolios are also getting affected badly. The income streams from the investments are getting narrowed so creating wealth is now a difficult task to perform in this situation.

As a result, investors' ability to tolerate financial risks is also getting affected. Their actual ability to take investment risk is getting reduced as they do not have a solid fund to cover up losses.

For example, if you, being an investor, can take up to 30% loss over your investments previously, now you are hesitating to bear the even a minimum 10% loss. Clearly, you may not be in a position to take that much loss due to the shortage of funds.

So, it's the best time to reconsider the risk tolerance and avoid making investments in those sectors which might incur a high loss. Do not overestimate your financial capability to take high risks, the situation isn’t like the same before.

An accurate reassessment of your risk tolerance will help you start wealth creation all over again. But you should also protect your money at the same time.

5. Refurbish your investment portfolio

The investment options are not as exciting or prompt, just like it used to be before the COVID - 19 outbreak had erupted. So, before investing in multiple sectors and asset classes, you must consider your age, financial goals, risk tolerance, and expected returns.

Due to the economic slowdown and the fall in the investment markets, your investment portfolio might also face an imbalance; many of the investment returns have been narrowed or stopped.

So, you should now rebalance or refurbish your damaged investment portfolio so that you may increase or decrease the proportion of investment items in the asset classes.

Do this to make the sync between your investment profile and with your current financial goals, risk tolerance, and expected returns on various asset classes. You may also discuss the matter with a professional investment advisor if you want expert advice on this. For example, if you want to invest in the real estate sector to grow your wealth, then you should discuss the matter with a professional realtor and get suggestions or tips on real estate investing.

6. Invest in gold for future

Gold investment is the safest and best investment in the world. Being a wise investor you may invest in buying Sovereign Gold Bonds which may generate an interest income of 2.5% per annum.

In the last 30 days, gold prices have dropped by 3.16%. It is solely because of the COVID - crisis. Remember, in the future when the vaccine of COVID - 19 will be released, the economy will rise again, as well as the gold prices. So, if you have enough funds to invest in this item, go for it.

This is a guest post by Patricia Sanders

Patricia Sanders is a professional content developer and a regular contributor to debtconsolidationcare. She specializes in the financial niche and is well known for her unique financial tips that can be very effective. She always tries to help people, suffering from financial hardships, through her writing. To get in touch with her (or if you have any questions regarding this article) email at sanderspatricia29@gmail.com.

My Travel Experience During COVID

Although US Citizens are currently banned from about 33 countries (27 countries of the EU, Canada, Bahamas, China, Japan and New Zealand), there are countries whose borders have re-opened for visitors. Some of these countries include most of the Caribbean, Mexico, Turkey and Maldives.

Although US Citizens are currently banned from about 33 countries (27 countries of the EU, Canada, Bahamas, China, Japan and New Zealand), there are countries whose borders have re-opened for visitors. Some of these countries include most of the Caribbean, Mexico, Turkey and Maldives.

My husband and I love to travel! So needless to say when we were able to safely do so again, we were (cautiously) on board. We decided to take an early Anniversary trip to Mexico and are currently staying at Secrets The Vine Resort in Cancun.

Airport Experience In The U.S

We flew on American Airlines out of Pittsburgh into Cancun International Airport with a connection in Philadelphia. Masks were 100% required throughout all the airports and even on our flights. Moving through the airports was easy and efficient as not many people are traveling these days. Upon boarding the aircrafts, we were given goodie bags containing bottled water, a snack (pretzels) and hand sanitizing towelettes.

Tip: Travel with hand sanitizer and sanitizing wipes to wipe down your seats, arm rests and tray table.

Airport Experience in Mexico

Once we landed in Mexico, we were instructed to remain seated and deplane the aircraft by row allowing a safe distance between passengers. Customs officers were more efficient than usual and wore masks and face shields. Even though there were long lines, we spent less than 15 minutes getting through immigration. Once through customs, we retrieved our luggage from baggage claim (which were off the belts and waiting) and we exited to our prepaid private transportation.

Our driver also wore a mask for the duration of our short 25 minute trip to our hotel.

Resort COVID Precautions

The resort has gone above and beyond to ensure guests feel safe. Some things that have been implemented are:

Mandatory mask requirement upon arrival/check-in

Social distancing in lobby and common areas

Luggage sanitized upon arrival before being taken to our rooms

Hand Sanitizer stations throughout the resort

Social distancing on elevators ( 2 guest limit)

Staff required to wear masks and face shields at all times

All items are covered and/or placed in sanitized packages (see images below)

Beach chairs and loungers are sprayed down (sanitized) the minute someone gets up.

No buffet services

The utilization of e-menus (must carry cell phone around to scan) versus paper menus

Luggage with sanitized seal

All drink ware covered in sealed & sanitized packages

TV Remote control covered in sealed & sanitized packages

iPad covered in sealed and sanitized packages

All drink ware covered in sanitized packages

These are only a few photos of the measures our hotel is taking. Not pictured are the sealed vanity items like body gel, shampoo, conditioner, soaps, etc.

Returning To The US

When returning to the US from Mexico in particular, you will be required to scan a QR code at the airport which takes you to a questionnaire. The questionnaire includes biographical information (name, date, etc), if you have experienced symptoms of COVID, the countries you’ve visited in the last 14 days and your flight information. You will not be allowed into the security check point area without filling out the questionnaire and providing the resulting QR code to the gate agent. This is their way of tracking who goes in and out of the country.

Once back in the US, airports and specifically airline carriers are not operating at full capacity and you may have a longer than normal wait time in your connecting city. Most stores and restaurants in the airports are still closed and If you’re accustomed to going to the lounges, very few are open.

If you do get the itch to travel, do your homework and take necessary precautions. Safe travels!

7 Personal Development Podcasts To Inspire, Motivate & Transform Your Life

There are so many amazing inspirational and motivational podcasts out there. I love reading books as well but unlike books, podcasts are extremely convenient. I listen while at the gym, getting dressed, driving to work, going for a walk or even during cooking. I love the idea that In just about 20-30 minutes per day I can listen to a podcast that can transform your life.

Personal development is one of my favorite topics. Give me a space where I can work on Improving myself and that’s where I’ll be - whether it’s via a great book, podcast or course.

There are so many amazing inspirational and motivational podcasts out there. I’ve been listening to podcasts for years, and have listened to more than I can possibly count! Over the years, I’ve definitely found some that stood out more than others. I love reading books as well but unlike books, podcasts are extremely convenient. I listen while at the gym, getting dressed, driving to work, going for a walk or even during cooking. I love the idea that In just about 20-30 minutes per day I can listen to a podcast that can transform your life.

Here are my favorite personal development podcasts :

1. Design Your Dream Life - hosted by Natalie Bacon - a former lawyer and financial planner turned life coach who has been able to make a living teaching and helping high-achieving women reach their goals. In the Design Your Dream Life podcast, Natalie shares lessons on how to master your mindset, make more money, accomplish goals, and build a business.

2. Goal Digger - with host Jenna Kutcher, is one of the most popular personal development podcasts and for a good reason. Jenna shares the strategies she uses to become a self-made millionaire. She speaks on all things productivity, social media, business strategies, and hacks that will help you create your dream career.

3. Do It Scared - with host Ruth Soukup is created to help listeners face fears, overcome adversity, and create a life you LOVE. Each week she provides actionable strategies for greater productivity, motivation, entrepreneurship, creativity, fulfillment, success, and happiness, along with the motivation and encouragement to actually start making real changes that lead to big results.

4. Hey, Girl - Alex is probably one of my favorite people to follow on Instagram. I’ve been following her for years and love her mantras, affirmations and how transparent she is. She created the podcast with sisterhood and storytelling in mind. Alex sits down with people who inspire her. She unites the voices of phenomenal women near and far.

5. The Happiness Lab - This podcast is hosted by Yale Professor Dr. Laurie Santos and is based on the psychology course she teaches at Yale. Dr. Laurie will take you through latest scientific research and share some surprising and inspiring stories that will change the way you think about happiness. You might think you know what it takes to lead a happier life… more money, a better job, or Instagram-worthy vacations. You’re dead wrong. Dr. Laurie has studied the science of happiness and found that many of us do the exact opposite of what will truly make our lives better.

I discovered the podcast after taking her course, The Science Of Well Being on Coursera. Visit the Resource Page and sign up with Coursera to take courses like this and many more from other Ivy League Institutions. It’s Free!

6. The Life Coach School - Hosted by Brooke Castillo is a go-to resource in the self development department. The podcast is about solving any problem you have in your life. Topics include how to take more action, how to set goals, how to love more, how to beat procrastination, how to feel better, how to manage your time, etc. Each episode is typically 25-40 minutes.

7. The Tony Robbins Podcast - Tony Robbins is without a doubt of the biggest names in the personal development space, and his motivational podcast is a hub where he shares all of that amazing knowledge. Tony shares proven strategies and tactics for achieving massive results in your business, relationships, health, and finances.

What’s your favorite personal development podcast? Drop them in the comments.

What Is That Smell?!

Picture this, you wake up ready to start your day, walk into the kitchen and smell a fresh pot of coffee brewing. That’s a nice surprise since you don’t remember even starting the coffee maker. You walk over to the living room, pull out your yoga mat to get a nice morning stretch in and get a whiff of fresh cut roses. You inhale deeply and smile…

Picture this, you wake up ready to start your day, walk into the kitchen and smell a fresh pot of coffee brewing. That’s a nice surprise since you don’t remember even starting the coffee maker. You walk over to the living room, pull out your yoga mat to get a nice morning stretch in and get a whiff of fresh cut roses. You inhale deeply and smile. You complete your 10 minute stretch and walk out to the balcony to get some fresh air and you’re immediately turned off by the smell of cigarette smoke - yuck! The morning was going so great.

The coffee must be done brewing by now, so you go back inside to pour you a cup, but there’s no coffee. Puzzled, you wander back to the living room and take a seat. Wait, where are the roses? And who was outside smoking? Nobody, since you live on a 5 acre lot and the nearest home is a half mile away. Strange, huh?

The brief episodes of smelling something that’s not there is called Phantosmia. That’s what Dr. Tonia Farmer, a board certified Otolaryngologist / Ear, Nose and Throat (ENT) Surgeon explains she suffers from. Her phantom smell or olfactory hallucination often presents itself in the form of smelling cigarette smoke.

As she explains, some common causes/triggers of phantosmia include:

Migraines

Seizures

Respiratory Infection

Inflamed Sinuses

Head Trauma

Brain Tumor

Parkinson’s Disease

The treatment typically depends on the etiology, which is sometimes unknown. Dr. Farmer mentions regardless of the cause there are several things which help to alleviate symptoms. Those include rinsing the nose with saline, using a natural nasal inhaler (like her very own Himalayan Pink Sea Salt Inhaler) or by masking the smell( essential oils or our UnOrthoDoc Candle Co. scented candles).

If you or someone you know suffers from related symptoms, see an ENT specialist like Dr. Farmer for a comprehensive evaluation.

Dr. Tonia Farmer, MD is a Otolaryngology (Ear, Nose & Throat) Specialist in Warren, OH and has over 24 years of experience in the medical field. Dr. Farmer has more experience with Upper Respiratory Conditions, Ear, Nose, and Throat Surgery, and Sleep-disordered Breathing than other specialists in her area. She graduated from Virginia Commonwealth University School Of Medicine in 1996. She is co-owner of the world-renowned Lippy Group for ENT and Lippy Surgery Center. She is affiliated with medical facilities such as Saint Elizabeth Youngstown Hospital and St. Joseph Warren Hospital. Dr. Farmer is also the owner Salt Me! a sinus and body care business she created using salt therapy to help her patients with sinus issues.

You can find Dr. Farmer on Instagram here and here.

5 Easy, Must-Have Summer Cocktails

I don’t know about you, but summertime for me means sun, sand, beach, bikinis, flip-flops and cocktails! We’re not certain what this summer has in store for us since we are still in the middle of a pandemic. This doesn’t mean we can’t mimic our usual vacation activities and fully enjoy a staycation. All you need is a blow up pool, your swimsuit, a blender and some key ingredients!

I don’t know about you, but summertime for me means sun, sand, beach, bikinis, flip-flops and cocktails! We’re not certain what this summer has in store for us since we are still in the middle of a pandemic. Some of the beaches are closed, outdoor activities have been canceled and the borders are still closed in some of our favorite vacation spots. This doesn’t mean we can’t mimic our usual vacation activities and fully enjoy a staycation. All you need is a blow up pool, your swimsuit, a blender and some key ingredients!

For the past several weeks I’ve been sharing my cocktails on IG stories with my followers. Surprisingly, the cocktails have been garnering lots of conversation and questions. Some individuals have even requested a recipe book! I don’t know that I’m adept at creating an entire recipe book of cocktails (not a food blogger by any stretch of the imagination) but I have created a magazine-like guide called “mixed.” to share my top 5 must-have cocktails for the summer. I make these all the time and they are super easy!

I think you will really enjoy these simple and easy recipes. You can print it and place it in your kitchen where it’s easily accessible.

Leave a comment to let me know if you love the guide and don’t forget to take a pic of your drink and tag me in your stories on IG @dr.unorthodoc

8 Must-Listen Podcasts By Black Women

I am admittedly a podcast junkie. I might need help with this addiction. I learn so much from podcasts and they are a very convenient way to gain knowledge, gather information or simply get whisked away by storytelling.

I am admittedly a podcast junkie. I might need help with this addiction. I learn so much from podcasts and they are a very convenient way to gain knowledge, gather information or simply get whisked away by storytelling. Podcasting is a big business and one that is expected to keep growing. Once upon a time I considered going into it but currently opting to be a guest instead. Did you catch my first guest appearance on The Dental Diaries Podcast? Here you go.

Podcast listening by women increased by 14% in 2018. Yet, podcasting remains a genre mostly used and created by white people. However, in more recent years black people, black women in particular, are turning to podcasting as a way to amplify their voices. With that in mind, here are 8 of my favorite podcasts by black women:

1. Courtney Sanders Podcast- On The Courtney Sanders Show (formally known as The Think and Grow Chick Podcast), host Courtney dives into entrepreneurship, finances, spirituality, and personal growth topics that are sure to kick you in the butt to chase your goals

2. Myleik Teele’s Podcast - Myleik is the CEO of curlBOX and is on of my favorite people to follow on social media. She constantly drops gems and shares her insights, things she learned along the way of becoming an entrepreneur in hopes that her audience won’t have to do it the hard way.