23 Goals for 2023 Midyear Check-In

At the beginning of this year, I wrote a blog post titled "23 for 2023" where I shared my 23 goals for the year. I firmly believe in the power of goal setting as a means of self-improvement, and I am excited to provide you with a midyear check-in on my progress. Remember, research shows that writing down your goals increases the likelihood of achieving them. So, let's dive in and see how far I've come!

"Happy are those who dream dreams and are ready to pay the price to make them come true." — Leon Joseph Cardinal Suenens

At the beginning of this year, I wrote a blog post titled "23 Goals for 2023" where I shared my 23 goals for the year. I firmly believe in the power of goal setting as a means of self-improvement, and I am excited to provide you with a midyear check-in on my progress. Remember, research shows that writing down your goals increases the likelihood of achieving them. So, let's dive in and see how far I've come!

1. Read at least 23 books in 2023: I have completed 8 books so far. Usually, I would have already read about 13 books but a few other things have taken priority this year. While I'm not on track to reach my target just yet, I plan to devote more time to reading in the coming months.

2. Commit to working out 2-3 times per week: I've managed to workout at least once per week. I will have to schedule the workouts to improve on this.

3. Run a 10K: Training for a 10K has been a challenging but rewarding journey. I was scheduled to complete a 10K on May 21st and had to miss it for an impromptu meeting out of town. My goal is to find another 10K before the year is out.

4. Maintain a 7-figure practice/business: My practice/business has seen steady growth and is on track to meet this goal. I've implemented effective strategies and continue to strive for success.

5. Re-commit to date night with my husband once per week: Carving out quality time with my husband has brought us closer together. We've managed to maintain our weekly date nights, making our relationship a top priority.

6. Schedule a CEO day once per month: This goal has provided me with invaluable time to focus on strategic planning and long-term goals. I've successfully dedicated a day each month to be the CEO of my life.

7. Go to church at least one Sunday per month: I'm grateful to have attended church regularly and nourished my spiritual well-being. I have found a church home and not only attend EVERY Sunday but on several days throughout the week (online). It has brought me a sense of peace and fulfillment.

8. Complete the Wharton Masters Business of Orthodontics-AAO Program: I have completed this program! The knowledge gained has been invaluable.

9. Be more active on the Board of the DC Dental Society: I've actively participated in board meetings, contributing my expertise and ideas to benefit the dental community. It's been an enriching experience so far.

10. Drink more water (4-6 cups/day): Staying hydrated has been a challenge. I forget some days but it has been steady progress.

11. Increase my blogging & candle company income: I've implemented various strategies to grow my blogging and candle company income. I have seen tremendous growth in my blogging income this year. While I've seen some progress in the growth of my candle company, there is still room for improvement.

12. Do one family/kid-friendly activity per week(end): Spending quality time with my family has been a priority. We've enjoyed numerous activities together, creating lasting memories.

13. Spend 1000 hours outdoors: Embracing nature has been rejuvenating. I've spent considerable time outdoors with the family and plan to do a lot more this Summer whether it's hiking, picnicking, or simply enjoying the fresh air.

14. Try a new restaurant every month: The culinary scene in DC is unlike any other. Exploring this has been a delightful adventure. I've managed to try several new restaurants, expanding my palate along the way.

15. Find ways to give back to my community: Volunteering and contributing to my community have been incredibly fulfilling. I plan to increase my involvement slowly over time.

16. Do continuing education(CEs) once per month: I've attended valuable continuing education courses, broadening my knowledge and staying up-to-date in my field. So far I have only done the mandatory ones but hoping to carve out time to do some more this year.

17. One spa day per month (self-care): Monthly spa days have allowed me to recharge and prioritize my well-being. I have missed a few months but this is my reminder to schedule them in advance.

18. Book at least four trips and two "real" vacations: I've successfully booked two trips, and one real vacationing I'm currently planning the remaining two trips and vacation. I may be able to swing an additional vacation this year. The anticipation of these adventures brings me joy.

19. Gain a new skill: Learning new skills is an ongoing process, and I've been actively pursuing personal growth. I'm excited about the progress I've made and the skills I've acquired.

20. Get more sleep: Prioritizing sleep has positively impacted my overall well-being. While I still have room for improvement, I've been making conscious efforts to ensure I get adequate rest.

21. Pay off debt: I've made significant progress in paying off my debts. By adhering to a disciplined financial plan, I'm steadily moving towards my goal of financial freedom.

22. Learn one new recipe every month: I have done a terrible job here. Re-evaluating.

23. Shop with more small businesses: Supporting small businesses has become a conscious choice for me. I've actively sought out and purchased from local entrepreneurs and black-owned businesses knowing that my contribution makes a difference.

Midyear Check-In Reflection:

Reflecting on my progress thus far, I'm proud of what I have accomplished. However, I also recognize areas where I can strive for improvement in the second half of the year. Regularly assessing my goals helps me stay accountable and motivated.

I invite you to share your progress and goals for 2023. Together, let's continue working towards our dreams and creating the lives we envision. Remember, it's never too late to set new goals and take steps towards achieving them. Stay tuned for the end-of-year update on my 23 for 2023 goals!

What are your 2023 goals? Let's inspire each other on this journey of personal growth and self-improvement.

23 Goals for 2023

Time and time again, research shows that you are more likely to achieve your goals when you write them down. In that same breath, it is important then when you’re thinking about setting goals, you set yourself up for success. That means having a method of planning that allows you to track your progress in the right way, stay motivated, and encourages you to be both consistent and disciplined.

“Happy are those who dream dreams and are ready to pay the price to make them come true.” — Leon Joseph Cardinal Suenens

I really enjoy goal setting. It is one of my key methods of self improvement yearly.

Time and time again, research shows that you are more likely to achieve your goals when you write them down. In that same breath, it is important that when you’re thinking about setting goals, you set yourself up for success. That means having a method of planning that allows you to track your progress in the right way, stay motivated, and encourages you to be both consistent and disciplined. For as long as I can remember, I’ve kept a planner where all tasks, meetings, outings and goals (big, small, daily, weekly, monthly, etc) live. I highly recommend downloading the 2023 goal planner from my shop. I personally use this and update it every year. You can download it for free by signing up for my newsletter.

This year I’m writing my goals down as it corresponds with the year! I heard this pretty cool idea on the GenTwenty podcast and thought I’d give it a whirl so here goes…these are my 23 goals for 2023:

Read at least 23 books in 2023

Commit to working out 2-3 times per week

Run a 10K

Maintain a 7-figure practice/business

Re-commit to date night with my husband once per week

Schedule a CEO day once per month

Go to church at least one Sunday per month

Complete the Wharton Masters Business of Orthodontics-AAO Program

Be more active on the Board of the DC Dental Society

Drink more water (4-6 cups/day)

Increase my blogging & candle company Income

Do one family/kid friendly activity per week(end)

Spend 1000 hours outdoors

Try a new restaurant every month

Find ways to give back to my community

Do continuing education (CEs) once per month

One spa day per month (self care)

Book at least four trips and two “real” vacations

Gain a new skill

Get more sleep

Pay off debt

Learn one new recipe every month

Shop with more small businesses

Now that I’ve written this on the blog, you get to be my accountability partner. I will do one check-in mid year to update my progress and another at the end of the year. What are your 2023 goals?

Retirement Planning for Young Professionals in 2023

If you’ve been a reader here for a while you know that financial development is one of my favorite topics, especially when it comes to retirement planning. It is never too early (or late) to start saving towards your retirement! The past several years have made saving and investing a bit challenging but if I had any advice for a place to park what little money you may have left over for investing, it would be in a retirement account.

2023 RETIREMENT CONTRIBUTION LIMITS

If you’ve been a reader here for a while you know that financial development is one of my favorite topics, especially when it comes to retirement planning. It is never too early (or late) to start saving towards your retirement! The past several years have made saving and investing a bit challenging but if I had any advice for a place to park what little money you may have left over for investing, it would be in a retirement account.

It is no secret at all that we are heading into a recession, if we are not already in the middle of one. The US government is trying to tighten up to decrease spending across all boards to combat our current inflation crisis. This could mean higher prices for goods and services which will trigger less spending but we could also see a smaller amount left over on our paychecks. It is imperative now more than ever to dump whatever money you may have into a safe place like a retirement fund. Now is not the time for gambling and high risk, in my opinion.

When speaking of saving for retirement, it is very important to have some knowledge of compounding interest to fully understand the benefits of starting early. This post will cover some retirement basics, contribution limits and what to do with extra money should you find yourself so lucky.

I must remind you that retirement planning is a long term investment. In most cases you will not be able to access these funds until around age 59 1/2 without severe ramifications (taxes + penalties). So, if you are investing and need to access your funds sooner than this, you may have to think of other types of investments. Take a look at other investment vehicles here, here and here.

There are many different accounts and plans available and choosing the right one is very important as they each have different benefits and advantages, especially when it comes to tax planning. Here are a few to help you get started:

Simple IRA (Savings Incentive Match Plan for Employees)

For the year 2023, participants can make employee contributions of up to a maximum of $15,500 per year if you are under 50 years old and $19,000 if you are older than 50. This is a retirement plan that is usually available to self-employed individuals, however both employee and employer contribute to this account. Contributions are non tax deductible.

Traditional IRA

Anyone can open a traditional IRA account - but honestly, if you are a dentist or physician (like most of my colleagues are), then there really is no use for this type of account. During residency you have the option to open a Roth IRA (more on that below) because your lower salary allows you to stay within the income restrictions. Later as you start your career and your salary increases you will most likely surpass the income caps and will have the ability to deduct your traditional IRA contributions. However, it’s worth understanding as it forms the framework for all other types of retirement accounts. A Traditional IRA is set up by you (not an employer) and the maximum contribution to this type of account is $6,500 if you’re under 50 years old and $7,500 if you’re older. The contributions are tax deductible and grows tax-free. If you withdraw the money prior to age 59 1/2, there will be ramifications of a 10% tax (penalty) as well as any income tax which would be owed on the money. After age 59 1/2, you just have to pay the income tax based on your tax bracket at that time. At age 70, you will be required to start withdrawing part of the money each year, the “Required Minimum Distribution (RMD).” This is age based and starts out at about 3.6% and increases to about 8.8% at age 90.

Roth IRA

I absolutely love a Roth IRA. However, there is a contribution income limit. If you make more than $153K (single) or $228K (married), you cannot contribute to a Roth IRA. However, there are ways to get around that with Roth IRA conversions, which we will discuss in a subsequent post. Anyone with earned income can open a Roth IRA and contribute up to $6500 per year. If you’re over 50, those limits are raised to $7500 per year.

The reason I love a Roth IRA is because you contribute with after-tax money, but it is never taxed again! You don’t pay taxes on capital gains and dividends as the money grows, and it comes out tax-free in retirement. You generally can’t access the money before age 59 1/2, but unlike a 401K or Traditional IRA there are no required minimum distributions beginning at age 70.

401K

If you are an employee of a company and your employer offers a 401K retirement plan, there’s absolutely no reason why you should not be participating. It is even more important that you participate if said company is offering a match. A match is basically free money! Do not leave free money laying on the table. The contribution maximum for the year 2023 is $22,500 and the great thing about a 401K is that you are investing pre-tax dollars. The not-so great thing is that when you go to retrieve your money (after age 59 1/2), you will be taxed on this (unlike with a Roth IRA).

If you're an Independent Contractor (not a W2 employee), you’re considered to be “running your own business.” In this case, you can also make an employer contribution of 20% of your net income up to $55,000.

SEP IRA (Simplified Employee Pension)

If you have your own practice, a SEP IRA may be a good option. This allows you to contribute 25% of your business profit or $66,000 per year, whichever is less. The contributions are tax deductible, and investments grow tax deferred until retirement.

IF YOU FIND YOURSELF WITH SOME EXTRA CASH, HERE’S WHAT YOU CAN DO WITH IT:

Fund a Traditional Brokerage Account

Traditional brokerage accounts don't offer any sort of tax benefit for the money you put in, unlike IRAs and 401Ks. However, they offer flexibility in that you can withdraw funds at any time and for any reason. If you decide to retire early, like my husband did, you can use the money in your brokerage account to pay your living expenses. There are no income limits associated with funding a brokerage account.

Fund a Health Savings Account

HSAs are funded with pre-tax dollars, like traditional IRAs and 401(k)s. Withdrawals can be taken at any time, and they're tax-free as long as they're used to pay for qualified medical expenses. Any money not used immediately can be invested, just like in an IRA or 401(k). If withdrawals are taken for non-medical purposes, they will be subject to a 20% penalty.

However, once the contributor reaches the age of 65 funds can be accessed for any reason without being penalized. At that point, your HSA can serve as a general retirement savings account.

This is not a comprehensive list of retirement vehicles but certainly a great place to start. Everyone, as early as possible, should start contributing to one of the above. Speak with your financial planner or accountant for more clarification about which plan is best for you. If you need more info on this visit, the IRS website. Hope this helps in getting started.

How To Smash Your Goals in 2023

The last several years taught us a lot about uncertainty, to the point where now we probably have gotten used to plans changing on a whim or at least a bit more comfortable with variability. Nevertheless, the beginning of a new year is a hopeful time. It is often a time where we daydream and envision our ideal future and motivate ourselves to turn our vision of this future into reality by reaching and smashing our goals.

The last several years taught us a lot about uncertainty, to the point where now we probably have gotten used to plans changing on a whim or at least a bit more comfortable with variability. Nevertheless, the beginning of a new year is a hopeful time. It is often a time where we daydream and envision our ideal future and motivate ourselves to turn our vision of this future into reality by reaching and smashing our goals.

My method of goal setting remains the same, but I wanted to add a few specifics this time around:

1.START WITH A YEAR REVIEW

I know this might seem like a lot of work, but it’s worth your time. Don’t stress, just be honest with yourself. If you had a planner last year, just look back through the months and assess everything without judgment. The easiest way to do this review is by answering these 5 questions:

Identify 3 to 5 things that made you proud from 2022

If you set goals for 2022, how far did you get?

Identify what worked well, what didn’t work and why

Are there things you would like to improve, start or stop doing?

What are some of the lessons you learned last year that you want to keep moving forward?

2. PRIORITIZE YOUR GOALS

Now that you’ve done your year review, identify the top priority areas that you want to work on whether it is career, finances, health, relationships, etc. It could be all of the above, but pinpoint specific things in each category to work on. Remember, this is not about anyone else but YOU. This is personal.

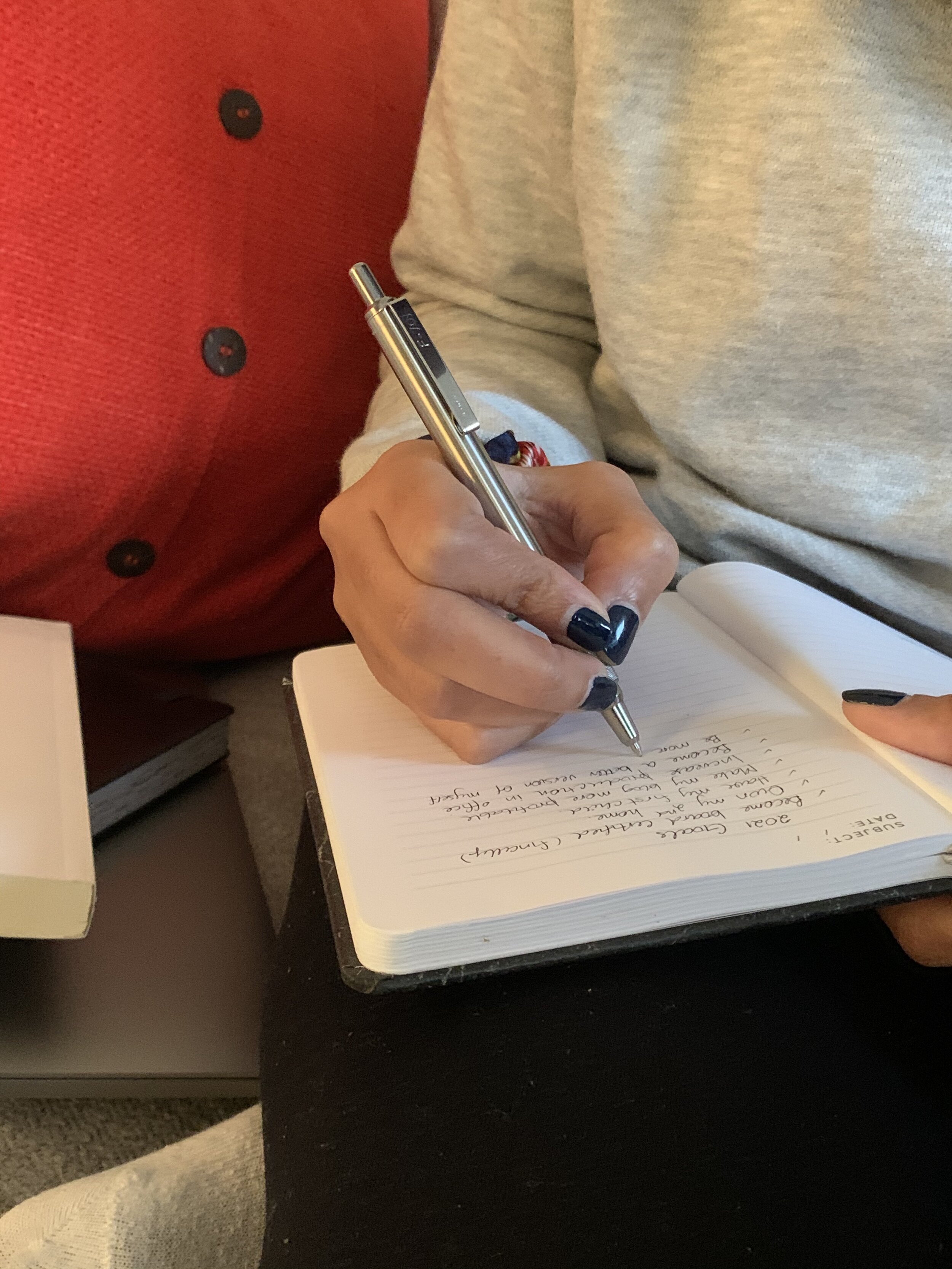

3. WRITE YOUR GOALS DOWN

A sure way to make things happen is to write it down. It sounds strange, but there is enormous power in putting things down on paper, and according to research you become 42% more likely to achieve your goals and dreams when it’s written. I always keep a physical (paper) planner even though I use the planner on my smartphone as well.

4. BUILD A SYSTEM AROUND ACHIEVING YOUR GOALS

This is where we sometimes lose focus. We may know what goal(s) we want to accomplish but before putting action steps into place they are intentions. Right now the steps in how to accomplish your goals might be blurry, let’s turn them into action:

5. MAKE YOUR GOALS S.M.A.R.T.E.R

So how exactly do you set intentions that you will actually stick to? Be SMART about it. But this year, I want us to be SMARTER.

Before you set a goal, first figure out your “why.” By figuring out and articulating the reason you want to achieve something you are more likely to remain motivated to stick to it.

S - Small and Specific: What do you want to do? Break your goals into smaller, more specific ones. For example, if your goal is to eat healthier in 2022, be more specific by making it about adding 1 fresh fruit or vegetable and a bottle of water per day for the month of January.

M - Measurable : How will you track your progress? All your goals must be measurable, that means you should be able to describe the physical manifestation of the outcome of your goal. Example, losing 2lbs per week by adding one fruit or vegetable and a bottle of water to our diet each day.

A - Attainable: How will you do it? Is your goal attainable? Can you realistically achieve your goal? Another great way to stay on track is to find an accountability partner. Example, someone who will check in to make sure you had your fruit/vegetable each day or someone who will ensure you meal prep.

R - Relevant: Is this relevant to your life right now? Is this goal relevant to you or even realistic? Ensure you’re not setting a goal that you really don’t care about and hence not realistic. Example, I dislike running. If I make it a goal of mine to incorporate running 1 mile/day I know I will fail. Instead, I ensure I get my cardio in by getting on the elliptical, peloton or taking a Zumba class.

T - Timely: When do you want to do it? Make a tentative plan for everything you do. Don’t just make it a goal to exercise once per day. You know your schedule, you know if you’re a morning or late night person. Instead of saying you will work out once per day, say you will work out at 5:30am on Mondays, Wednesdays and Fridays for 1 hour before work.

E - Evaluate: How is it going? If you’re not tracking your progress how will you know what’s the cause of you not getting those killer abs? At the end of the month, go back through your planner and see if you stuck to the plan to reach your goal. 1. Did you meal prep every week for the past month? 2. Did you in fact incorporate 1 fruit/vegetable and a bottle of water to your diet each day for the month? Did you work out 3 times per week for the month? It’s okay if you missed a day or two (you’re a work in progress).

R - Readjust: How can you make it better? If you missed the mark in some areas last month =, you can make adjustments to improve next month. 3 days per week at 5:30am didn’t work for you? Maybe try Monday morning at 6am before work, Wednesday evening at 6pm after work and Saturday afternoon. Readjust until you hit your sweet spot.

6. TRACK YOUR PROGRESS, REFLECT AND RE-CALIBRATE

Resist the urge to freestyle your goals and actually check your progress as you go along. At the end each month, take time out to analyze what you have achieved, what you failed to achieve and how to improve on this (last 2 steps above). Journaling as you go along and circling back at the end of each month can really help you to stay on track.

7. ADJUST TO LIFE’S LEMONS

Life gets in the way and can derail you. Things such as illness, family commitments, work, life emergencies etc can impact your goals. Take note of these things and adjust as you proceed.

8. ASK FOR HELP

Lastly, get an accountability partner. Have a friend or loved one you can lean on for moral support and encouragement, you will need it from time to time. If you need specific help, reach out to those who can offer any guidance or assistance. The internet and social media is a great way to make connections.

Bonus: Be your own D**n Cheerleader and eliminate self doubt. Figure out what keeps you motivated and inspired. I love quotes! I keep them everywhere - my phone’s wallpaper, sticky notes around the house, on my desk at work, on the bathroom mirror, etc. I listen to music, books and podcasts that are uplifting. I tolerate no negativity and try to stay away from it at all costs.

Remember, a goal without a plan is just a wish. By breaking down your goals into bite-sized, manageable actions and writing them down, setting goals and intentions for the new year that you can actually stick to becomes a much easier process.

Grab a planner, a journal and let’s get ready to smash our 2023 goals! Remember, a sure way to make things happen is to write it down.

A Guide To Setting SMART Goals

The value of setting goals in life cannot be overstated. We need to feel like we’re working toward a goal to ultimately feel fulfilled and joyful in life. But are all goals created equal? Not necessarily. The outcomes you want ultimately point to the quality of the objectives you’re setting for yourself – and if you’re not using SMART goals, you could be holding yourself back

Sometimes we set goals and then fall short, that’s okay. Everyone fails from time to time – it’s part of life’s journey. But if you find yourself consistently not reaching or giving up on your goals, it’s time to find a new way to set your intentions.

The value of setting goals in life cannot be overstated. We need to feel like we’re working toward a goal to ultimately feel fulfilled and joyful in life. But are all goals created equal? Not necessarily. The outcomes you want ultimately point to the quality of the objectives you’re setting for yourself – and if you’re not using SMART goals, you could be holding yourself back

MAKE YOUR GOALS S.M.A.R.T

So how exactly do you set intentions that you will actually stick to? Be SMART about it.

Before you set a goal, first figure out your “why.” By figuring out and articulating the reason you want to achieve something you are more likely to remain motivated to stick to it, rather than it being something you think you should do.

S - Small and Specific: Break your goals into smaller, more specific ones. For example, if your goal is to eat healthier in 2023, be more specific by making it about adding 1 fresh fruit or vegetable and a bottle of water per day for the month of January. Do you want to make more money this year? Saying you “want to earn more” is too vague. Instead, pick a number for how much money you want to earn. Is it $150,000 per year, $500,000 or even $1 million? Set a clear number to track your progress against. Having a specific goal is helpful in two ways: you can better visualize your outcome – imagine all those zeroes in your bank account – and you will know without a doubt when you’ve achieved it.

M - Measurable : All your goals must be measurable, that means you should be able to describe the physical manifestation of the outcome of your goal. Example, losing 2lbs per week by adding one fruit or vegetable and a bottle of water to our diet each day. Or, in the case of making $150,000 per year you can check the numbers as the year goes on to see if you’re reaching the goal.

A - Attainable and Accountability: Is your goal attainable? Can you realistically achieve your goal? Another great way to stay on track is to find an accountability partner. Example, someone who will check in to make sure you had your fruit/vegetable each day or someone who will ensure you meal prep. If it’s to make $150,000 do you have the potential to even earn that income (switching jobs, salary increase, unique skills, side hustles, etc). When you create a goal that’s too lofty, it can seem impossible. You may be overwhelmed and eventually give up.

R - Relevant and Realistic: Is this goal relevant to you or even realistic? Ensure you’re not setting a goal that you really don’t care about and hence not realistic. Example, I dislike running. If i make it a goal of mine to incorporate running 1 mile/day I know I will fail. Instead, I ensure I get my cardio in by getting on the elliptical, bike or taking a Zumba class. Realistic goals are those that you are willing and able to work toward that can be achieved by improving your current habits.

T - Timely: Make a tentative plan for everything you do. Don’t just make it a goal to exercise once per day. You know your schedule, you know if you’re a morning or late night person. Instead of saying you will work out once per day, say you will work out at 5:30 each morning for 1 hour before work/school. Do you think you can start earning your desired salary in six months, one year or two years? Having a clear time frame is essential for checking your progress along the way to reaching your goal.

Because of their effectiveness, SMART goals are commonly used in business, but you can also use them in your personal life, from creating fulfilling relationships to mastering a new skill. No matter which area of your life you want to improve, this tested strategy saves you the wasted time of not knowing precisely what you want or how to get it. SMART goals can help you “ladder up” to the bigger goals you set when you identify your purpose. Being purposeful and living with intention is what SMART goals are all about.

HOW TO ACHIEVE SMART GOALS

Now that we’ve answered the question “what is a SMART goal?” let’s look at a few tips for achieving them.

START SMALL

Instead of tackling your most urgent or loftiest goal pick something small to start with.

WRITE IT DOWN

According to a study conducted at the Dominican University in California, those who write down their goals are 42% more likely to achieve them. It doesn’t matter whether you write your SMART goals in a journal, enter them into an app or type them into a Word document. Just make sure they are documented.

CHECK-IN REGULARLY

How long will it take you to reach your SMART goals? How do you know if you’re falling off track? Regular check-ins allow you to evaluate your progress and course-correct when necessary.

DON’T LET FEAR HOLD YOU BACK

If you’re not making the progress you’d like, take a look at what’s holding you back. Are you hesitant because your goal or approach is unreasonable, or are you reticent because of a deep-seated fear of failure? Finding the source of your hesitation is critical, since overcoming our fears is pivotal to goal mastery as well as personal and professional development.

CELEBRATE EVERY WIN

When you celebrate wins – even the small ones – your brain gets a boost of dopamine that reenergizes and refocuses you. If you’re working on professional SMART goals, celebrate small wins with your team. Not only will this help you to continue to press forward but it will also inspire your team to do the same. Personal successes? Celebrate with your friends or family. After you’ve celebrated, get right back on track so you can work toward celebrating the next win.

Setting Financial Goals in 2022

It may be important to cut down on carbohydrates or increase the number of trips you make to the gym each week (of course, you can still do those things), but harnessing the power of focused financial discipline can provide you with practical habits that can serve you for a lifetime.

At this point we have become very good at setting new year goals or resolutions. However, setting financial goals for the new year is a very different kind of ambition than working out, losing weight or making our beds every day.

Yes, it may be important to cut down on carbohydrates or increase the number of trips you make to the gym each week (of course, you can still do those things), but harnessing the power of focused financial discipline can provide you with practical habits that can serve you for a lifetime.

Here are seven straightforward and achievable practices for helping to improve your financial future.

Set Up a Budget & Track what you spend

A great first step is taking note of your monthly net income. That would be your take-home pay or any other income you have, after taxes. Next, list all of your expenses, including fixed items such as housing, utilities, transportation, and any regular debt payments, such as loans, credit cards, insurance, etc.

Include and track your average grocery costs, out-of-pocket medical fees, and discretionary personal spending. Hopefully there’s enough room left in the budget for saving and investing. The important idea here is to make a budget that works for you and to stay on track.

Set Up an Emergency Fund

It’s easy to feel confident when everything is going fine, but having a rainy day fund set aside in an accessible account could mean the difference between getting through a difficult stretch or falling into a much more dire situation. Th rule of thumb is to have 3-6 months of living expenses put aside. Some people opt to have a more hefty cushion, like 12 months. If you lose your job, encounter a serious health issue, or are met with any number of other unexpected financial challenges, having an emergency fund could make all the difference to your financial wellbeing.

Pay Off Credit Cards

Getting a handle on credit card debt is critical in creating healthy New Year’s resolutions you can actually stick to and follow through on. The credit card companies are very adept at convincing people that spending is easy. Try to pay off the entire credit card balance whenever it is used.

If you’re unable to pay the entire balance and have multiple credit cards consider credit card consolidation. This can allow you to get on a fixed payment schedule with a target payoff date, potentially lower your interest rate, and possibly improve your credit score.

Saving X Amount of Dollars

I am not a big proponent of having money sit in a savings account because the interest rates on average are really low. Unless you’re putting money towards your emergency fund or putting money aside for a big purchase like a downpayment on a car or home, your money is better placed in investments where the returns are much higher.

Saving for Retirement

It is never too early (or late) to put money away for retirement. Opening a 401(k) or an IRA should be a top priority. Hopefully, your employer will offer to match your 401(k) contribution up to a certain percentage. This can be especially beneficial because your contributions aren’t taxed on the way in.

Alternatively, if your job does not offer a 401(k) plan, you can set up your own IRA. If you already have one, you can make it a New Year’s resolution to contribute the maximum amount. Currently, 401(k) plans and IRAs have a maximum limit of $20,500 and $6000 for 2022, respectively.

Start Investing

Deciding on what investments to make can be a part of your overall financial strategy. Most likely you have goals spread throughout all the stages of your life plan and your portfolio should reflect those priorities.

For example, your short term goals (fewer than three years) may include an emergency fund, travel plans or buying a car. You may want these funds to be liquid in order to access them more quickly. For medium and longer term investments (saving for a down payment or retirement etc), you may be able to take some risk, thereby increasing the opportunity for greater returns. It’s always helpful to have some guidance as you establish your investment plans. Speak with your financial advisor to see the options that are best for you and your situation.

Here are some Investment topics and strategies to dive into:

Investing 101: Invest In Yourself

Setting Up Your First Investment Account

How To Start Investing In The Stock Market

6 Questions To Ask Before Investing

6 Tips on Getting Into Real Estate Investing

5 Ways To Invest in Real Estate

Up Your Investing Game with NFTs

Long Term Financial Planning

While it may seem like you have plenty of time before you need to focus on long-term financial goals, there can be more to it than just saving for retirement. It’s never too early to imagine where your life is headed and what you want to achieve in the future.

This can be anything from owning a home, to raising a family, to starting a business, to becoming debt free, to maximizing your earning power. Envisioning what’s possible can enable you to set practical goals to get you there. Once you’ve outlined a plan it is equally important to revisit your plan regularly and make adjustments as needed.

All of these options provide a practical way to rethink your financial activities so you can begin developing an overall strategy for building wealth. And the earlier in your career that you start—especially in your 20s and 30s—the more power your money can provide you over the long run.

Of course it’s never too late to start adopting practical habits for spending, saving, investing and planning. And if you set your mind to it, there’s no limit to the possibilities you can uncover—while maintaining that resolution to go to the gym regularly, too.

How to Smash Your Goals in 2022

The years 2020 and 2021 taught us a lot about uncertainty. Nevertheless, the beginning of a new year is a hopeful time. Let’s set and smash our goals in 2022!

The years 2020 and 2021 taught us a lot about uncertainty, to the point where now we probably have gotten used to plans changing on a whim or at least a bit more comfortable with variability. Nevertheless, the beginning of a new year is a hopeful time. It is often a time where we daydream and envision our ideal future and motivate ourselves to turn our vision of this future into reality by smashing our goals.

My method of goal setting remains the same, but I wanted to add a few specifics this time around:

1.START WITH A YEAR REVIEW

I know this might seem like a lot of work, but it’s worth your time. Don’t stress, just be honest with yourself. If you had a planner last year, just look back through the months and assess everything without judgment. The easiest way to do this review is by answering these 5 questions:

Identify 3 to 5 things that made you proud from 2021

If you set goals for 2021, how far did you get?

Identify what worked well, what didn’t work and why

Are there things you would like to improve, start or stop doing?

What are some of the lessons you learned last year that you want to keep moving forward?

2. PRIORITIZE YOUR GOALS

Now that you’ve done your review, identify the top priority areas that you want to work on whether it is career, finances, health, relationships, etc. It could be all of the above, but pinpoint specific things in each category to work on. Remember, this is not about anyone else but you.

3. WRITE YOUR GOALS DOWN

A sure way to make things happen is to write it down. It sounds strange, but there is enormous power in putting things down on paper, and according to research you become 42% more likely to achieve your goals and dreams when it’s written. I always keep a physical (paper) planner even though I use the planner on my smartphone as well. If you’re in need of a planner, you can find one here.

4. MAKE YOUR GOALS S.M.A.R.T.E.R

So how exactly do you set intentions that you will actually stick to? Be SMART about it. You’ve heard me speak on setting smart goals here and here. But this year, I want us to be SMARTER.

Before you set a goal, first figure out your “why.” By figuring out and articulating the reason you want to achieve something you are more likely to remain motivated to stick to it.

S - Small and Specific: What do you want to do?

M - Measurable : How will you track your progress?

A - Attainable: How will you do it?

R - Relevant: Is this relevant to your life right now?

T - Timely: When do you want to do it?

E - Evaluate: How is it going?

R - Readjust: How can you make it better?

5. Build a system around ACHIEVing YOUR GOALS

This is where we sometimes lose focus. We may know what goal(s) we want to accomplish and at this point they are intentions, but the steps in how to accomplish them might get blurry, so we need to turn them into action.

6. TRACK YOUR PROGRESS, REFLECT AND RE-CALIBRATE

Resist the urge to freestyle your goals and actually check your progress as you go along. At the end each month, take time out to analyze what you have achieved, what you failed to achieve and how to improve on this. Journaling as you go along and circling back at the end of each month can really help you to stay on track.

7. ADJUST TO LIFE’S LEMONS

Life gets in the way and can derail you. Things such as illness, family commitments, work, life emergencies etc can impact your goals. Take note of these things and adjust as you proceed.

8. ASK FOR HELP

Lastly, get an accountability partner. Have a friend or loved one you can lean on for moral support and encouragement, you will need it from time to time. If you need specific help, reach out to those who can offer any guidance or assistance. The internet and social media is a great way to make connections.

Bonus: Be your own D**n Cheerleader and eliminate self doubt. Figure out what keeps you motivated and inspired. I love quotes! I keep them everywhere - my phone’s wallpaper, sticky notes around the house, on my desk at work, on the bathroom mirror, etc. I listen to music, books and podcasts that are uplifting. I tolerate no negativity and try to stay away from it at all costs.

Remember, a goal without a plan is just a wish. By breaking down your goals into bite-sized, manageable actions and writing them down, setting goals and intentions for the new year that you can actually stick to becomes a much easier process.

Grab your planner and let’s smash our 2022 goals! Remember, a sure way to make things happen is to write it down.

7 Steps to Smashing Your Goals in 2021

As we optimistically set out to achieve great things at the beginning of the year, we must break our goals down into small manageable, attainable and realistic ones. Setting new year resolutions has been a long time tradition but did you know that statistics show that only about 10% of people actually stick to their new year resolutions past the month of January?

Beginning a new year is such a hopeful time. Whether we break out an unblemished calendar or merely scroll over to the month of January on our smart phones, there’s the sense of being given a fresh start every January. We make notes, either mentally or on paper, of New Year’s resolutions we’re determined to accomplish. Goal setting is a powerful process for thinking about your ideal future, and for motivating yourself to turn your vision of this future into reality by smashing your goals in 2021. The process of setting goals helps you choose where you want to go in life. By knowing precisely what you want to achieve, you know where you have to concentrate your efforts. You’ll also quickly spot the distractions that can, so easily, lead you astray.

With that said, as we optimistically set out to achieve great things at the beginning of the year, we must break our goals down into small manageable, attainable and realistic ones. Setting new year resolutions has been a long time tradition but did you know that statistics show that only about 10% of people actually stick to their new year resolutions past the month of January?

I am a huge proponent of self improvement and and an even bigger proponent of setting goals that are actually measurable and attainable. With that said, let’s make 2021 the year we actually accomplish our goals with these 7 steps:

1. WRITE YOUR GOALS DOWN

A sure way to make things happen is to write it down. It sounds strange, but there is enormous power in putting things down on paper, and according to research you become 42% more likely to achieve your goals and dreams when it’s written. I always keep a physical (paper) planner even though I use the planner on my smartphone as well. After years of not being able to find the perfect planner, I have decided to create a goal planner and to share it with my readers.

2. PRIORITIZE YOUR GOALS

Identify the top priority areas that you want to work on. Is it health? Finances? Career? It could be all of the above, but pinpoint specific things in each category to work on. For example, if it’s finances a realistic goal would be to increase your monthly savings by 5% or to save $X amount for an emergency fund by X-date. This process of narrowing your goals down helps to weed out the ones you just aren’t that committed to.

3. MAKE YOUR GOALS S.M.A.R.T

So how exactly do you set intentions that you will actually stick to? Be SMART about it.

Before you set a goal, first figure out your “why.” By figuring out and articulating the reason you want to achieve something you are more likely to remain motivated to stick to it, rather than it being something you think you should do.

S - Small and Specific: Break your goals into smaller, more specific ones. For example, if your goal is to eat healthier in 2021, be more specific by making it about adding 1 fresh fruit or vegetable and a bottle of water per day for the month of January.

M - Measurable : All your goals must be measurable, that means you should be able to describe the physical manifestation of the outcome of your goal. Example, losing 2lbs per week by adding one fruit or vegetable and a bottle of water to our diet each day.

A - Attainable and Accountability: Is your goal attainable? Can you realistically achieve your goal? Another great way to stay on track is to find an accountability partner. Example, someone who will check in to make sure you had your fruit/vegetable each day or someone who will ensure you meal prep.

R - Relevant and Realistic: Is this goal relevant to you or even realistic? Ensure you’re not setting a goal that you really don’t care about and hence not realistic. Example, I dislike running. If i make it a goal of mine to incorporate running 1 mile/day I know I will fail. Instead, I ensure I get my cardio in by getting on the elliptical, bike or taking a Zumba class.

T - Timely: Make a tentative plan for everything you do. Don’t just make it a goal to exercise once per day. You know your schedule, you know if you’re a morning or late night person. Instead of saying you will work out once per day, say you will work out at 5:30 each morning for 1 hour before work/school.

4. FIGURE OUT HOW YOU WILL ACHIEVE YOUR GOALS

This is where we sometimes lose focus. We may know what goal(s) we want o accomplish but the steps in how to accomplish them might get blurry.

Say you want to increase your savings this year. As in the example above, you would start by committing to an extra 5% of your biweekly salary. To make this actually attainable would be to automate it. If 5% of your biweekly salary is $350 then automate that amount to go into your savings vehicle twice per month. A “set it and forget it” approach works well in this case.

5. TRACK YOUR PROGRESS, REFLECT AND RE-CALIBRATE

Resist the urge to freestyle your goals and actually check your progress as you go along. What can you improve? What isn’t working? At the end each month, take time out to analyze what you have achieved, what you failed to achieve and how to improve on this. Journaling as you go along and circling back at the end of each month can really help you to stay on track.

6. ADJUST TO LIFE’S LEMONS

Life gets in the way and can derail you. Things such as illness, family commitments, work, life emergencies etc can impact your goals. Take note of these things and adjust as you proceed.

7. ASK FOR HELP

Lastly, get an accountability partner. Have a friend or loved one you can lean on for moral support and encouragement, you will need it from time to time. If you need specific help, reach out to those who can offer any guidance or assistance. The internet and social media is a great way to make connections.

Bonus: Be your own D**n Cheerleader and eliminate self doubt. Figure out what keeps you motivated and inspired. I love quotes! I keep them everywhere - my phone’s wallpaper, sticky notes around the house, on my desk at work, on the bathroom mirror, etc. I listen to music, books and podcasts that are uplifting. I tolerate no negativity and try to stay away from it at all costs.

Remember, a goal without a plan is just a wish. By breaking down your goals into bite-sized, manageable actions and writing them down, setting goals and intentions for the new year that you can actually stick to becomes a much easier process.

Grab your planner and let’s smash our 2021 goals! Remember, a sure way to make things happen is to write it down.

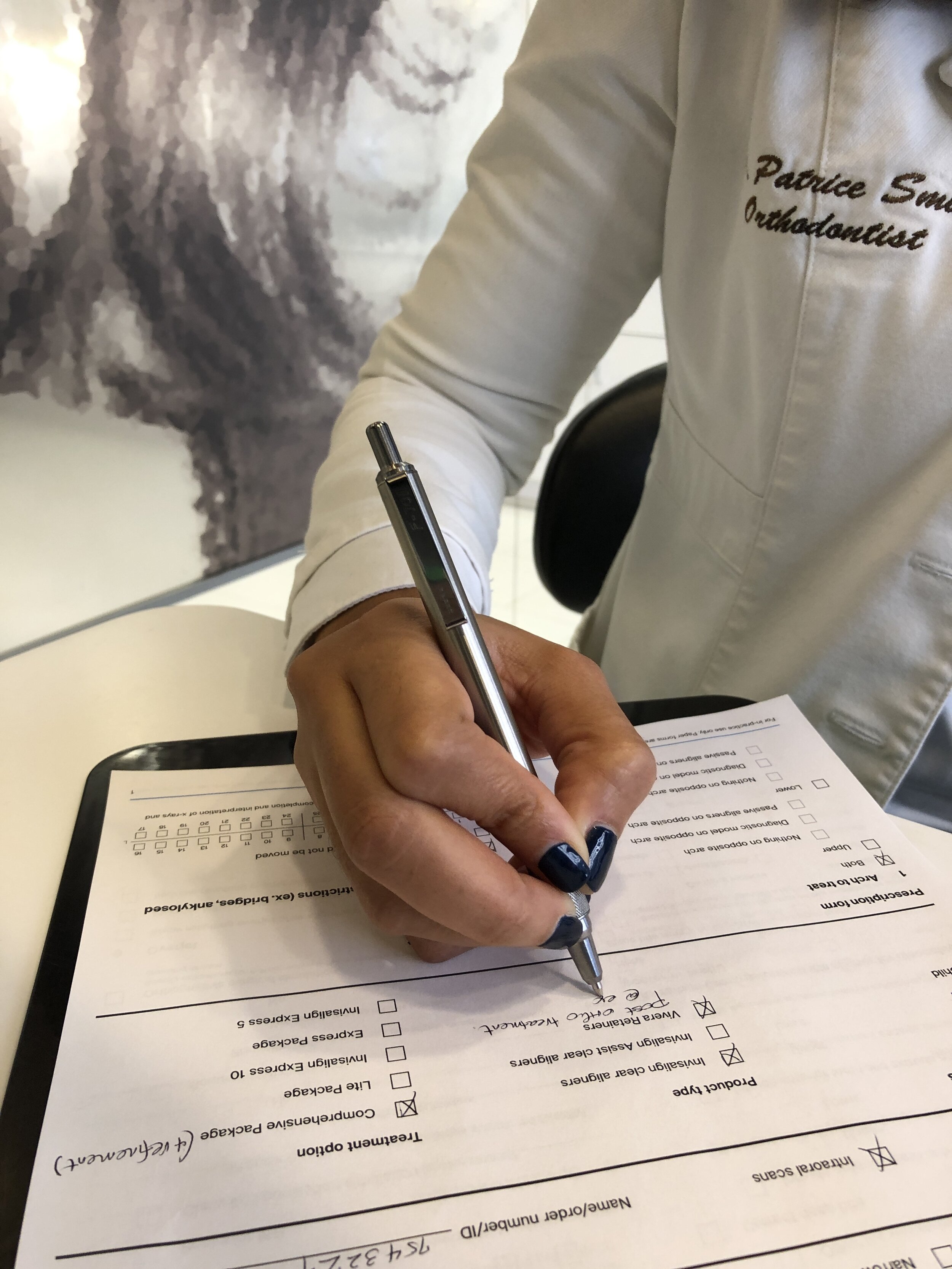

Write It Down & Make It Happen With Zebra Pen

As an Orthodontist, blogger, philanthropist and side hustle extraordinaire, my life takes a certain level of organization and my writing utensil is a big part of that. From writing charts, treatment planning, signing documents, and creating content, I need instruments that will help to not only keep me on track but also offer reliability and efficiency. One Instrument I am very particular about is my pen.

This post has been sponsored by Zebra Pen. All thoughts and opinions are my own.

I don’t know about anyone else, but even though we are completely in the digital age, there’s just something about putting pen to paper that helps to clarify my goals and priorities. Whether it’s writing in my journal, scribbling down my daily to-do lists, scheduling meetings and due dates or scribing my treatments plans at work, there is something about the analog nature of writing things down with a real pen on paper that helps me to properly set my intentions and achieve my goals.

Writing things down forces our ideas to become real.

“When we write things down, we enter a world of possibility”

As an Orthodontist, blogger, philanthropist and side hustle extraordinaire, my life takes a certain level of organization and my writing utensil is a big part of that. From writing charts, treatment planning, signing documents, and creating content, I need instruments that will help to not only keep me on track but also offer reliability and efficiency. One Instrument I am very particular about is my pen.

My go-to writing utensil is the Zebra Pen STEEL F-701® ALL METAL Ballpoint Retractable Pen. Not only does it have a very stylish design but it also provides a high-quality writing experience that helps me stay organized and accomplish my goals. It’s rare that I come across high value items with great quality and style for a low cost. At under $10.00, this writing tool was made for the savvy and confident professional. This pen transitions well with my professional and personal style. Check out more information here to see how you can Choose Different.

HERE ARE A FEW OTHER REASONS TO LOVE THE ZEBRA STEEL F-701:

As an Orthodontist, I utilize pens to complete clinical charting and treatment planning for my patients. My notes require a premium quality pen, like the STEEL F-701, that does not smudge, has a convenient push clip, and that has a great grip. As a blogger, it is just as important in helping me to plan my blog and social media content.

This pen is housed in a silver stainless steel frame that I can easily clean and sterilize between uses. It is knurled, with a no-slip grip for ease of handle and it offers a smooth, even ink delivery from any portion of the ball tip. It is lightweight, durable, and easily clips to my white coat pocket. Best of all it contains an all-metal refill which is usually seen in pens with a hefty price tag. Its fast-drying ink prevents smudging on glossy prints and is great for writing on patient photographs and radiographs.

Blogging coupled with my other entrepreneurial endeavors takes quite a bit of planning. It seems I write on paper almost as much as I type. Needless to say, I always need a pen that’s reliable…. and stylish, of course.

I always carry the STEEL F-701 in my purse because it is practical, durable, reliable and long lasting.

How To Smash Your Goals in 2020

As we optimistically set out to achieve great things at the beginning of the year, we must break our goals down into small manageable, attainable and realistic ones. Setting new year resolutions has been a long time tradition but did you know that statistics show that only about 10% of people actually stick to their new year resolutions past the month of January?

“When we strive to become better than we are, everything around us becomes better, too.”

As the new year fast approaches and we are all in a resolution mindset, we must not forget the very important step of pausing and taking the time to reflect on all the progress we’ve made so far. It is quite easy to beat ourselves up on the areas we may feel we have fallen short, but remember that this process is not about perfection but about progress. As long as we are constantly improving and moving forward we are on the right track.

With that said, as we optimistically set out to achieve great things at the beginning of the year, we must break our goals down into small manageable, attainable and realistic ones. Setting new year resolutions has been a long time tradition but did you know that statistics show that only about 10% of people actually stick to their new year resolutions past the month of January?

I am a huge proponent of self improvement and and an even bigger proponent of setting goals that are actually measurable and attainable.

So how exactly do you set intentions that you will actually stick to? Be SMART about it.

Before you set a goal, first figure out your “why.” By figuring out and articulating the reason you want to achieve something you are more likely to remain motivated to stick to it, rather than it being something you think you should do.

S - Small and Specific: Break your goals into smaller, more specific ones. For example, if your goal is to eat healthier in 2020, be more specific by making it about adding 1 fresh fruit or vegetable and a bottle of water per day for the month of January.

M - Measurable : All your goals must be measurable, that means you should be able to describe the physical manifestation of the outcome of your goal. Example, losing 2lbs per week by adding one fruit or vegetable and a bottle of water to our diet each day.

A - Attainable and Accountability: Is your goal attainable? Can you realistically achieve your goal? Another great way to stay on track is to find an accountability partner. Example, someone who will check in to make sure you had your fruit/vegetable each day or someone who will ensure you meal prep.

R - Relevant and Realistic: Is this goal relevant to you or even realistic? Ensure you’re not setting a goal that you really don’t care about and hence not realistic. Example, I dislike running. If i make it a goal of mine to incorporate running 1 mile/day I know I will fail. Instead, I ensure I get my cardio in by getting on the elliptical, bike or taking a Zumba class.

T - Timely: Make a tentative plan for everything you do. Don’t just make it a goal to exercise once per day. You know your schedule, you know if you’re a morning or late night person. Instead of saying you will work out once per day, say you will work out at 5:30 each morning for 1 hour before work/school.

In all of this, a sure way to make things happen is to write it down. It sounds strange, but there is enormous power in putting things down on paper, and according to research you become 42% more likely to achieve your goals and dreams when it’s written. I always keep a physical (paper) planner even though I use the planner on my smartphone as well. After years of not being able to find the perfect planner, I have decided this year to create a goal planner and to share it with my readers.

Bonus: Be your own D**n Cheerleader and eliminate self doubt. Figure out what keeps you motivated and inspired. I love quotes! I keep them everywhere - my phone’s wallpaper, sticky notes around the house, on my desk at work, I listen to music, books and podcasts that are uplifting. I tolerate no negativity and try to stay away from it at all costs.

Remember, a goal without a plan is just a wish. By breaking down your goals into bite-sized, manageable actions and writing them down, setting goals and intentions for the new year that you can actually stick to becomes a much easier process.

Grab my planner and let’s smash our 2020 goals! Remember, a sure way to make things happen is to write it down.

Live Your Life on Purpose

To live a life of purpose means to live your life with Intention. To say you’re living with intention means that there is meaning and purpose behind all your actions. When you are living with intention life doesn’t just happen to you, you are not merely existing, everyday is not “just another day.”

You are a person of destiny. You are equipped. You are talented. You are creative. You were designed for a purpose.

To live a life of purpose means to live your life with Intention. To say you’re living with intention means that there is meaning and purpose behind all your actions. When you are living with intention life doesn’t just happen to you, you are not merely existing, everyday is not “just another day.”

It is quite easy for us to get caught up in the minutia of everyday life. There are so many distractions that can often lead us away from our life’s purpose. This is something a lot of us struggle with and not living with intention is often times the source of much of our unhappiness.

To live a purposeful life, you have to:

1. Find What Makes You Happy, Do More of That.

Think back to the times when you felt truly happy or fulfilled. What were you doing? Who were you with? What emotions did you feel? Once you’ve identified these things, try to incorporate more of those experiences in your life.

2. Get out of Your Comfort Zone, Be Intentional.

Living beyond your comfort zone helps you embrace uncertainty and unlock your true potential. If you say “yes” to experiences, or activities that shake up your sense of security, they can lead to the discovery (and confirmation) of your talents. When you strive to live outside your comfort zone, you will find yourself confronting some limiting beliefs that often times stem from fear. Move through these things knowing you will come out the other end having grown as an individual.

3. Take Time for Stillness (Mindfulness)

We are in a world of constant stimulation and distractions and it can be hard to quiet the turbulence of our thoughts. Cultivating stillness and silence is a powerful way to restore our balance and energy. Tapping into stillness creates inner clarity and expanded awareness that will help you discover yourself with greater ease and understanding. Stillness also allows us to pay close attention to our thoughts - we become active participants in our lives. We start to notice the things that make us happy and it’s easier to reject the things that don’t.

Start living your life today purposefully and intentionally. Go!

Step-by-Step Guide on How to Set New Year Intentions (Goals) that You Will Actually Stick To

A new year is upon us, which means it’s time to reflect on the past year and bid the last 12 months adieu. With 2019 comes the promise of a fresh start whether it be personal or professional. But, how many of us get really excited for a new year and set lofty goals only for them to fall by the wayside in mid-January? Setting new year resolution for goals has been a long time tradition but statistics show that only about 10% of people actually stick to their new year resolutions past the month of January - that’s pretty low, but we can change that.

A new year is upon us, which means it’s time to reflect on the past year and bid the last 12 months adieu. With 2019 comes the promise of a fresh start whether it be personal or professional. But, how many of us get really excited for a new year and set lofty goals only for them to fall by the wayside by mid-January? Setting new year resolutions has been a long time tradition but statistics show that only about 10% of people actually stick to their new year resolutions past the month of January - that’s pretty low, but we can change that.

I am a huge proponent of self improvement and and an even bigger proponent of setting goals that are actually measurable and attainable. So how exactly do you set intentions that you will actually stick to? Be SMART about it.

Before you set a goal, first figure out your “why.” By figuring out and articulating the reason you want to achieve something you are more likely to remain motivated to stick to it, rather than it being something you think you should do.

S - Small and Specific: Break your goals into smaller, more specific ones. For example, if your goal is to eat healthier in 2019, be more specific by making it about adding 1 fresh fruit or vegetable and a bottle of water per day for the month of January.

M - Measurable : All your goals must be measurable, that means you should be able to describe the physical manifestation of the outcome of your goal. Example, losing 2lbs per week by adding one fruit or vegetable and a bottle of water to our diet each day.

A - Attainable and Accountability: Is your goal attainable? Can you realistically achieve your goal? Another great way to stay on track is to find someone you trust to keep you accountable. Example, someone who will check in to make sure you had your fruit/vegetable each day or someone who will ensure you meal prep.

R - Relevant and Realistic: Is this goal relevant to you or even realistic? Ensure you’re not setting a goal that you really don’t care about and hence not realistic. Example, I dislike running. If i make it a goal of mine to incorporate running 1 mile/day I know I will fail. Instead, I ensure I get my cardio in by getting on the elliptical or bike each day.

T - Timely: Make a tentative plan for everything you do. Don’t just make it a goal to exercise once per day. You know your schedule, you know if you’re a morning or late night person. Instead of saying you will work out once per day, say you will work out at 5:30 each morning for 1 hour before work/school.

In all of this, a sure way to make things happen is to write it down. It sounds strange, but there is enormous power in putting things down on paper, and according to research you become 42% more likely to achieve your goals and dreams when it’s written.

Bonus: Be your own D**n Cheerleader and eliminate self doubt. Figure out what keeps you motivated and inspired. I love quotes! I keep them everywhere - my phone’s wallpaper, sticky notes around the house, on my desk at work, I listen to music, books and podcasts that are uplifting. I tolerate no negativity and try to stay away from it at all costs.

Remember, a goal without a plan is just a wish. By breaking down your goals into bite-sized, manageable actions and writing them down,setting goals and intentions for the new year that you can actually stick to becomes a much easier process. Happy New Year!