Up Your Investing Game With NFTs

If you haven’t been living under a rock you more than likely have heard of NFT’s by now. If you haven’t yet heard of them, it is all the rave in the crypto space right now! They are a new way of operating and owning assets that it is like a foreign language when getting into it for the first time. There is so much to learn and the information given in this blog post will only scratch the surface.

For some months all I kept hearing about was an online piece of work called an NFT. If you have been living under a rock you more than likely have no clue what I am talking about. In the cryptocurrency space it is all the rave right now! But what are they?? According to coinbase, NFTs (or “non-fungible tokens”) are a special kind of cryptoasset in which each token is unique — as opposed to “fungible” assets like Bitcoin and dollar bills, which are all worth exactly the same amount. Because every NFT is unique, they can be used to authenticate ownership of digital assets like artworks, recordings, and virtual real estate.

Non-fungible - What is that?

Non-fungible means that something is unique and cannot be replaced with something else. Bitcoin, for example, is worth as much as every other bitcoin. A dollar bill, is worth exactly one dollar. “Fungibility” refers to goods or assets that are all the same and can be swapped interchangeably.

NFTs on the other hand are unique and cannot be swapped interchangeably. Concert tickets are non-fungible. Even if every Drake concert ticket is the same price, they aren’t directly exchangeable. Each represents a specific seat and a specific date — no other ticket will have those exact characteristics.

The reason why they are such a big deal is because they are appreciable assets, you can buy and hold or you can buy and sell these digital assets for a lot of money! Some of the more recognizable ones on the marketplace have come from projects by Bored Apes and Crypto Punks - earlier this year the Crypto Punk NFT(crypto punk 7524 aka Covid Alien) shown below sold at Sotheby’s for 11.75 million!! The creator put them up for auction, starting at $100 and the winning bid was astronomical.

This NFT titled Everydays: The first 500 days by Beeple was put up for auction at Christie’s starting at $100 and sold for $69million!!

The below NFT, also by Beeple was purchased for $66K and sold for $6.6 million - 10 times the purchase price!

Why are NFTs Important?

You can think of NFTs as being kind of like certificates of authenticity for digital artifacts. They’re currently being used to sell a huge range of virtual collectibles, including:

NBA virtual trading cards

Music and video clips

Video art

Digital art

Virtual real estate (in a place called Decentraland)

As with Bitcoin and other crypto that has boomed in popularity over the last year, NFTs have also soared — growing to an estimated 7 billion. Each NFT is stored on an open blockchain (often Ethereum’s) and anyone interested can track them as they’re created, sold, and resold. Because they use smart contract technology, NFTs can be set up so that the original artist continues to earn a percentage of all subsequent sales (royalties).

I am a new comer to the NFT space and only purchased my first in September of this year. Some NFTs that I have personally invested in are from Boss Beauties, World of Women, Women Rise and Alpha Girl Club. I purchased a Women and Weapons NFT for 0.175 ETH which is roughly $700 USD and have gotten a few offers, the best so far being for 1.18 ETH which is roughly $5000 USD. I have not sold it - I will be holding on to it for now or until I get a much better offer. The reason I chose to invest in some of the above NFTs is because they embody a cause or a mission that I can get behind. For example, Boss Beauties has a mission to educate and empower the next generation of Women and Girls through scholarships and mentorship programs.

Tweet from Reese W.

A recent tweet from Reese Witherspoon on NFTs and the need for more women to take up space in this arena. Reese is also one that I follow on Twitter as she is part of the large NFT twitter community.

How to Purchase NFTs

NFTs are bought and sold through an NFT marketplace built specifically to handle the blockchain transaction. NFTs can cost anywhere from a few dollars to millions of dollars for a digital asset thanks to the scarcity model. To buy NFTs, you must have a cryptocurrency and seek out a purchase through an investment marketplace. Most NFTs are sold on the Ethereum blockchain, meaning you must have the cryptocurrency Ethereum to purchase. Another crypto that’s used to purchase some NFTs is Solana (Sol).

Here’s how I purchase my NFTs:

You will need the cryptocurrency Ethereum (ETH) to purchase NFTs. I purchase all my cryptocurrencies on Coinbase. If you use my referral link to purchase your first $100 worth of crypto you will get $10 worth of Bitcoin. You will also need a wallet, such as the coinbase wallet or metamask and a marketplace to purchase your NFT on, such as Opensea.

Create an Opensea account - Go tot the website opensea.io and create an account. After which you can connect your crypto wallet to OpenSea, edit your profile, and begin interacting in the space. Here’s a video on how to open an account.

Connect your wallet - A crypto wallet, such as coinbase wallet or metamask, stores your Ethereum and processes transactions on the Ethereum blockchain. A unique wallet address will be generated and you will use this address to complete transactions. Here’s a short video on how to connect a wallet to your opensea account - in this case it shows how to connect a metamask wallet, but any wallet you choose will be set up in the same way.

Fund your wallet with Ethereum - You can get ETH, the digital currency that fuels transactions on the Ethereum blockchain, from a digital currency exchange like Coinbase. You will need ETH to "mint,” create and purchase an NFT.

Research available NFTs on Opensea - You'll want to choose an NFT that you feel has an upside value potential. The NFT can be some art, music, video, or even an item within a video game. You can even search Google or Twitter for NFTs. When looking at the upcoming NFTs, note when the sale is, what the cryptocurrency requirements are, and how many of the NFT are being sold. This helps you better understand the scarcity behind the NFT you are choosing. I am a member of an NFT community where these are talked about all day and I am also involved with a number of NFT communities on twitter (the only reason I am currently on that platform).

Bid on or Purchase your NFT - Make sure that there is enough crypto to conduct the transaction including any relevant fees. Fees can include the costs of purchasing and transferring cryptos, converting one crypto into another, and gas fees(amount it costs to process the transaction). When the NFT is purchased, it is stored in a crypto wallet on the same blockchain, on a different blockchain, or in decentralized storage. Mine are stored in my coinbase and metamask wallets.

*Coinbase will launch it’s own NFT platform in Q1 of 2022, I will more than likely switch from opens when that happens*

This information is so new that it can come off very confusing. It’s an entirely new world and a new way of operating and owning assets that it is like a foreign language when getting into it for the first time. There is so much to learn and the information given in this blog post only scratches the surface. Be sure to educate yourself and do your research before investing in any NFT. I can’t wait to see how this shapes the future.

Change is Here!

Another tweet from Reese - everything is changing and we must move with the times in order to not get left behind. Investing in the stock market is great and I encourage that but there’s a new way of investing that is not yet mainstream that in my opinion, we ought to get involved in NOW.

Next Investing Step: Cryptocurrencies

There has been a lot of developments lately in the crypto space. It sounds like some cryptocurrencies like Bitcoin and Ethereum are here to stay. In my opinion, it would be unwise to not invest, if even a small portion, in cryptocurrency.

Updated January 3, 2022

If you’ve been here for a while you know Investing is one of my favorite topics. I did a mini series of blog posts a while back and many found them quite beneficial. If you missed them here they are:

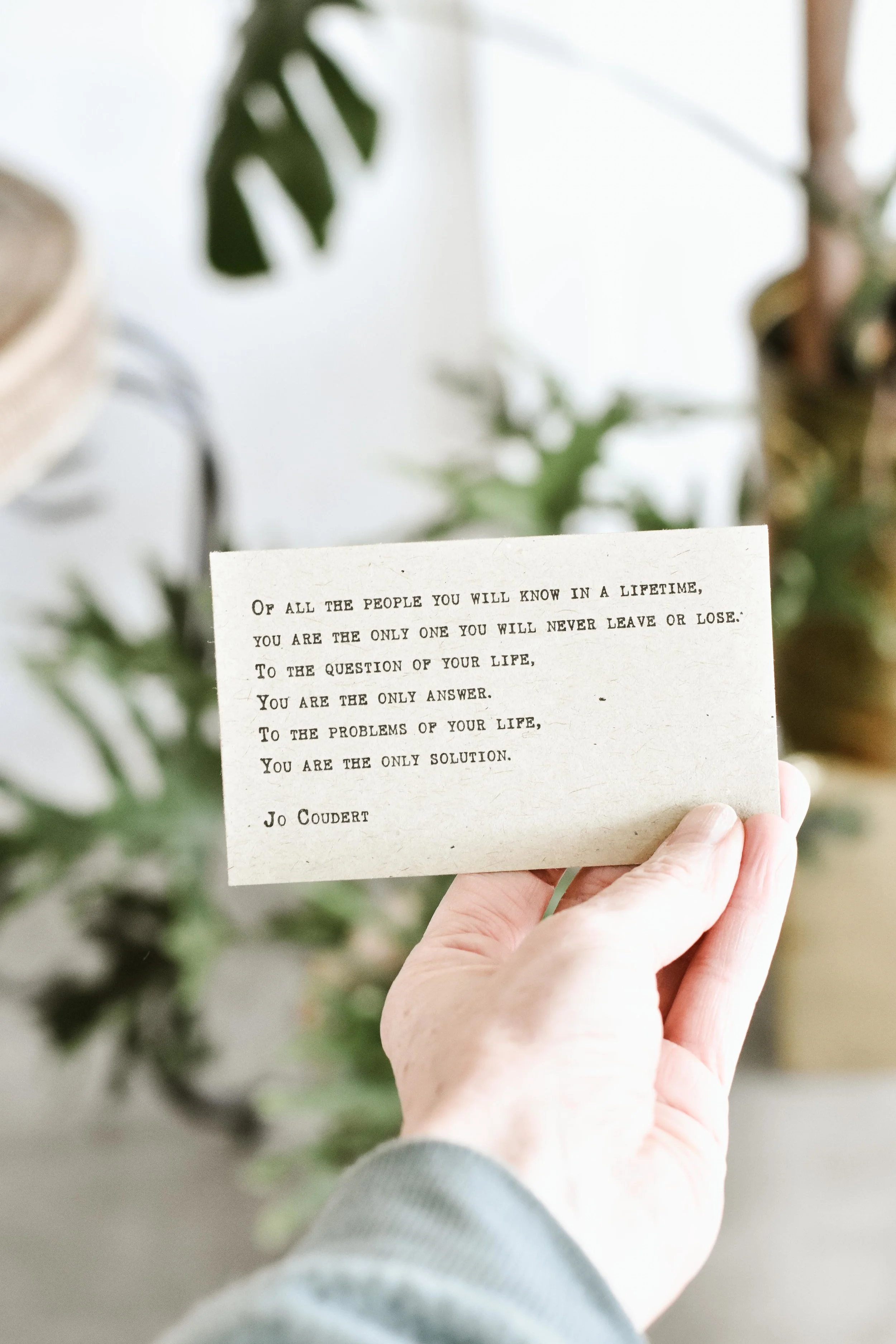

Investing 101: Invest In Yourself

Setting Up Your First Investment Account

How To Start Investing In The Stock Market

6 Questions To Ask Before Investing

6 Tips on Getting Into Real Estate Investing

5 Ways To Invest in Real Estate

Before diving in, I want to preface by saying that I am by no means a cryptocurrency expert or any kind of investment advisor. I will try to keep this short and sweet with some actionable steps I used to get started with investing in crypto. The information shared are my thoughts and based on my personal experience on the topic. I’m only sharing these because I feel that if you’re not on board with crypto at this point i.e if it’s not part of your investment portfolio, you’re seriously missing out on an opportunity to build wealth.

What is Cryptocurrency?

According to nerdwallet, cryptocurrency (or “crypto”) is a digital currency that can be used to buy goods and services, but uses an online ledger with strong cryptography to secure online transactions. They work using a technology called blockchain, which is a decentralized technology spread across many computers that manages and records transactions. Part of the appeal of this technology is its security. The most popular cryptocurrency at the moment is, you guessed it, Bitcoin.

I will admit that several years ago when cryptocurrency was being introduced I was, like many, quite skeptical. It sounded highly volatile, very risky (aka scammy) and sometimes the returns sounded too good to be true. Fast forward several years later after spending quite a bit of time educating myself on the topic and speaking in depth with my financial advisor, crypto educators and other professionals, my only regret is that I didn’t invest in them a lot sooner.

Bitcoin is the world’s first digital asset, is slated to be the currency of the future and as as such, supporters are racing to buy them now in hopes that it will be more valuable later. Just like the internet changed the world many years ago, Bitcoin is expected to usher in a similar change.

My first real introduction to Bitcoin was at the beginning of the pandemic when there was a lot of time to devote to learning something new (the good old days). My husband and I dabbled in a bit of investing and trading during those times with some really good returns. During that time Bitcoin was under $10K. Today (at the time this post is being written) bitcoin sits at around $65K and is predicted to get to upwards of $80K by end of November and north of $100K by December.

There has been a lot of developments lately in the crypto space - major banks around the world and some politicians have sent out pro-bitcoin sentiments. The SEC has approved a Bitcoin ETF, New York’s mayor will be receiving his first 3 paychecks in bitcoin, so are athletes like Aaron Rogers and podcaster Joe Rogan, and El Salvador has made Bitcoin its currency (with more countries to follow suit). It sounds like Bitcoin is here to stay. In my opinion, it would be unwise to not invest, if even a small portion, in cryptocurrency.

How To Invest in Crypto

At the time of writing this, Bitcoin sits at about $65K. If you have that kind of cash to spare you can go ahead and purchase an entire bitcoin. However, you do not need to. You can purchase fractions of bitcoin, whatever dollar amount you can afford. One of the most popular platforms (and what I use) to purchase bitcoin (and other crypto) is Coinbase. However, there are other places where you can purchase bitcoin such as Paypal, Cash app, Venmo and if you use Robinhood for investing you can purchase there too. If you’re a Paypal user, grab my referral link to buy your first $5 of crypto and we can both get $10 (use it to buy even more crypto).

What is Coinbase?

Coinbase is a secure cryptocurrency trading and investing platform that offers users the ability to buy, sell, and exchange over 100 tradable cryptocurrencies such as Bitcoin, Ethereum, and more. It is very user friendly and an account is easy to set up. By using my referral link you will receive your first $10 in Bitcoin after buying or selling $100 of any cryptocurrency you want.

If I were you, I would start investing ASAP as Bitcoin is predicted to get to upwards of $80K by end of November 2021 and north of $100K by December 2021.

*This prediction has changed as the markets changed due to the new COVID-19 strain, Omicron*

If you are very risk averse or still think putting your money in crypto is scary you can earn crypto in other ways. I no longer use my regular debit card for purchases. I now use the Fold debit card where I earn satoshis (a small portion of bitcoin) with my everyday purchases.

What is Fold?

Fold is a bitcoin app and debit card that gives you free bitcoin for qualifying purchases.

Fold lets you earn free bitcoin while you shop. It works just like a regular debit card from any major bank where you would earn rewards (like cash back) on purchases but instead earn free crypto. The average purchase provides 25% cash back in bitcoin. Downloading the app and signing up for a Fold debit card is really easy and there’s benefit in getting both. The app is available in the App Store and if you use my referral link to sign up you can earn 5000 satoshis or sats for short. Satoshis, what’s that? The name is a moniker for bitcoin’s founder Satoshi Nakamoto and is a fraction of bitcoin. In the app, you will also have the opportunity to win additional bitcoin daily with the spinwheel. They have a range of prizes with the ultimate being an entire bitcoin. Read more about that here. There are two different types of debit cards, the Spin or the Spin+. The spin has no annual fee but has a $21 activation fee, while the spin+ has an annual fee of $150 but no activation. With the latter, you are able to earn more rewards and up to 100% cash back. Personally, I have the spin card - I get the benefit of getting fractions of bitcoin (which over time will add up to a large sum) with all my purchases without paying an annual fee. Plus, I am already investing in Bitcoin elsewhere so I don’t feel the need to try to get 100% cash back. After you’ve accumulated at least 50,000 satoshis you can transfer your crypto to a wallet, such as the coinbase wallet (there are others but this is what I use). Ultimately, if you’re looking for a relatively easy way to join the world of cryptocurrencies without investing your own money this is a great option.

There you have it! I have touched on my experience with investing in crypto and hopefully it gives a little insight on making it a part of your investing portfolio. It is very easy to get started, but as with any investment vehicle, do your due diligence, speak with your financial advisor, take caution and be aware that any form of investing is risky.

Next Investing topic will be on NFTs. Be on the look out for that.

5 Ways to Invest in Real Estate

Real Estate Investing has been a hot topic, especially among the the financial independent community and those looking to build wealth through passive income. I firmly believe we are all budding entrepreneurs. We want to control our destiny, work for ourselves and feel good about making a difference in the world. Real estate investing is an excellent way to stretch one’s entrepreneurial muscles.

Real Estate Investing continues to be a hot topic of discussion especially among the financial independence community and those looking to build wealth. I firmly believe we are all budding entrepreneurs who seek to control our destiny, work for ourselves and feel good about making a difference in the world. Real estate investing is an excellent way to stretch one’s entrepreneurial muscles.

It wasn’t until I met my husband (then boyfriend) that I fully understood real estate investing or even cared about it. It was an area he was excited and passionate about and that I naturally (as the engaging and supportive partner) got excited about too. At the time he had a mixture of both residential and commercial properties that garnered significant income - the best part being it was passive income, or as he calls it mailbox money. That is, money that arrives in the mail or in your account that you don’t physically go to work for. FYI, it doesn’t come without its struggles but the reward can be life altering.

There are several ways to get involved in real estate. They include the purchase, ownership, management, rental and/or sale of real estate for profit.

THERE ARE GENERALLY FIVE LARGE CATEGORIES OF REAL ESTATE INVESTING:

Rental Property: Become a Landlord

This is what most people think of when they hear the term real estate investing: You buy a house, rent it out and collect a paycheck each month. It sounds easy, but it comes with challenges. Finding a property with the perfect mix of location, the right price, higher-than-average rental rates, great tenants, etc is difficult. In addition to this, there are at times issues where tenants won’t pay rent, high taxes, foundation issues, etc and unless you hire a property management company you will be dealing with these yourself. In an ideal situation, a property appreciates over the course of the mortgage, leaving the landlord with a more valuable asset than he/she started with.

Real Estate Investment Groups

Real estate investment groups are like small mutual funds that invest in rental properties. In a typical real estate investment group, a company buys or builds a set of apartment blocks or condos, then allow investors to purchase them through the company, thereby joining the group. A single investor can own one or multiple units of self-contained living space, but the company operating the investment group collectively manages all of the units, handling maintenance, advertising vacancies and interviewing tenants. In exchange for conducting these management tasks, the company takes a percentage of the monthly rent.

Real Estate Trading (Flipping)

This typically involves buying a distressed property with the intention to refurbish it and sell it quickly for a profit. You have to buy low and sell high; you need to estimate closing costs, resale value and rehab costs carefully. From there, you’ll need to add your holding costs (insurance, property taxes, utilities, interest on the money if you’re borrowing it) and your cost to sell (typically 8%). This is for people with significant experience in real estate valuation and marketing. flipping houses has a shorter time period during which capital and effort are tied up in a property. But depending on market conditions, there can be significant returns, even in shorter time frames.

Real Estate Investment Trusts (REITs)

A REIT is a company that owns and finances real estate properties. You, as an individual, can invest in that REIT and essentially be investing in real estate. This is a great option for someone who only wants portfolio exposure to real estate and is not looking for a side job

Crowdfunding

What if there was a really great property for sale but it is too expensive for you alone to invest in? With crowdfunding platforms, you can invest in real estate by pooling funds and sharing the returns with other investors. Real estate crowdfunding is a passive investment; you won’t have to become a landlord, but you can still reap the rewards of real estate investing.

BONUS: If you’re a dentist going into practice ownership, it is very beneficial to own the commercial real estate of your practice - more on this in a letter post.

If you ever considered going into real estate investing but not sure what avenue to take, these are all great options to get involved. Remember, all investments have risks but its how you manage and mitigate those risks that make the difference. Take a look at these Real Estate Investing Tips before diving in.

This is the 6th and final article of the Investing Series. Click here for Part V, Part IV, Part III, Part II and Part I

Sign up below to ensure you get all these amazing articles directly to your inbox. Articles are published once per week with an occasional bonus article.

This article is for educational and informational purposes only. Contact a financial advisor before making any financial decision.

This article may contain affiliate links.